Bitcoin: 3,400 wallets dump BTC, but whales have other plans – Why?

- Whale wallets scooped up 81,338 BTC as retail fled in panic.

- Inventory-to-Circulation ratio jumped to 669.72 post-halving, fueling a scarcity-driven bullish outlook.

Bitcoin [BTC] noticed a drop of three,400 wallets holding no less than one BTC within the final two months. This decline displays diminished confidence amongst long-term holders throughout latest volatility.

On the time of writing, Bitcoin traded at $96,678.63, up 2.28% up to now 24 hours.

Naturally, market watchers are actually centered on $93,198—probably the most vital assist. If it collapses, $83,444 turns into the following key stage to observe.

Subsequently, retail softness continues to forged doubt on Bitcoin’s short-term power, at the same time as whales quietly transfer in a special path.

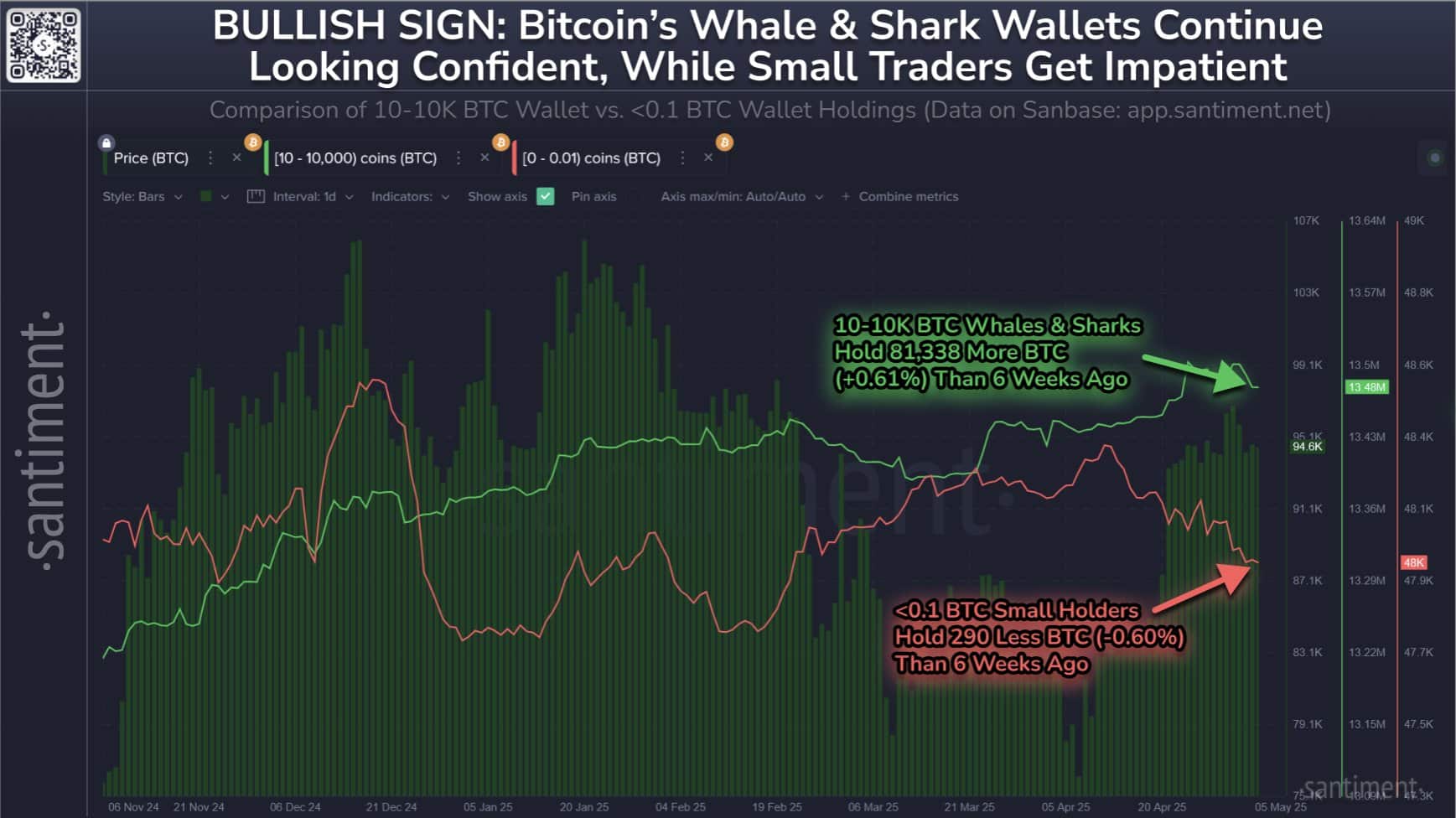

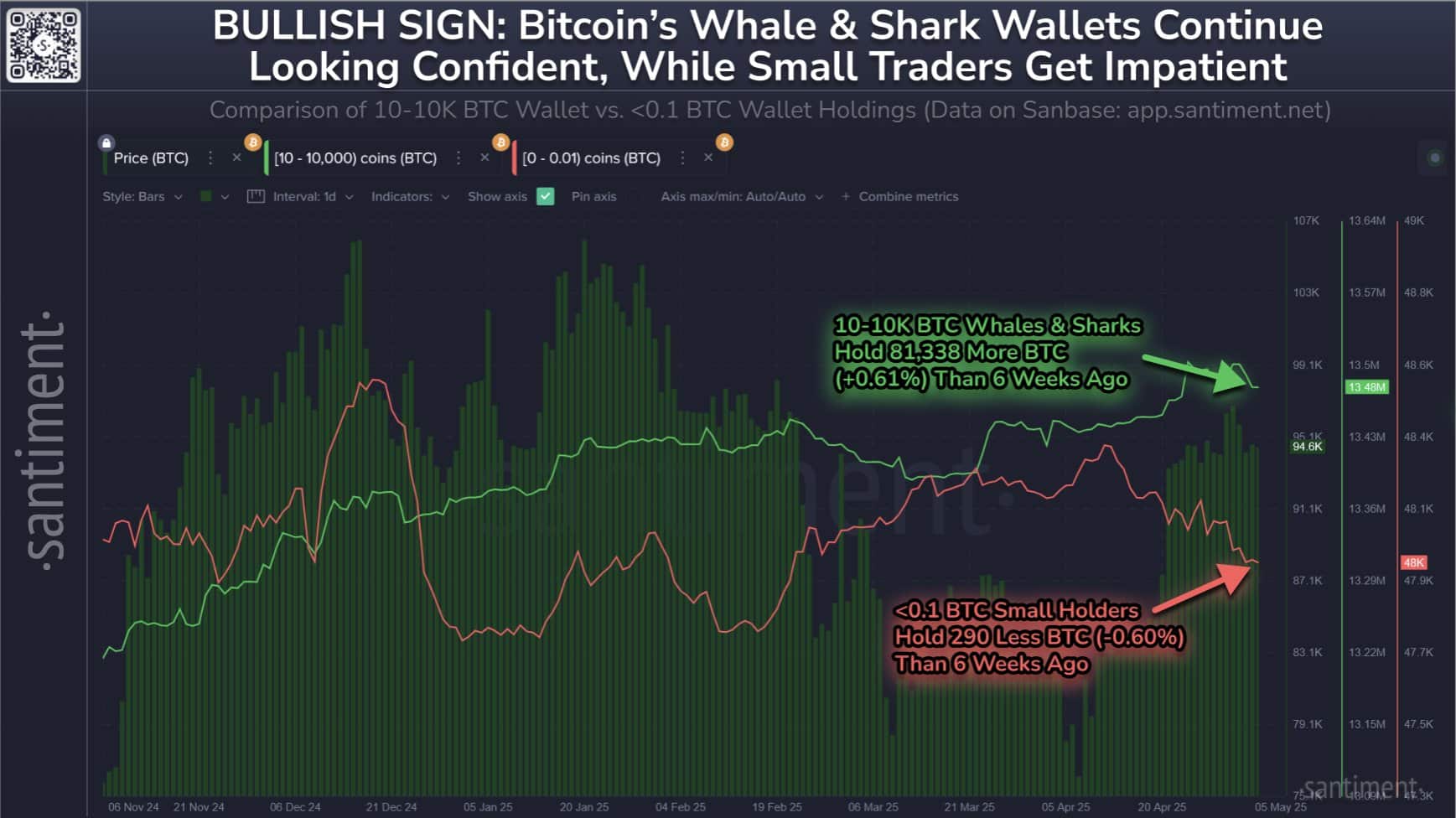

BTC whales are loading up whereas retailers hit the exit

Massive holders added 81,338 BTC up to now six weeks, rising their holdings by 0.61%. In the meantime, smaller wallets dumped 290 BTC, trimming 0.60% of their complete belongings.

This divergence suggests a well-known setup: retail panic promoting, whereas whales quietly accumulate.

Traditionally, this development has preceded worth rallies, particularly when retail panic creates momentary promoting strain. Subsequently, the present section could mark a strategic accumulation zone.

Supply: X/Santiment

Bitcoin’s trade flows reflect robust conviction.

Outflows surged by 182.36% whereas inflows solely grew by 26.15% in seven days. This massive discrepancy exhibits that extra traders are pulling BTC off exchanges for long-term storage.

On prime of that, it implies fading near-term promoting strain, supporting a bullish case.

BTC MVRV hints at room to develop earlier than hazard zones emerge

Bitcoin’s MVRV Z-score sat at 2.42.

This stage suggests traders stay in average revenue however not at excessive threat ranges.

