BNB defends $640 – With active users at an ATH, is $674 in sight?

- BNB bounced off $639 help as Non-Sybil Customers hit 1.7 million and Energetic Addresses reached 2 million.

- If person and whale momentum persists, Binance Coin may goal $674; if not, a retest of $639 is probably going.

After hitting an area excessive of $673, Binance Coin [BNB] retraced following political tensions within the Center East, reaching a low of $639.

Nevertheless, over the previous day, the altcoin has efficiently defended the $640 help degree and bounced again.

This isn’t bots—it’s a breakout in actual demand

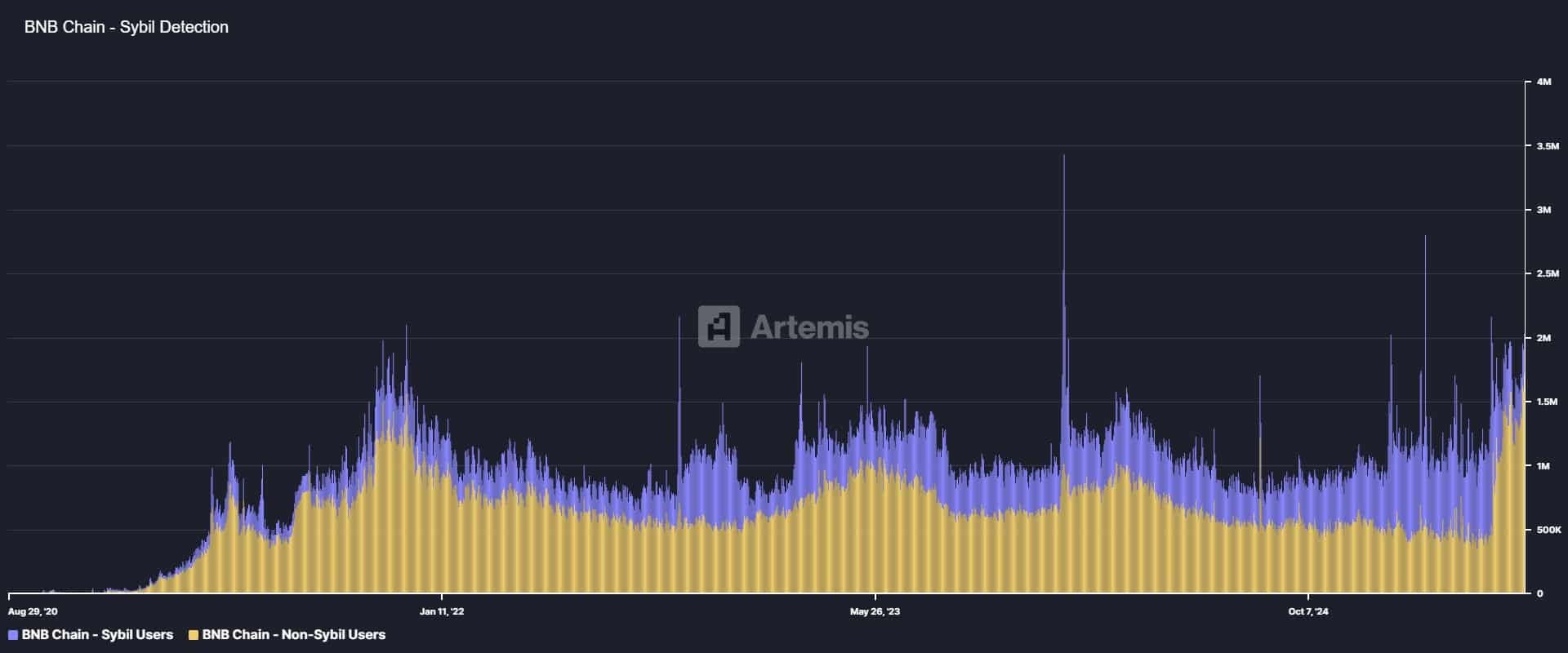

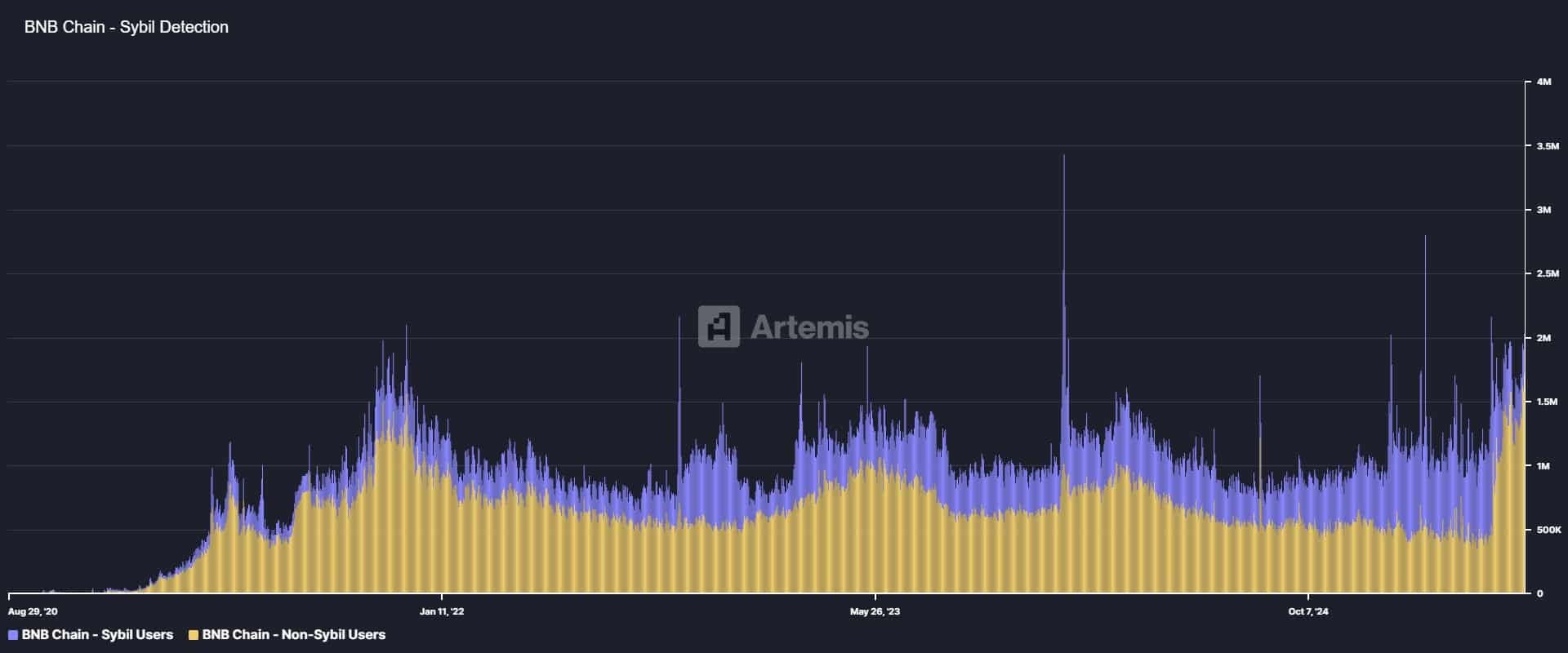

In keeping with AMBCrypto’s evaluation, new on-chain information suggests the rebound wasn’t random. BNB’s Non-Sybil Customers hit an all-time excessive of 1.7 million, per Artemis.

These are verified actual customers, excluding airdrop hunters and bots, making the surge much more significant.

Supply: Artemis

As such, extra actual persons are actively utilizing BNB chain and never bots or aidrop hunters. Thus, there’s rising curiosity, demand, and utility for BNB because the community turns into stronger.

