Ethereum – How changes in adoption stats and scarcity can fuel a new breakout

- Ethereum’s community exercise and whale accumulation highlighted bullish alignment regardless of range-bound worth

- Rising shortage and cooling speculative demand might help a long-term breakout above $2,833

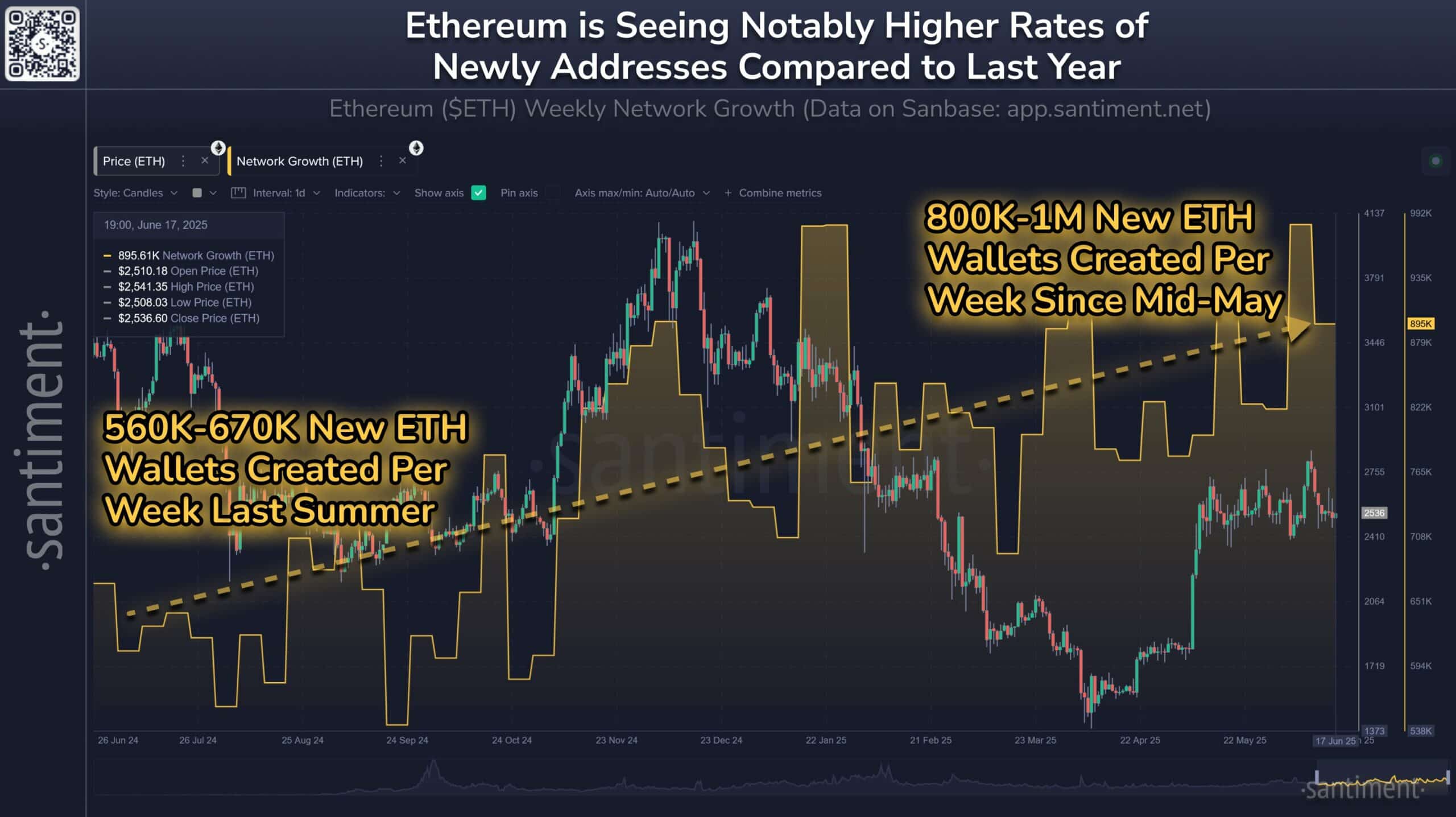

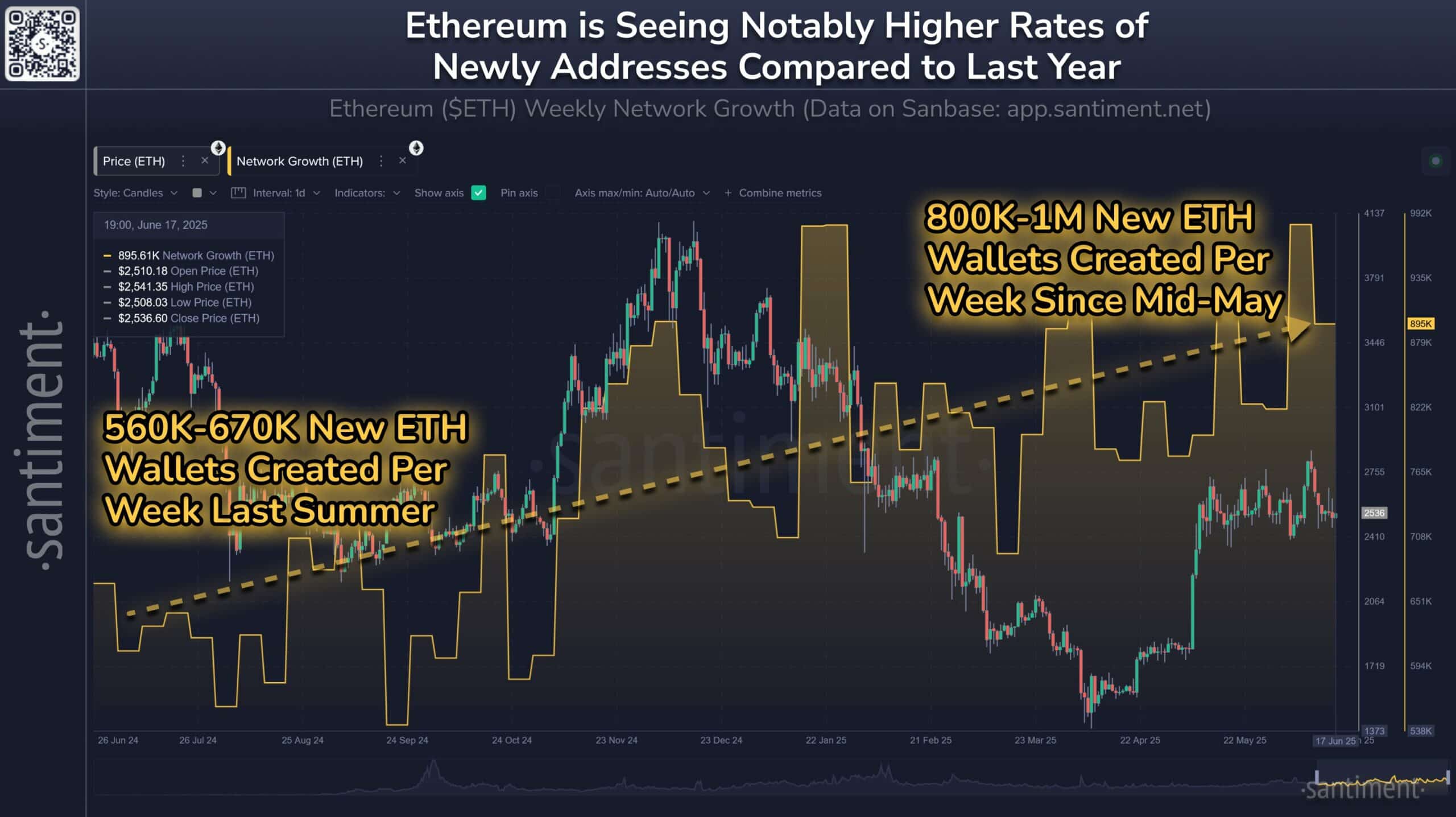

Ethereum [ETH] has seen a constant uptick in weekly handle creation these days, ranging between 800k and 1M since mid-Could – Up from 560k–670k this time final 12 months.

With ETH buying and selling inside a slender band close to $2,500, the surge in new wallets might imply that the community’s fundamentals are strengthening quickly.

A hike in consumer participation usually alerts deeper utility adoption, notably when pockets creation grows alongside steady worth motion.

Due to this fact, Ethereum’s increasing community base might function a basis for stronger demand and long-term valuation help.

Supply: Santiment/X

Are whales quietly returning to build up ETH?

Massive holder netflows have reversed sharply over the previous week, rising by over 7,400% after weeks of muted exercise. This spike adopted a protracted interval of unfavourable flows, which can have signaled distribution or repositioning.

Now, the renewed inflows might imply rising confidence amongst whales. This pattern additionally appeared to coincide with regular worth help, probably reflecting strategic accumulation.

Moreover, this whale conduct might precede a provide crunch if the pattern continues. Due to this fact, the newest accumulation pattern by giant holders might sign the beginning of a extra bullish part.

Supply: IntoTheBlock

Will Ethereum’s worth break away from its consolidation sample?

ETH has remained locked in a variety between $2,396 and $2,833, respecting an ascending channel construction.

