Ethereum: What you should know about ETH’s 10-year low exchange supply

- Ethereum alternate provide dropped to 4.9% as accumulation and exercise surge.

- MVRV rebounds and Open Curiosity rises, supporting bullish breakout potential.

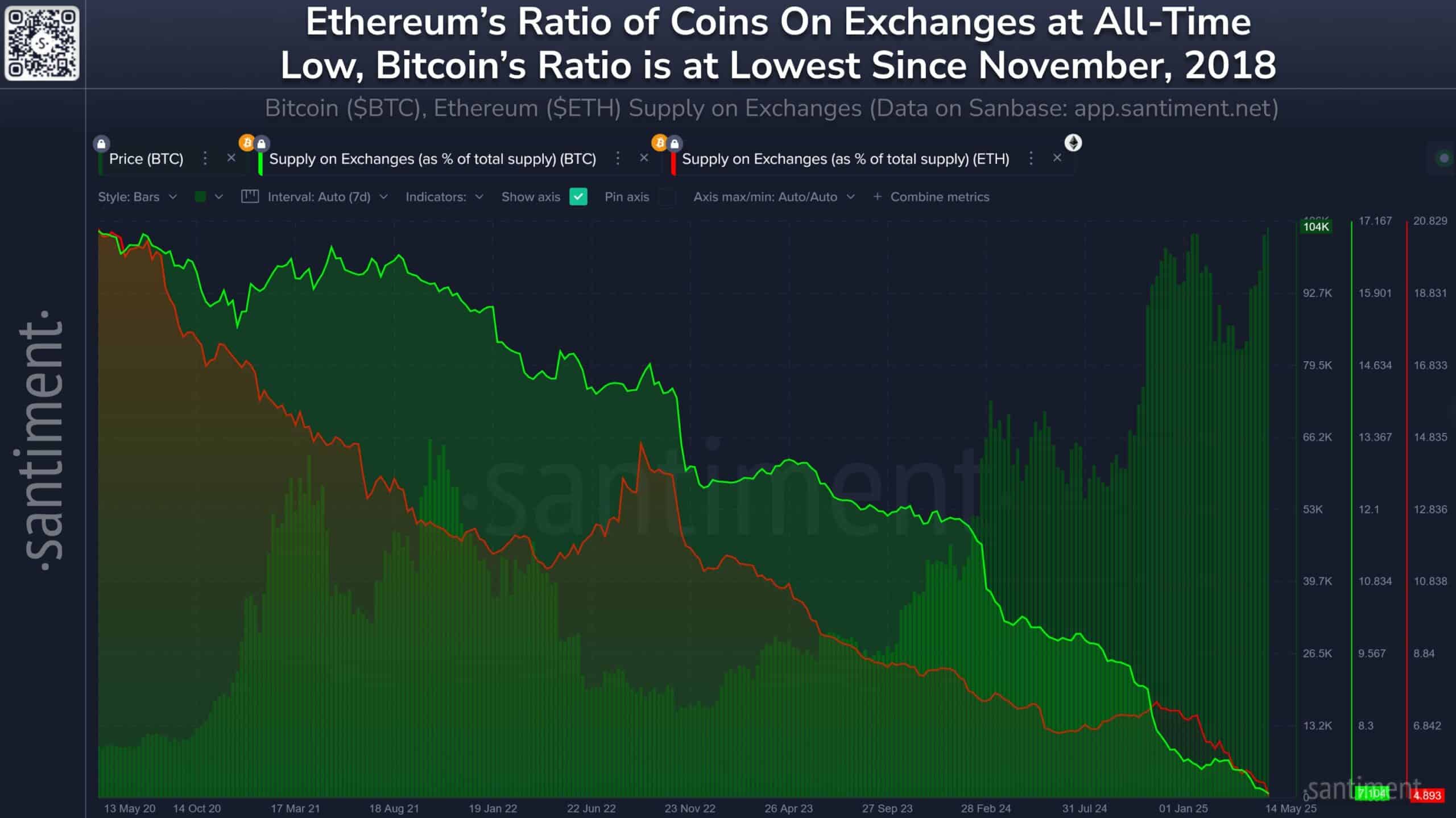

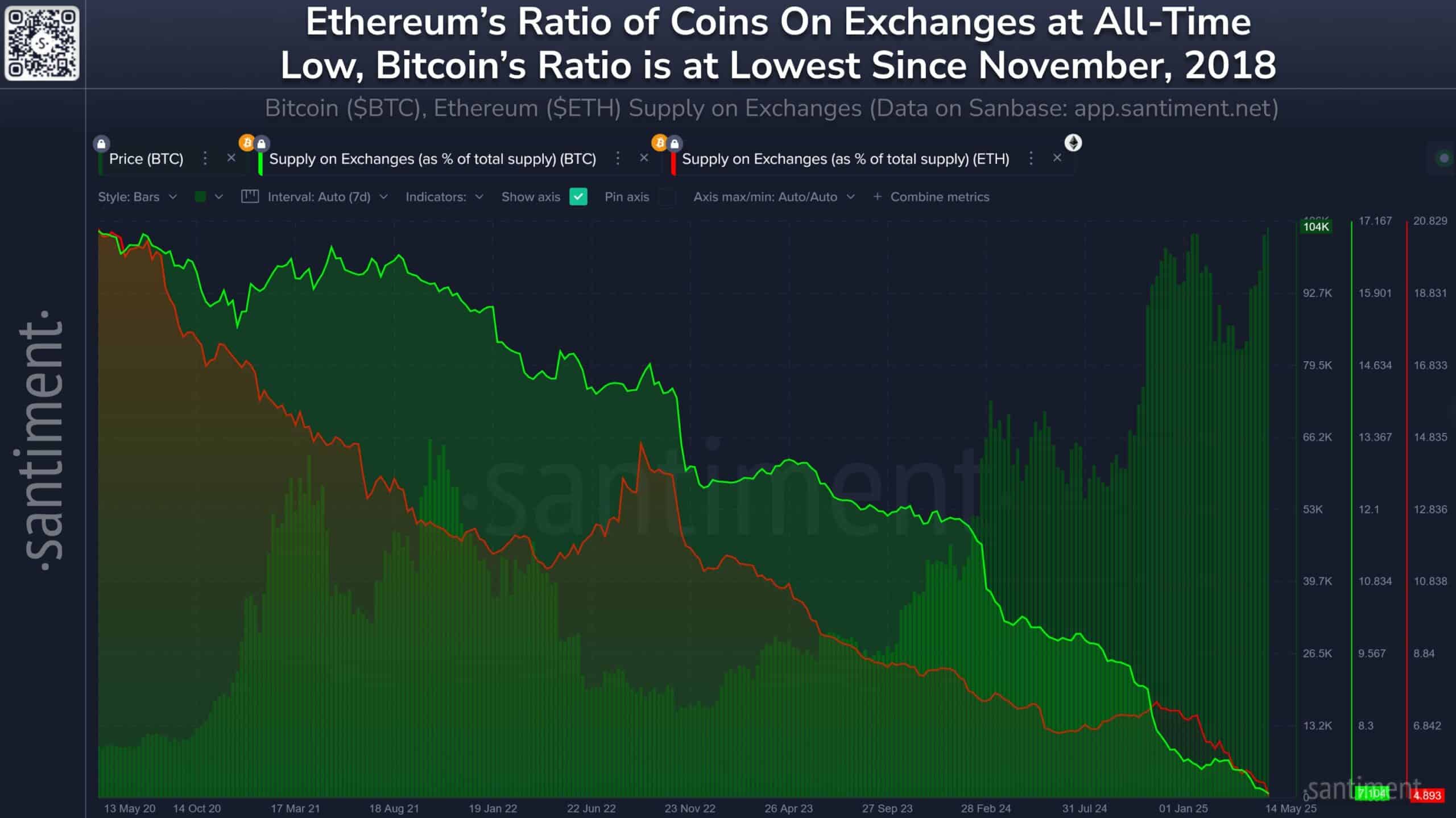

Ethereum’s [ETH] provide on exchanges has dropped to 4.9%, the bottom degree in over a decade, whereas greater than 15.3 million ETH have left centralized platforms since 2020.

This sharp decline displays sturdy long-term accumulation and lowered sell-side stress throughout the board.

Moreover, Open Curiosity (OI) has climbed 11.31% to 16.59B, suggesting elevated positioning from derivatives merchants.

On the time of writing, Ethereum traded at $2,537.15, up 5.37% prior to now 24 hours, with rising metrics throughout each retail and institutional segments pointing to renewed market optimism.

Supply: Santiment

ETH’s consumer exercise and whale transactions ignite recent community momentum

Ethereum’s community exercise has picked up notably, as proven by a 6.09% weekly improve in lively addresses.

New addresses have additionally surged by 28.43% in the identical interval, signaling a rising variety of contributors becoming a member of the community. This spike typically displays an increase in retail consumer curiosity or the onboarding of recent capital.

Traditionally, a rise in each lively and new addresses tends to precede worth expansions, notably when mixed with lowered alternate balances.

Supply: IntoTheBlock

Ethereum’s transaction quantity has expanded considerably throughout all tiers, with essentially the most notable progress seen in bigger transfers. Transactions within the $1 million–$10 million vary have surged by 204.68%, whereas these exceeding $10M jumped 240.63%.

This whale exercise usually displays institutional or high-net-worth investor curiosity. Concurrently, even lower-tier brackets like $1–$10 and $100–$1K recorded progress over 40% and 33%, respectively.

Ethereum: These metrics reinforce bullish conviction

