Will $94,500 be Bitcoin’s next price target? Key datasets suggest…

- A Bitcoin accumulation tackle made a big buy following the most recent bout of market decline

- Charts highlighted the potential of the value crossing into the $90,000-zone

Bitcoin [BTC] has managed to take care of a gradual value threshold over the previous couple of days, hinting on the potential rebirth of a market rally.

And but, over the previous week, the crypto has recorded a slight decline of three.81% to commerce at $81,016 at press time. In accordance with AMBCrypto, shopping for quantity within the derivatives and institutional markets has been larger recently and this might quickly set off an upward transfer.

Will Bitcoin add one other $13,000 to its value?

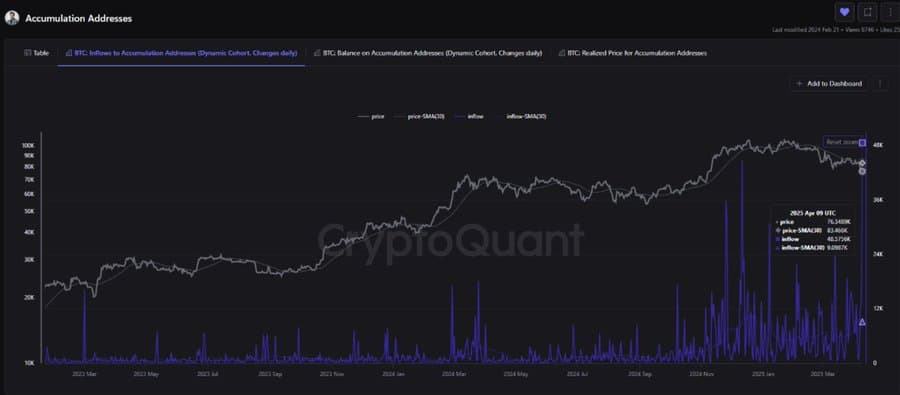

A CryptoQuant report discovered {that a} Bitcoin accumulation tackle, recognized for getting the asset at strategic market positions, lately made its second-most vital buy over the previous three years.

Following the value drop to the $76,000-region, the tackle purchased 48,575 BTC, price roughly $3.6 billion – Its largest single-day buy since buying 95,000 BTC on 01 February, 2022. Apparently, each transactions had been price roughly the identical quantity in greenback phrases – $3.6 billion.

Supply: CryptoQuant

A big buy comparable to this from a whale account usually implies that an incoming rally may very well be on the horizon. This might lend confidence to the general market, resulting in extra shopping for exercise.

Additional evaluation revealed that if the rally begins, the asset would seemingly have a free run till it hits the $94,500 zone. It is a stage the place notable promoting strain exists, which may push the value decrease. If this rally materializes from its press time value stage, BTC would have added $13,480 to its greenback worth.

Supply: Glassnode

Different markets assist a run-up

Institutional and by-product market merchants have been putting bets on a push for Bitcoin larger up the charts.

