Bitcoin whales’ profits and $95K – Here’s what traders should REALLY look out for!

- Bitcoin whales’ unrealized earnings surged to $150 billion, signaling potential short-term market shifts

- MVRV ratio indicated overvaluation, suggesting a attainable correction if earnings are realized

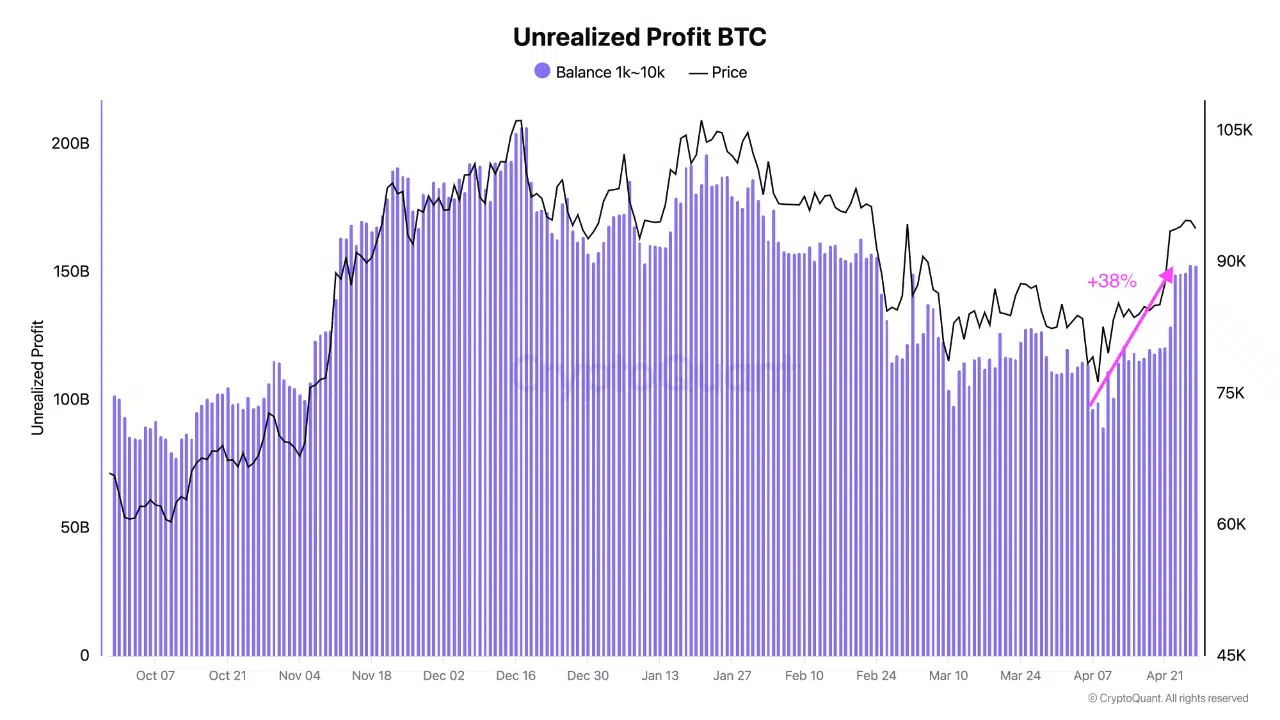

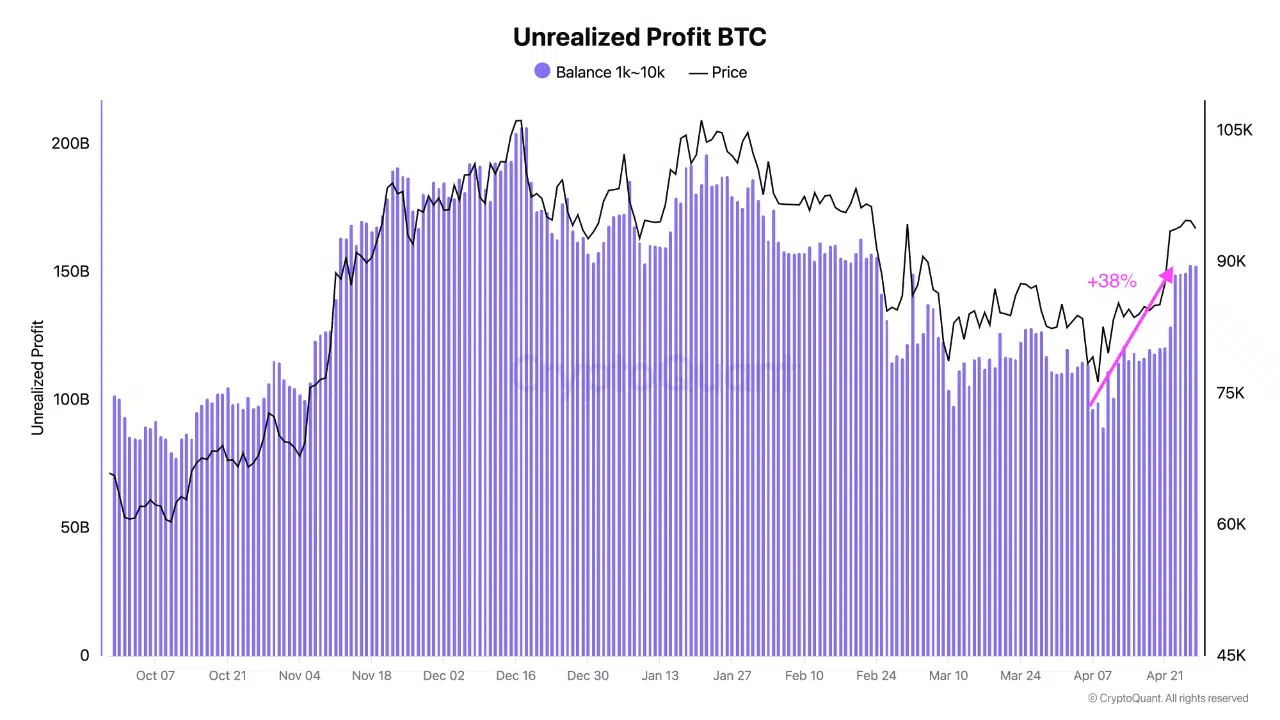

Bitcoin [BTC] whales, holding between 1K to 10K BTC, have seen their unrealized earnings surge by roughly 38% for the reason that begin of April – Hitting $150 billion.

Traditionally, when these earnings close to $200 billion, whales are likely to take earnings, doubtlessly slowing Bitcoin’s upward momentum.

Such a hike in whale earnings usually alludes to potential shifts in market sentiment, elevating questions on whether or not BTC can proceed its upward trajectory or face a value correction. At press time, Bitcoin was buying and selling at $94,811.68, following a modest 0.16% uptick during the last 24 hours.

Supply: CryptoQuant

Day by day lively addresses, transactions point out wholesome community development

Bitcoin’s community exercise has been sturdy, with 808.82k day by day lively addresses and 392.47k transactions recorded at press time. These numbers hinted at a rising stage of adoption and transactional exercise, supporting the bullish narrative for Bitcoin.

Now, whereas these metrics alone don’t assure sustained value development, robust community exercise is commonly correlated with larger investor demand, which may additional gasoline Bitcoin’s rally.

Because the variety of lively addresses continues to rise, the demand for BTC could climb too. This might doubtlessly push the value larger within the coming weeks.

Supply: Santiment

Excessive MVRV ratio – What does it imply?

