Ethereum’s new adoption rate is on the rise nearing 40%

- Ethereum’s new adoption charge was on the rise, nearing 40%.

- ETH was seeing elevated demand from new customers, particularly massive gamers.

Though Ethereum [ETH] has struggled on its value charts, its fundamentals are strengthening.

Actually, over the previous week, the altcoin’s new adoption charge has recovered. In line with IntoTheBlock, Ethereum’s new adoption charge spiked and approached 40% final week.

An upswing in adoption charge alerts consumer development.

Supply: IntoTheBlock

An increase in adoption charge alerts robust consumer curiosity, with ETH seeing a surge in new contributors. Over the previous week, Ethereum’s distinctive depositors have climbed to 1.83 million, highlighting elevated engagement.

This development suggests extra people are actively interacting with Ethereum by way of CEXs, staking, or DeFi protocols. Usually, an increase in distinctive depositors displays renewed market curiosity in ETH and its ecosystem.

Supply: CryptoQuant

Given the present market situations, the expansion in customers and adoption displays growing curiosity past hypothesis. Traders and customers are coming into the market with long-term intent, quite than looking for short-term beneficial properties.

When demand strikes past hypothesis, it signifies market maturity and potential stability.

The important thing query is whether or not this rising demand is impacting Ethereum’s value charts and total market efficiency.

Who’s actively participating with ETH

According to AMBCrypto’s evaluation, probably the most lively customers are principally massive entities and people or massive holders.