The ratio doesn’t but present overheating, that means the market can nonetheless maintain good points. Subsequently, promoting strain stays managed.

Traditionally, MVRV ranges above 3.5 sign euphoria, however BTC stays under that threshold.

Consequently, traders could proceed holding fairly than taking earnings. This situation favors continued upward momentum, assuming no main shocks or breakdowns happen at present assist ranges.

Supply: Santiment

Shortage surges because the Inventory-to-Circulation ratio explodes post-halving

Submit-halving, Bitcoin’s Inventory-to-Circulation ratio has skyrocketed to 669.72—a stage reflecting severe provide constraints.

Excessive S2F readings usually point out long-term worth progress, particularly when demand rises alongside provide constraints. Subsequently, this sign strengthens the bullish outlook.

Supply: Santiment

Traditionally, post-halving cycles align with main rallies as a consequence of provide shocks. This latest spike mirrors comparable setups seen earlier than previous breakouts.

In consequence, long-term traders could view present costs as undervalued based mostly on future provide dynamics.

Bitcoin’s NVT Ratio has climbed to 380.12—among the many yr’s highest readings. This studying exhibits that the worth is rising quicker than the transaction quantity.

Excessive NVT values usually warn of overvaluation, particularly when community exercise slows. Nevertheless, early-stage rallies also can present this sample.

So, whereas warning is warranted, there’s no purpose for rapid alarm.

Supply: Santiment

What’s subsequent for BTC

Retail merchants seem like dropping curiosity, however whale exercise and Change Outflows counsel the alternative. Shortage metrics proceed to rise whereas revenue ranges keep manageable.

Subsequently, Bitcoin may very well be making ready for its subsequent transfer greater. If assist at $93K holds, the market could witness one other breakout try.

Based mostly on present knowledge, whales stay accountable for the narrative.