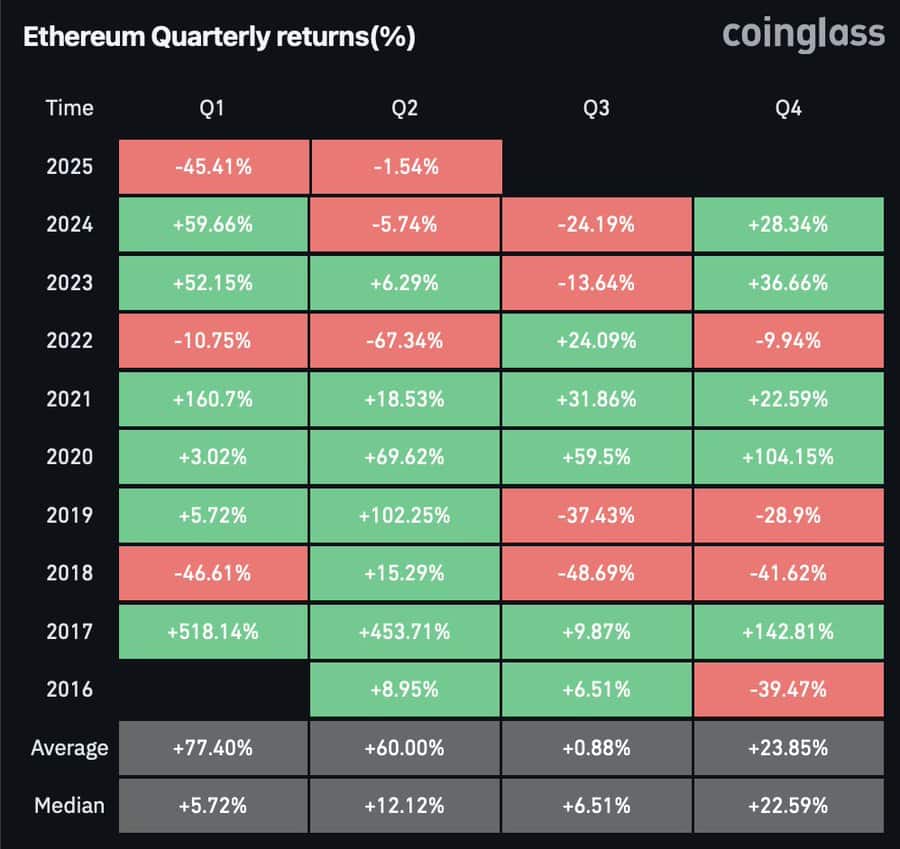

Is Ethereum a smart investment for Q2? A look at potential returns after a rough Q1

- Ethereum’s Q2 efficiency for 2025 is at present sitting at a modest -1.54%

- It’s nonetheless early within the quarter, and there’s loads of time for ETH to search out its footing

Ethereum’s Q1 2025 didn’t precisely roll out the pink carpet.

With -45.41% quarterly returns in Q1, Ethereum broke its two-year streak of conservative value motion. Consequently, FOMO-driven patrons from final 12 months’s This autumn ‘Trump pump’ are in all probability nonetheless observing unrealized losses.

Nonetheless, if you happen to have been an investor who jumped in through the Q1 cycles of 2023 or 2024, you in all probability noticed your place soar. These early patrons probably watched their holdings double in worth over simply three months.

To interrupt it down – In case you had bought 1 million ETH in Q1 of 2023 or 2024, you’d have made a revenue of 1 million ETH throughout that quarterly surge.

However, now? Quick ahead to this cycle, and also you’d be closing the books with a internet lack of about $454k.

Supply: Coinglass

Traditionally, Q2 has been a stronger season for Ethereum – Apart from 2024 and 2022, with the latter nonetheless haunted by the brutal post-FTX collapse cycle.

That being stated, Ethereum’s Q2 2025 efficiency shouldn’t be in full panic mode but. Actually, on the time of writing, ETH’s quarterly returns have been down a modest -1.54%.

