Crypto stocks rally on ceasefire optimism – But will it last?

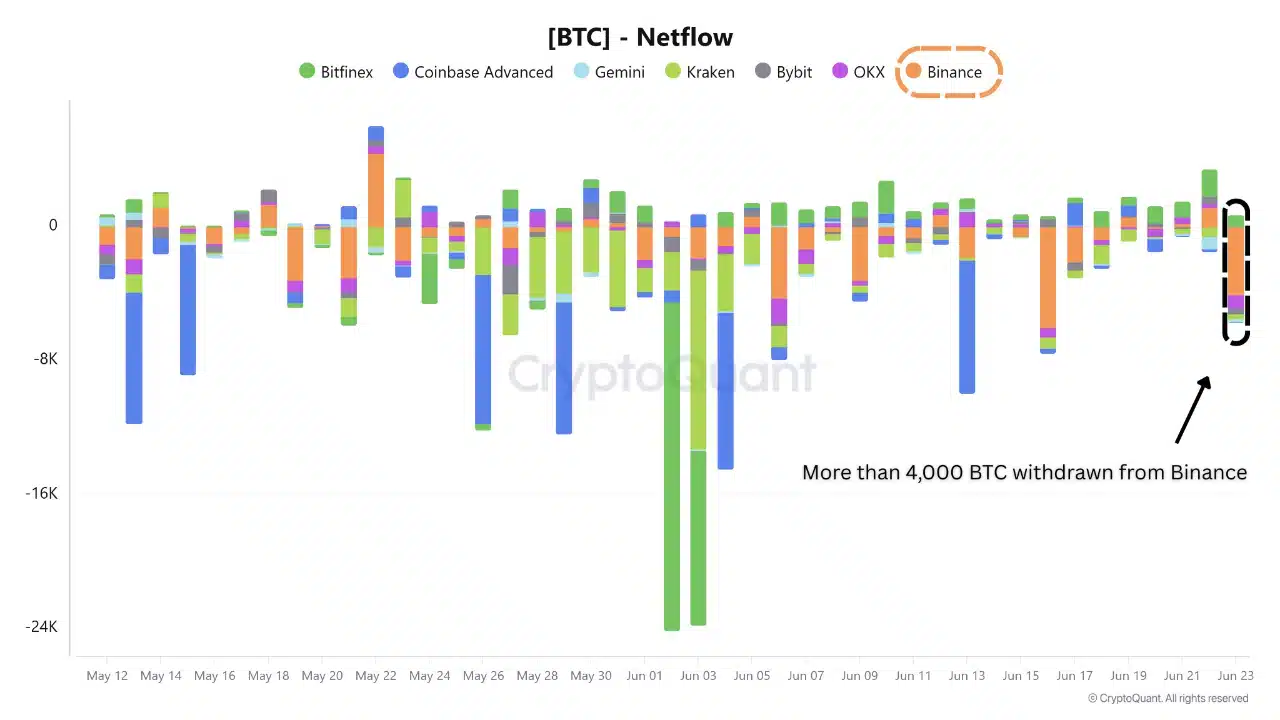

