Japan’s Metaplanet goes all in on Bitcoin – Raises $25M after latest 555 BTC purchase

- Metaplanet ramped up Bitcoin accumulation with newest $53.4M buy.

- Plans to develop into the U.S. with a $10 million Treasury Corp in Miami.

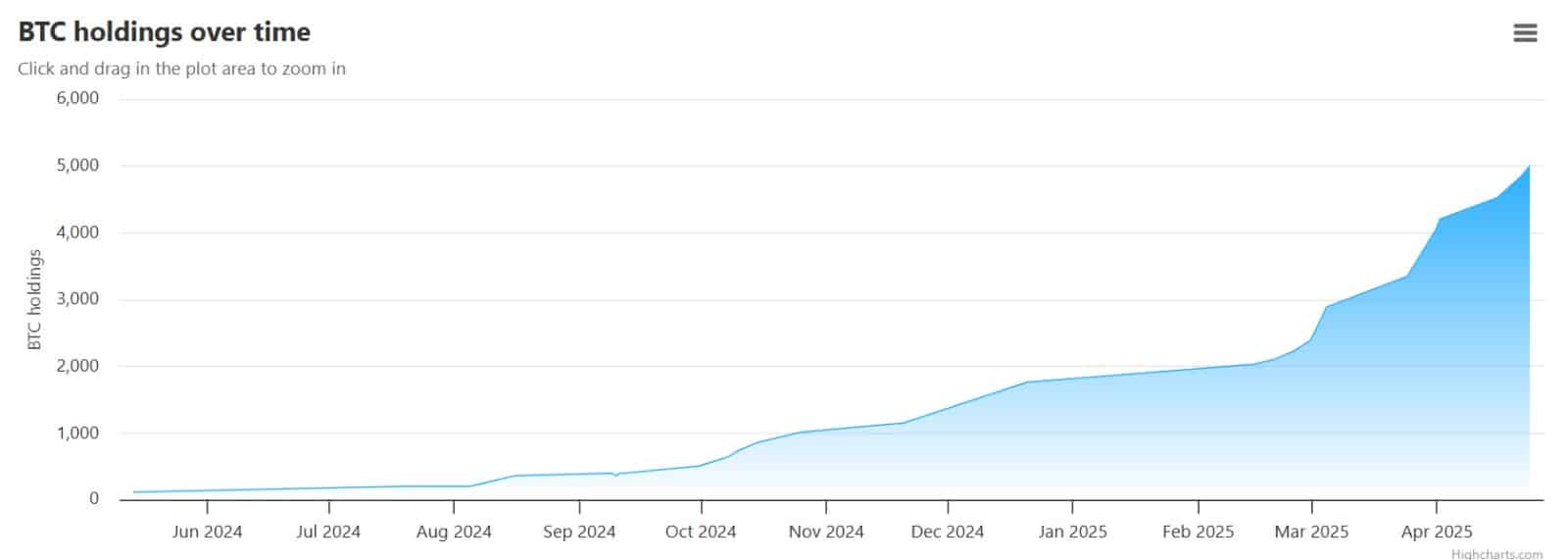

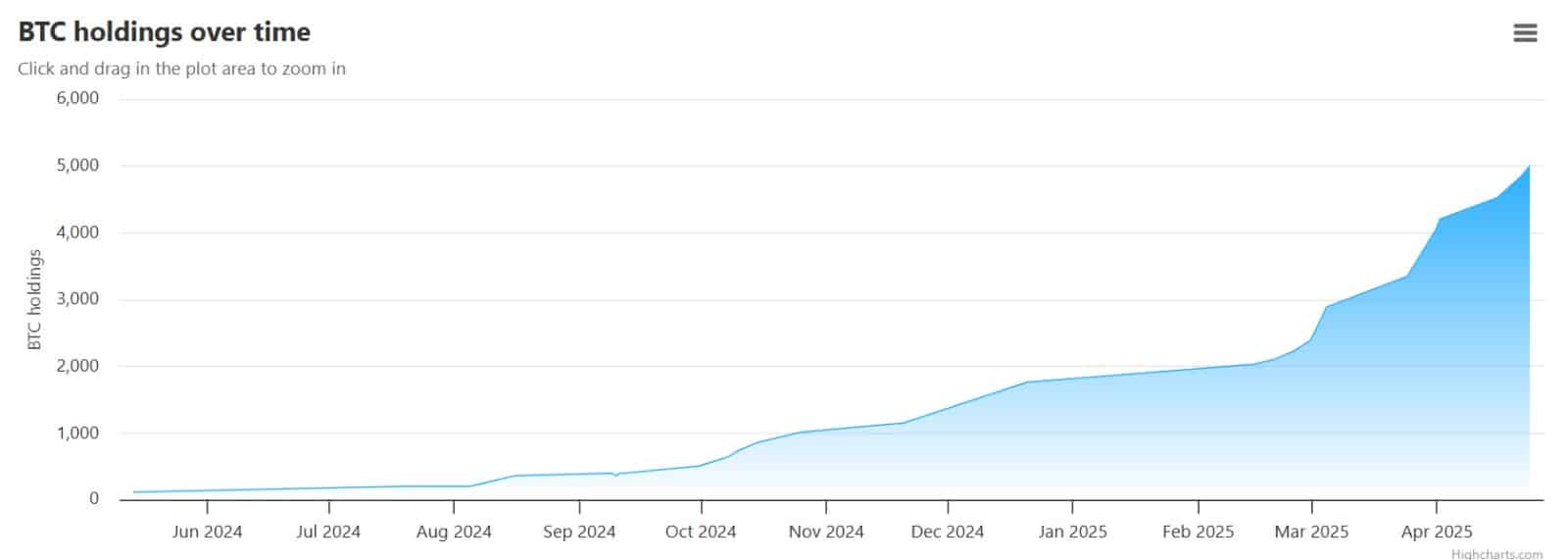

Over the previous 5 months, institutional urge for food for Bitcoin [BTC] has grown visibly stronger. One agency main this accumulation is Japan’s Metaplanet, actively increasing its BTC holdings.

Within the newest shopping for spree, the Tokyo-listed agency announced the acquisition of 555 BTC at a mean worth of $96,134, price $53.4 million.

This contemporary addition pushed its complete Bitcoin holdings to five,555 BTC, valued at roughly ¥71.76 billion (or $465 million), with a mean entry of $86,672 per coin.

Since April 2024, when Metaplanet unveiled its crypto technique, the corporate has been aggressively accumulating Bitcoin. As a part of the corporate’s technique, it goals to extend its holdings to 10k BTC by the top of 2025.

To this point, it has 4445 BTC extra to go to attain its yearly objective.

Supply: Bitbo

After all, the agency didn’t cease at simply shopping for. It financed the acquisition by issuing a brand new batch of extraordinary shares price $25 million, marking its thirteenth spherical of fundraising since 2024.

These share and bond issuances have grow to be a constant a part of Metaplanet’s “Bitcoin Monetary Technique,” rolled out in April 2024.

Apart from its shopping for spree, Metaplanet plans to enter america and develop its presence. It goals to open a department in Miami and set up a Treasury Corp in Florida, seeded with $10 million in capital and aiming to scale to $250 million.

At the moment, Metaplanet is the biggest public company holding Bitcoin in Asia.

Institutional curiosity in Bitcoin is heating up

Metaplanet’s continued acquisition of Bitcoin will not be solely bullish but in addition indicator of rising institutional demand. It signifies that establishments now understand BTC as a profitable and secure long-term funding.

Subsequently, Metaplanet acquisition will not be an remoted case, as establishments have returned to the market and at the moment are shopping for BTC. These market behaviors are evidenced by a constructive Coinbase Premium Index.

A shift to constructive right here means that as world markets calm down from tariffs, Bitcoin is changing into the primary cease.

Supply: CryptoQuant

Having stated that, Metaplanet’s aggressive technique has had ripple results. Its inventory has jumped 11.45% on the time of writing, underlining investor confidence in its BTC-focused strategy.

Supply: Google Finance

Metaplanet’s rising stash is now not only a steadiness sheet merchandise—it’s a worth driver. And its bullish stance is fueling wider confidence throughout the board.