Backside line? This slight dip prompt that regardless of a tough Q1, the market could possibly be gearing up for a restoration.

Ethereum in Q2 – Will persistence repay?

Again in 2018, 2019, and 2020, Ethereum made Q2 its private playground, posting a few of its largest bounce-backs – Particularly after tough Q1 performances.

2024 although? Totally different story. Certain, the 5.74% dip in Q2 appeared like a small paper minimize, till you seemed nearer.

As a result of even with Ethereum lastly scoring its first-ever spot ETF itemizing on Wall Road in July – a significant milestone – you’d count on a rocket, proper?

As an alternative, ETH stored sliding. Q3 didn’t deliver reduction both, with returns falling off a cliff by one other 24.19%. So, what modified?

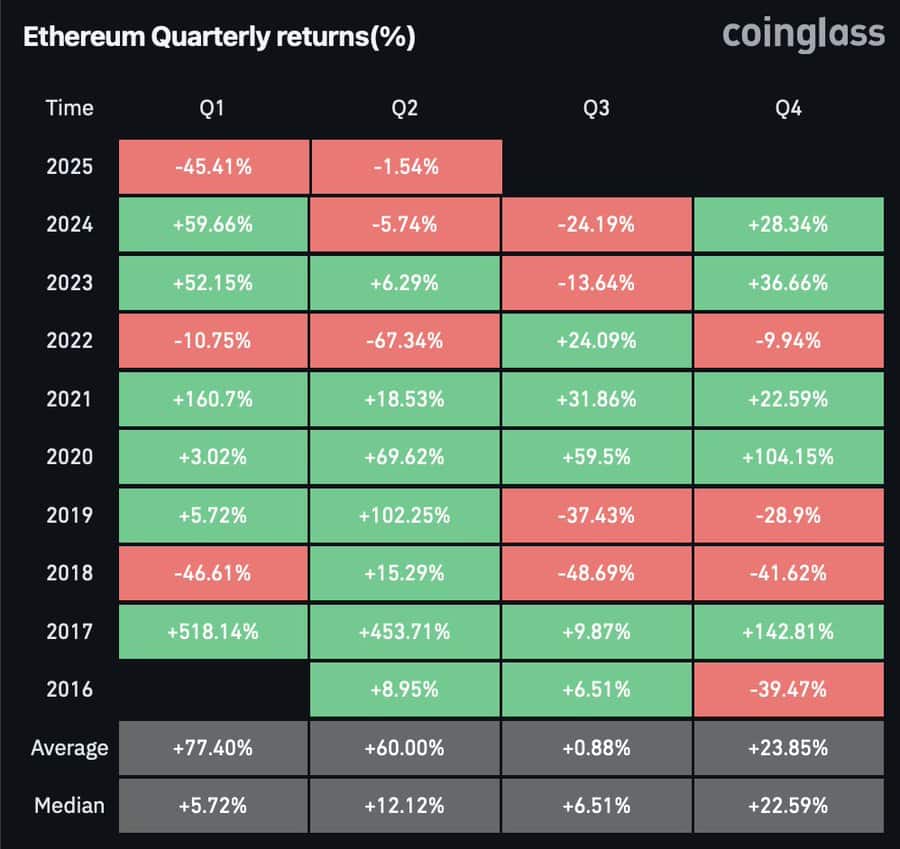

Based on AMBCrypto’s evaluation, the ETH/BTC pair crashed laborious on the similar time. And, guess what? That meltdown hasn’t bounced again, dragging the ratio to a painful five-year low.

Supply: TradingView (ETH/BTC)

In conclusion, Ethereum’s dominance, which remained between 15% and 20%, has now slipped to 7.40%.

Until ETH manages to claw again some market share from Bitcoin by breaking by these pesky resistance zones, a bullish Q2 would really feel like an extended shot.

Nonetheless, delicate returns might nonetheless pop up. Particularly with capital probably flowing again in – Due to Trump’s 90-day tariff maintain.

Double-digit returns although? That’d be an enormous stretch proper now.