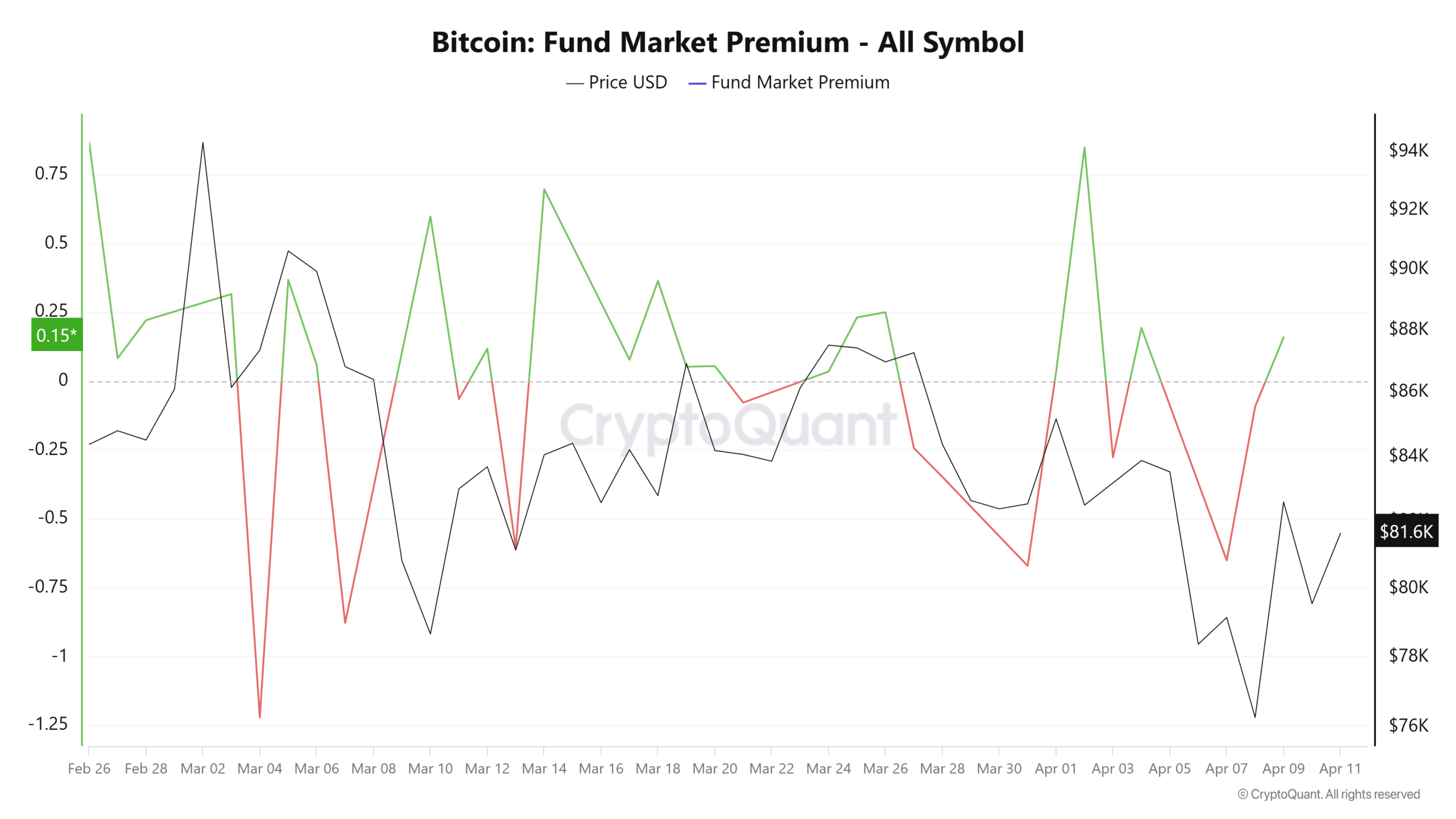

On the time of writing, the fund market premium, which tracks institutional investor exercise, highlighted ongoing shopping for exercise.

The institutional investor narrative is set primarily based on the value distinction between Bitcoin on institutional-focused platforms and retail-focused platforms (like Binance). When this distinction is constructive, as within the case of Bitcoin proper now with a studying of 0.15, it’s a signal of internet shopping for exercise available in the market.

Supply: CryptoQuant

Within the derivatives market, sentiment has remained bullish as properly, with extra shopping for than promoting quantity over the previous 24 hours.

Primarily based on the Taker Purchase/Promote Ratio, after a earlier day dominated by sellers, shopping for has resumed too. This exercise gave the impression to be clearly traceable on the chart, marked by a notable inexperienced spike, resulting in a press time studying of 1.09.

Miners be part of the race

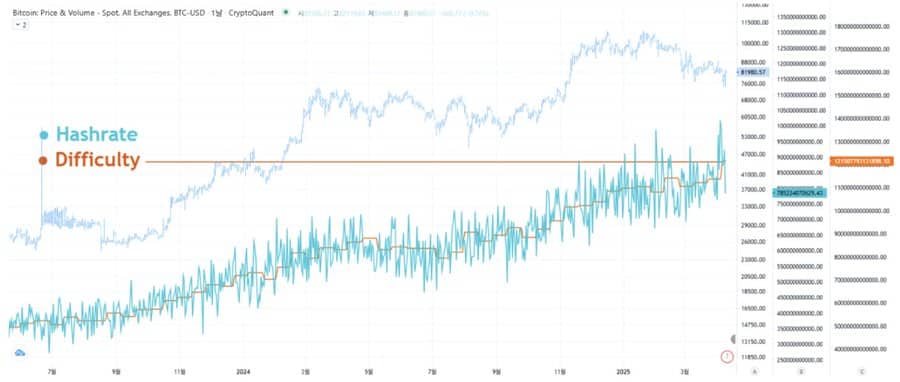

Regardless of the decline Bitcoin noticed from its all-time excessive above $109,000, there was sustained development in its hashrate.

Hashrate refers back to the whole computing energy utilized by miners to course of and safe transactions on a proof-of-work blockchain like Bitcoin. A rising hashrate implies the community is changing into safer, including to investor confidence.

Supply: CryptoQuant

In accordance with crypto analyst Ki Younger Ju, primarily based on its hashrate, Bitcoin may doubtlessly rally to a market capitalization of $5 trillion from its press time valuation of $1.6 trillion. This may imply an approximate rally of 3x, pushing the asset to $243,000 on the charts.