At press time, Bitcoin’s MVRV ratio stood at 2.37 – A excessive worth that indicated potential overvaluation. This additionally instructed that BTC could also be buying and selling above its “honest” worth, as measured by the common value at which cash had been final moved on the blockchain.

Traditionally, when the MVRV ratio is excessive, it has usually hinted originally of a market correction.

The Inventory-to-Stream ratio for BTC surged to 725.39 too, signaling rising shortage. This metric displays Bitcoin’s diminishing provide over time – Historically, a long-term bullish indicator.

As BTC turns into extra scarce, its worth may rise, supplied demand stays robust. The spike within the Inventory-to-Stream ratio instructed that whereas Bitcoin faces short-term volatility, its long-term worth proposition as a scarce asset may proceed to draw traders.

Supply: Santiment

Bitcoin battles key resistance – Can it break $95K?

Bitcoin has been testing essential value ranges, together with a resistance zone at $95k recently. On the time of writing, the RSI sat at 66.98, indicating that Bitcoin could also be approaching overbought situations. If BTC can break by way of the $95k resistance, it may goal the subsequent stage round $105k.

Nonetheless, if it faces rejection, it could take a look at help at $85k. The Bollinger Bands underlined that BTC was close to the higher vary, additional supporting the concept that the asset may face a pullback if momentum stalls.

Supply: TradingView

Will BTC proceed to rise or face a value correction?

Bitcoin’s market situations have been flashing blended indicators. Whereas whales are rising their unrealized earnings and community exercise has been robust, the excessive MVRV ratio is an indication that Bitcoin could also be overvalued.

The surge within the Inventory-to-Stream ratio highlighted long-term shortage – A bullish sign. Nonetheless, Bitcoin’s press time value ranges and technical indicators instructed {that a} potential value correction could possibly be subsequent if the resistance at $95k proves too robust.