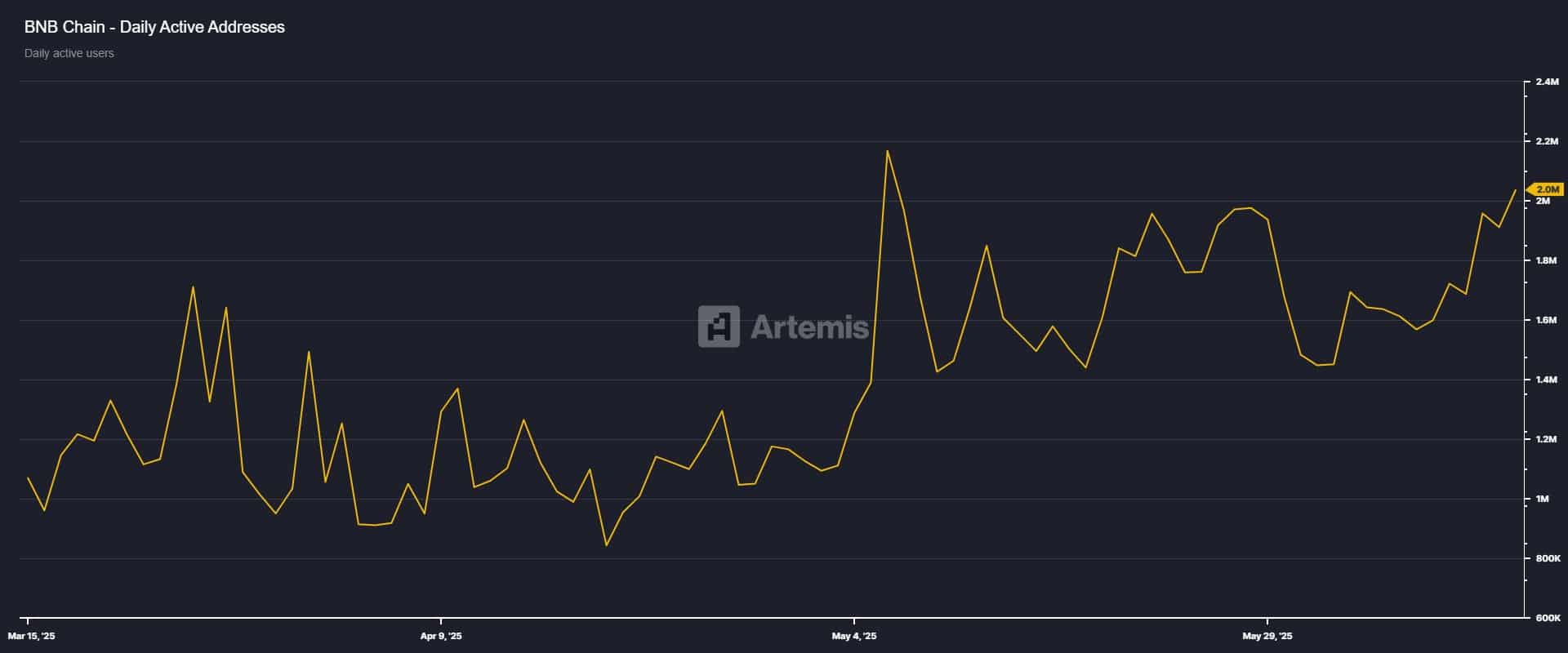

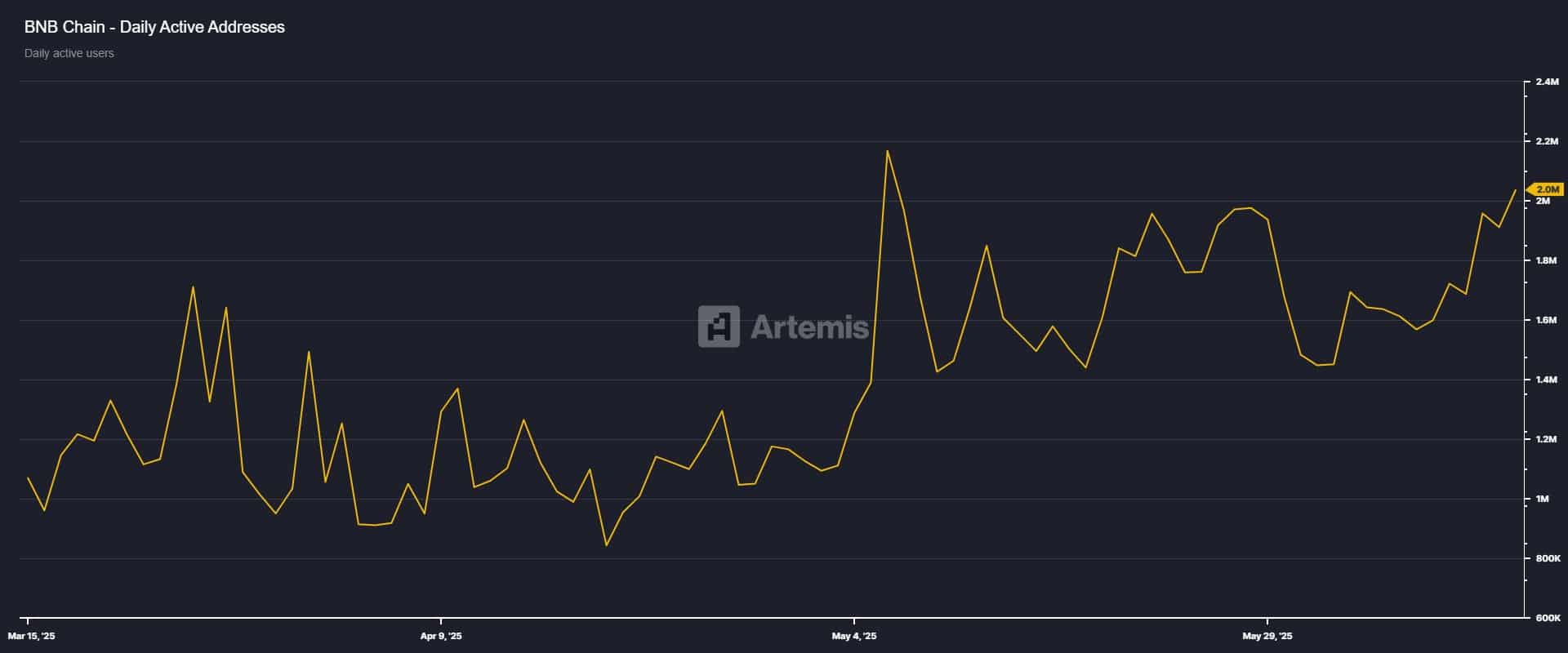

Supply: Artemis

Amid this rising variety of precise customers, BNB Energetic Addresses have additionally surged considerably, hitting a month-to-month excessive of two million. Amongst these energetic addresses are new wallets, which have additionally spiked to hit a month excessive of 595.7k.

Such a major surge in energetic addresses and new entrants displays rising demand for the chain. Traditionally, the next variety of customers pushes demand increased, which precedes elevated costs.

Futures say “bullish”—And the whales agree

Amid a rising person base, bullish sentiments are additionally increasing throughout all market members.

At the moment, it appears that evidently customers getting into the market are largely bullish and are additionally massive entities.

Supply: CryptoQuant

BNB’s Futures Taker CVD (Cumulative Quantity Delta) stays buyer-dominant over the previous 90 days. Which means taker orders in futures are largely long-biased, confirming market conviction.

What’s extra fascinating: Futures Common Order Measurement reveals massive whale trades have returned. Inexperienced dots dominate current charts, confirming that large gamers are stepping again in.

These members are extremely bullish as they’re getting into into the futures to take lengthy positions, as longs account for 73% of the overall contracts.

This suggests that bullish sentiments are additionally dominant and buyers anticipate costs to rise additional.

Supply: CryptoQuant

With the adoption fee hovering whereas buyers are bullish, these situations set BNB in a positive place for additional features.

When the variety of customers surged to such ranges on the sixth of Could, BNB broke out of consolidation and surged to $692.

Subsequently, if the situations witnessed persist, the altcoin will full the development reversal and eye $674.

Nevertheless, if the variety of customers getting into fails to spice up BNB increased, the altcoin will retrace and retest the $639 help degree.