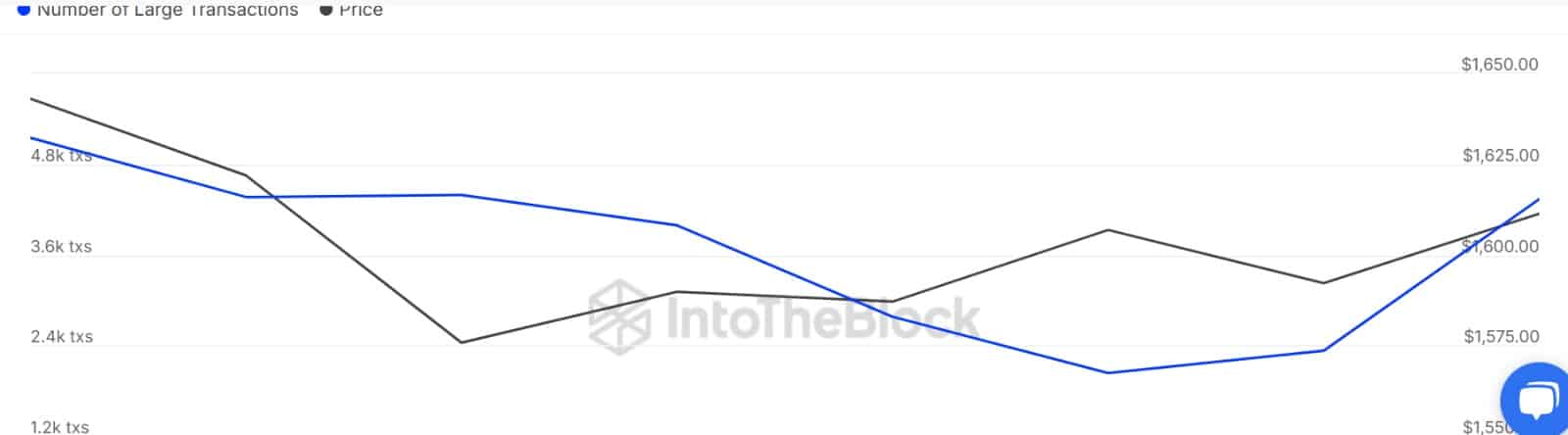

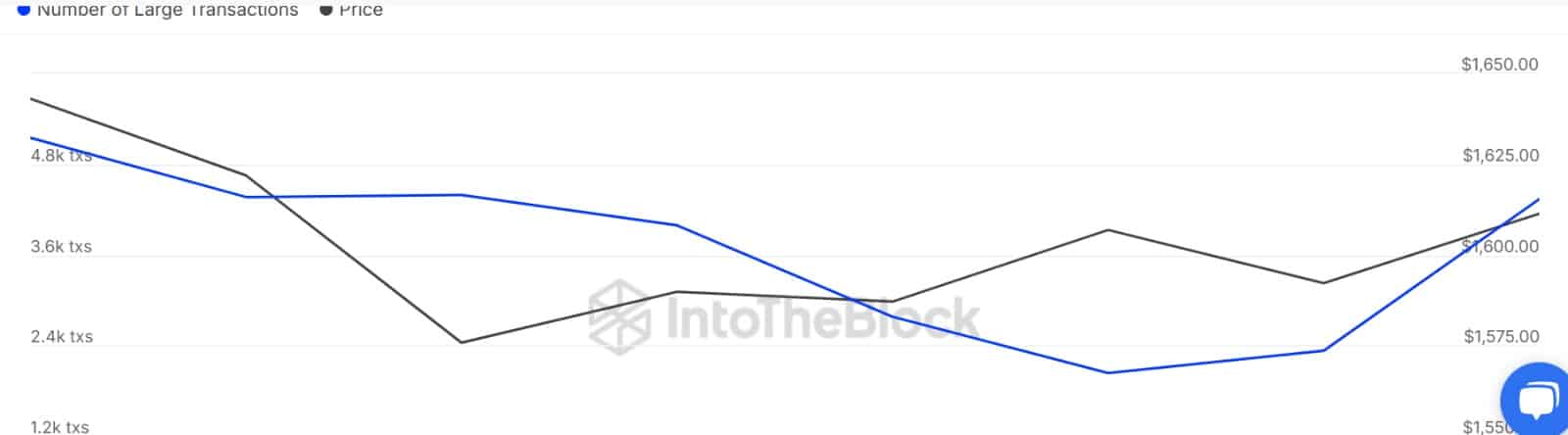

As ETH sees a restoration in curiosity, massive holders have recorded probably the most exercise available in the market. As such, massive holders’ transactions are on the rise, reaching 4.34k, a rise from 2.33k.

A rise in massive transactions means that whales are extremely lively in both promoting or shopping for.

