Bears Will Be Washed Out Of Bitcoin If This Happens

Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

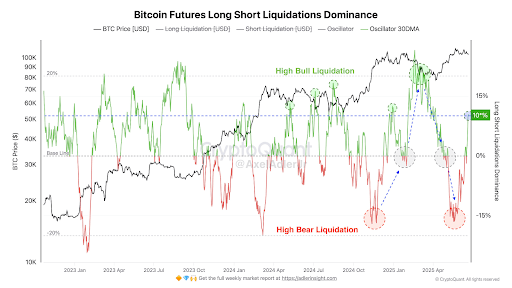

Bitcoin’s slender value motion over the previous week contradicts a a lot completely different growth within the futures market. In response to Axel Adler Jr., an analyst at on-chain analytics platform CryptoQuant, a pointy rise within the lengthy liquidation dominance metric may set the stage for a major shift in sentiment which will utterly wash out bears from the market. Adler shared the info in a recent post on X, accompanied by a chart displaying earlier factors that resemble the present setup.

Lengthy Liquidation Spike With out Value Crash

The dominance of lengthy liquidations has jumped from 0% to +10% over the previous seven days, a transfer that sometimes reveals misery amongst bullish merchants. Nonetheless, what makes the present growth particularly noteworthy is the absence of a steep crash in Bitcoin’s value. As an alternative, within the simply concluded week, Bitcoin held largely inside the $103,000 to $106,000 vary till a latest drop, regardless of going through rising strain from long-side liquidations.

Associated Studying

Axel Adler Jr. defined that this sustained liquidation of lengthy positions with out a full-blown value collapse signifies sustained purchaser assist. In response to information from CryptoQuant, BTC’s lengthy liquidations hit 2,200 BTC, the best up to now week. Normally, a surge in lengthy liquidations means that merchants who have been anticipating a value rally are being pushed out of their positions below strain.

The CryptoQuant chart beneath reveals how spikes in lengthy liquidation dominance, particularly within the 15% to twenty% vary, have all the time preceded bullish reversals. In response to the analyst, if this metric rises by one other 5–7%, it may trigger a high-probability situation the place bearish positions are washed out and flip Bitcoin’s value actions in favor of the bulls.

Massive Wallets Accumulate As Retail Exits

Information from Santiment, one other on-chain analytics platform, reveals an fascinating dynamic taking part in out amongst Bitcoin holders. Over the previous ten days, wallets holding over 10 BTC have elevated by 231 addresses, which is a 0.15% rise. In the meantime, smaller retail wallets containing between 0.001 and 10 BTC have dropped by 37,465 in the identical timeframe. This development highlights a divergence in sentiment between massive and retail holders.

Associated Studying

According to Santiment, the shift the place whales and sharks accumulate whereas retail exits is a bullish mixture for Bitcoin. Bitcoin’s market worth is hovering just under $104,000 throughout this accumulation section, and there might be an eventual upward breakout once retail holders begin to reenter.

Regardless of the underlying on-chain power, Bitcoin’s spot value has taken a short-term hit up to now 48 hours. Throughout this timeframe, Bitcoin’s value has slipped beneath assist ranges between $106,000 and $103,000. On the time of writing, Bitcoin is buying and selling at $102,670, down by 2.6% up to now 24 hours.

The decline will be largely attributed to latest U.S. strikes on Iran. The U.S. army strikes on Iranian nuclear services (June 21-22) induced rapid danger aversion throughout markets. Bitcoin fell 3.2% after announcements of the strikes, very similar to its 6% drop throughout related 2020 Iran tensions.

Featured picture from Dall.E, chart from TradingView.com