Regardless of a number of makes an attempt, bulls have struggled to breach the $2,833 resistance, whereas bears have failed to interrupt under the $2,396 help. This worth compression displays indecision, however one thing like this usually precedes explosive motion.

On the time of writing, the Stochastic RSI was low – Implying an incoming reversal if shopping for stress will increase. Till a breakout happens, the value will seemingly oscillate on this tight zone. Nevertheless, rising fundamentals might quickly tip the steadiness.

Supply: TradingView

Is ETH shifting from short-term hype to long-term worth?

Lastly, ETH’s short-term holder exercise, measured by the 0–1 day Realized Cap HODL Waves, noticed a decline after weeks of sharp spikes. This advised that current consumers could also be exiting or taking income, lowering short-term volatility and easing promote stress.

On the similar time, ETH’s Inventory-to-Move ratio surged to 43.2—its highest in months—indicating rising shortage as new issuance slowed down.

This mixture of fading speculative conduct and rising long-term worth metrics might set the stage for a extra sustainable upward transfer.

If long-term demand persists, ETH might quickly break its present worth ceiling and shift firmly into accumulation territory.

Supply: Santiment

Is Ethereum gearing up for a breakout past $2,800?

Ethereum’s on-chain power is changing into more and more tough to disregard. With new pockets creation accelerating, whales returning, and shortage metrics like Inventory-to-Move spiking, the basics could also be aligning for a possible rally.

Whereas the value stays trapped inside an outlined vary, the rising community exercise and declining short-term holder momentum might quickly shift the steadiness. If bullish stress holds, ETH might break previous $2,800.