Alongside rising transaction quantity and lively customers, Ethereum’s OI has grown by 11.31%, reaching 16.59 billion.

This metric tracks the overall worth of open lengthy and brief positions throughout exchanges, and a constant rise suggests rising speculative involvement.

Notably, this improve aligns with Ethereum’s latest worth rebound and robust on-chain fundamentals. Nevertheless, rising OI additionally signifies increased volatility forward, particularly if the value nears resistance ranges.

Supply: CryptoQuant

Ethereum’s MVRV ratio has climbed again to 27.19% after spending a number of weeks in unfavourable territory.

This metric compares the market worth to the realized worth of held ETH and helps decide whether or not holders are in revenue. A reasonably optimistic MVRV typically suggests a wholesome market with minimal threat of mass profit-taking.

Technical evaluation exhibits a descending channel breakout try

Ethereum just lately tried a breakout from its descending channel sample, bouncing off the $2,314 assist degree.

The value now faces resistance at $2,571 and $2,622, similar to the 0.5 and 0.618 Fib retracement ranges. A breakout above these zones may pave the best way for a rally towards $2,747.52 and presumably the 1.618 extension at $2,991.88.

Moreover, at press time, the Stochastic RSI was hovering above 70, indicating bullish momentum but additionally nearing overbought circumstances.

Subsequently, Ethereum is at a pivotal level the place additional bullish affirmation may unlock important upside.

Supply: TradingView

Ethereum at present reveals sturdy fundamentals supported by long-term accumulation, rising consumer exercise, surging whale transactions, and rising OI.

The MVRV ratio’s restoration indicators minimal promote stress, whereas the technical setup suggests a possible breakout. If momentum continues, Ethereum may clear key resistances and advance towards the $2,750–$3,000 zone.

Subsequently, present circumstances favor a bullish continuation, offered quantity and sentiment stay aligned.