Supply: IntoTheBlock

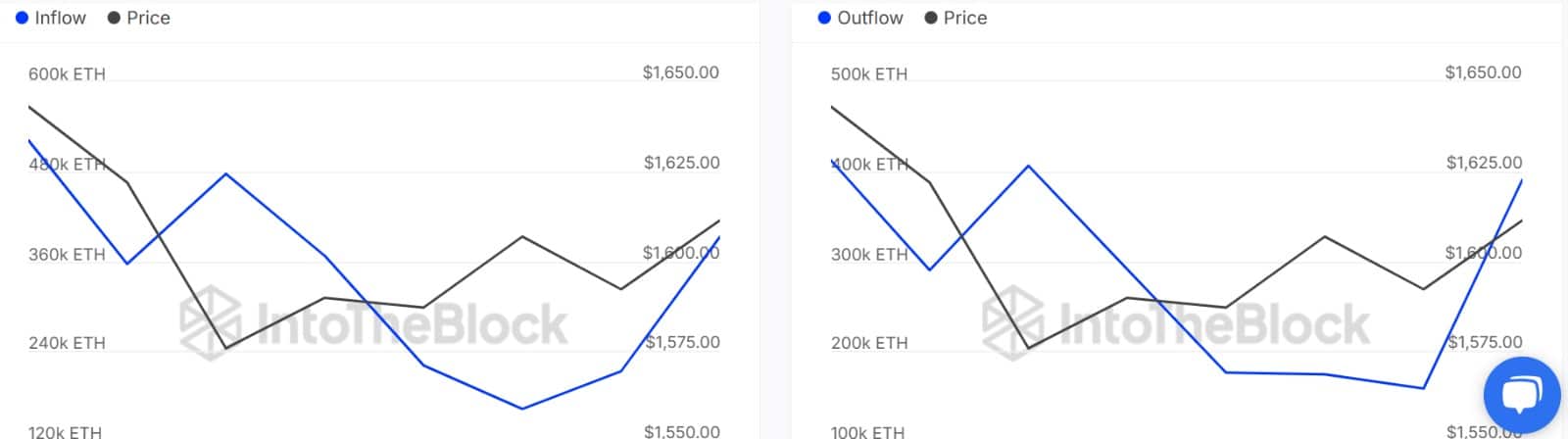

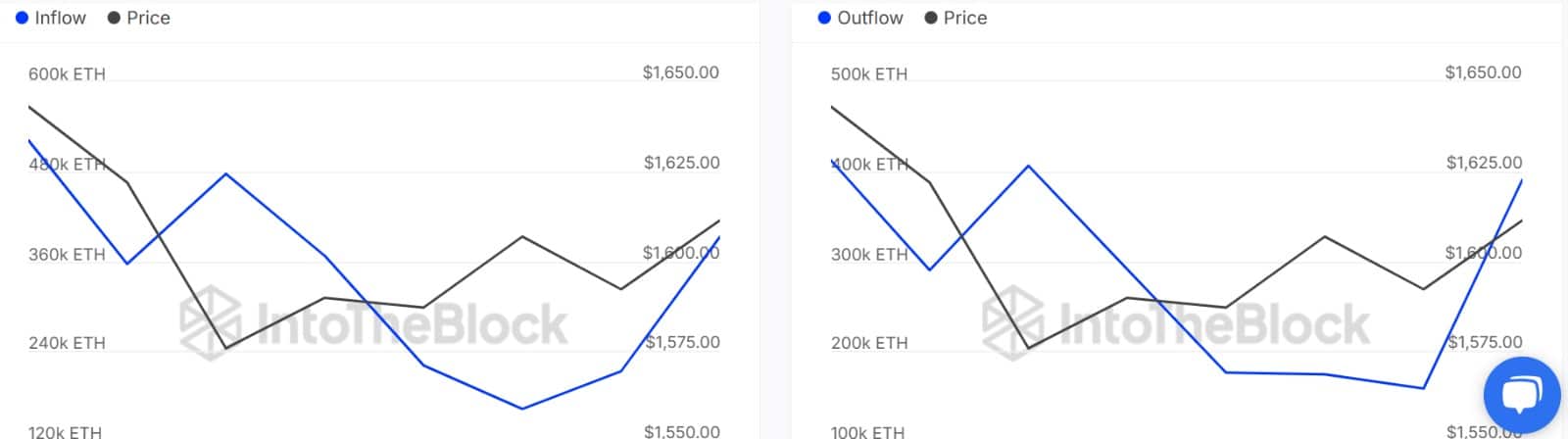

alternate netflow for giant holders, it reveals that they’re extra lively on the purchase facet. As such, the altcoin has seen 392.95k ETH of influx from massive holders, with an outflow of 390k. This leaves a constructive netflow of 2k ETH.

As such, whales are lively on each the purchase and promote facet, however patrons outweigh sellers.

This implies that the rising curiosity available in the market is usually favoring a possible restoration on the altcoin’s value and charts, and new customers are coming into the market to anticipate that Ethereum’s fortunes will change.

Considerably, with new customers exhibiting demand for ETH whereas the purchase facet stays robust, on-chain situations place Ethereum at a good level.

Supply: IntoTheBlock

Due to this fact, Ethereum is experiencing a powerful restoration in consumer demand, which usually reinforces its fundamentals and helps value rebounds. If ETH adoption continues to rise, its impression might quickly be seen in value actions.

A sustained uptrend might push ETH again to $1,660, whereas elevated volatility may set off a correction towards $1,540.

The following transfer relies on market stability and whether or not demand can outpace promoting stress.