Solana holders panic sell, dump $3.55B – What can save SOL now?

- Solana continues to point out an inclination to stay bullish as market sentiment turns optimistic.

- Lengthy-term holders are starting to lose conviction, as lots of them have began promoting their holdings.

Solana [SOL] has been on a gradual decline over the previous week, falling by 11.56%. Information means that bearish sentiment has intensified, with promoting stress rising over the past 24 hours.

Lengthy-term holders have performed a notable position on this downturn, elevating the potential of additional declines. Nonetheless, accumulation exercise seems to be rising, which can assist cushion SOL’s worth drop.

Regardless of this, rising accumulation and bullish sentiment in each the spot and by-product markets could assist forestall a significant decline in SOL’s worth.

However whether or not this will probably be sufficient stays to be seen.

LTHs at the moment are promoting their SOL

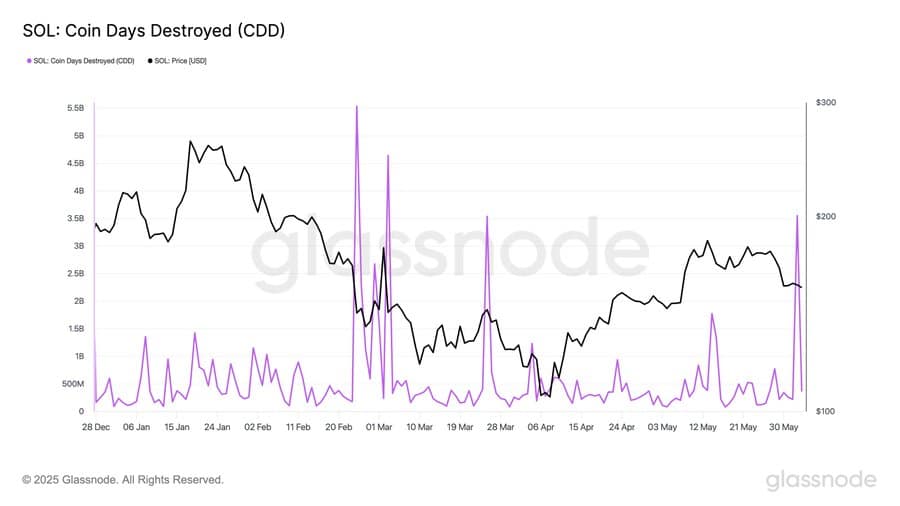

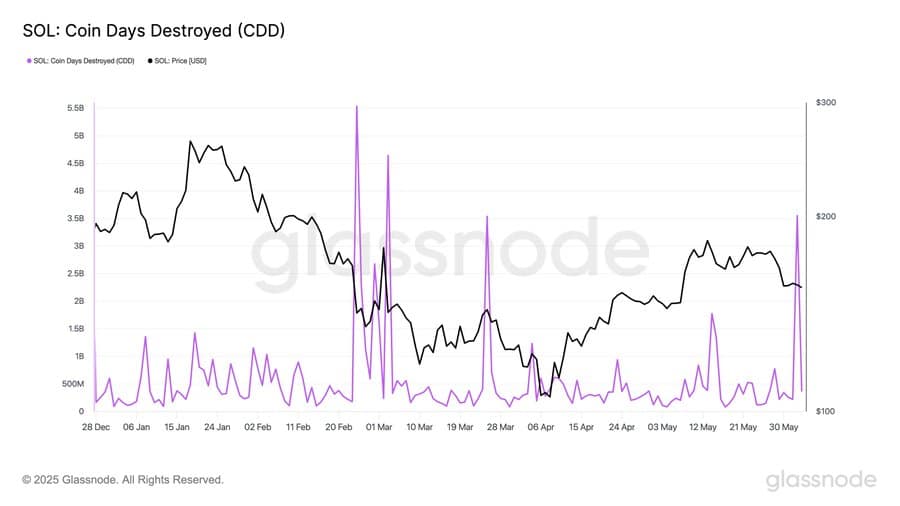

Information from Coin Days Destroyed (CDD), which tracks the final time long-term holders moved their belongings to find out potential shopping for or promoting habits, indicated a transparent promoting pattern.

Sometimes, promoting is assumed when long-term holders transfer their belongings after a chronic interval of inactivity.

Supply: Glassnode

That is the third-largest CDD occasion for SOL, with $3.55 billion value of tokens moved.

It’s surpassed solely by the $5.53 billion moved on the twenty sixth of February and $4.64 billion on the third of March.

Such a major motion would often have a significant impression on SOL’s worth, contributing to additional decline. Nonetheless, this hasn’t been the case. SOL has managed to take care of relative stability available in the market.

This restricted worth impression could be attributed to bullish exercise from each spot and derivatives traders, who proceed to help the asset.

Accumulation is on the rise

Within the spot market, Solana’s alternate netflow—measuring the influx and outflow of SOL between exchanges and personal wallets—signifies rising bullish sentiment.

At current, there was a significant outflow of SOL from exchanges, confirming elevated shopping for exercise. Curiously, the bought SOL is being moved into non-public wallets, suggesting long-term holding.

Supply: Coinglass

Prior to now 48 hours alone, traders have bought and moved over $12 million value of SOL. To date this week, whole purchases have reached $71.70 million.

By-product merchants are reflecting comparable sentiment. The OI-Weighted Funding Fee has climbed considerably, coming into optimistic territory.

Supply: CoinGlass

At 0.0060% at press time, this price signifies that open by-product contracts are largely dominated by merchants betting on a worth rally.

Extra indicators help a possible rally

On the charts, SOL seems well-positioned for a rally, as indicated by the Bollinger Band Indicator.

The Bollinger Band helps establish help (decrease band) and resistance (higher band) ranges for an asset. On the time of writing, SOL has touched the decrease band.

Supply: TradingView

The final time SOL traded at this stage, it skilled a 79% rally.

If the present setup mirrors earlier patterns, SOL has a powerful probability of returning to the $180–$200 vary on the charts.