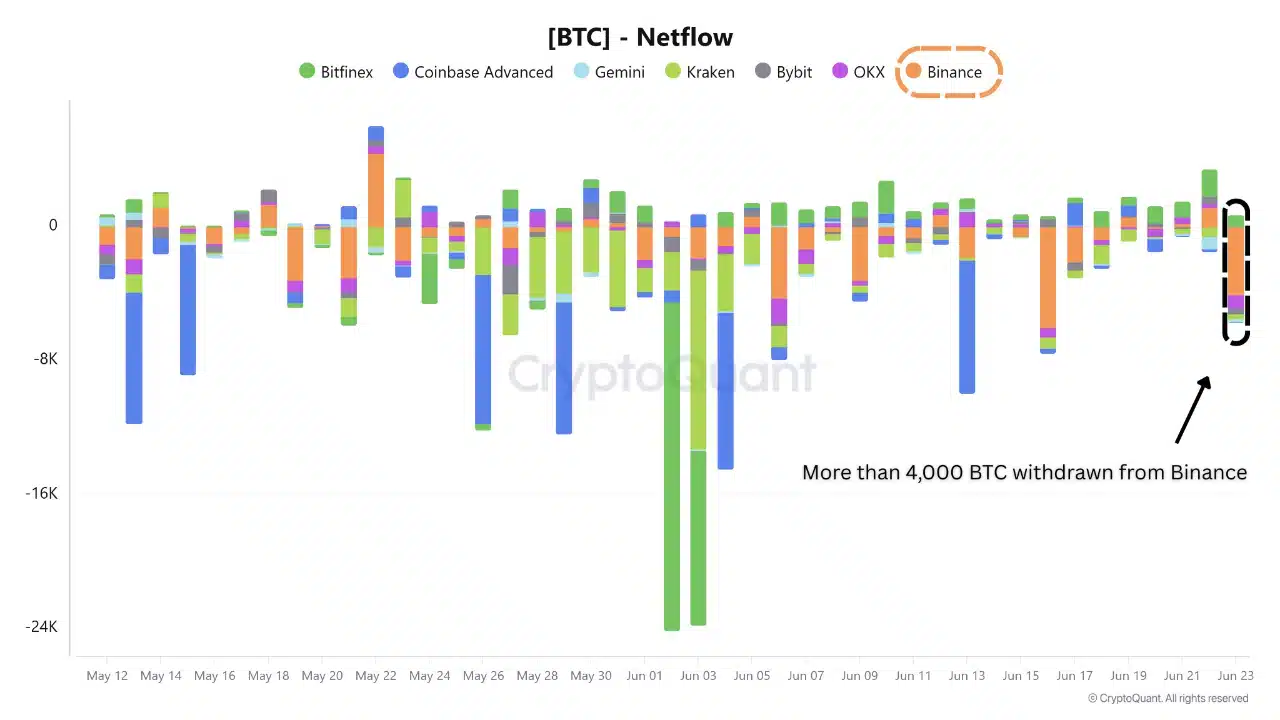

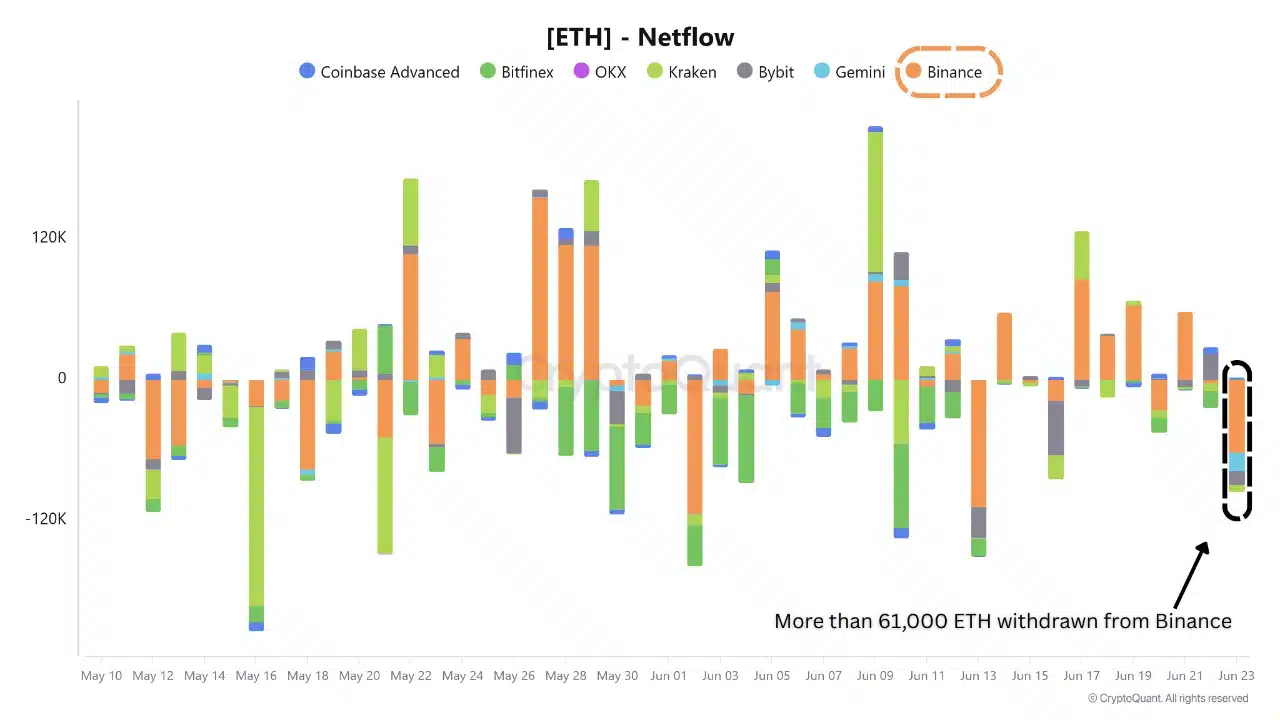

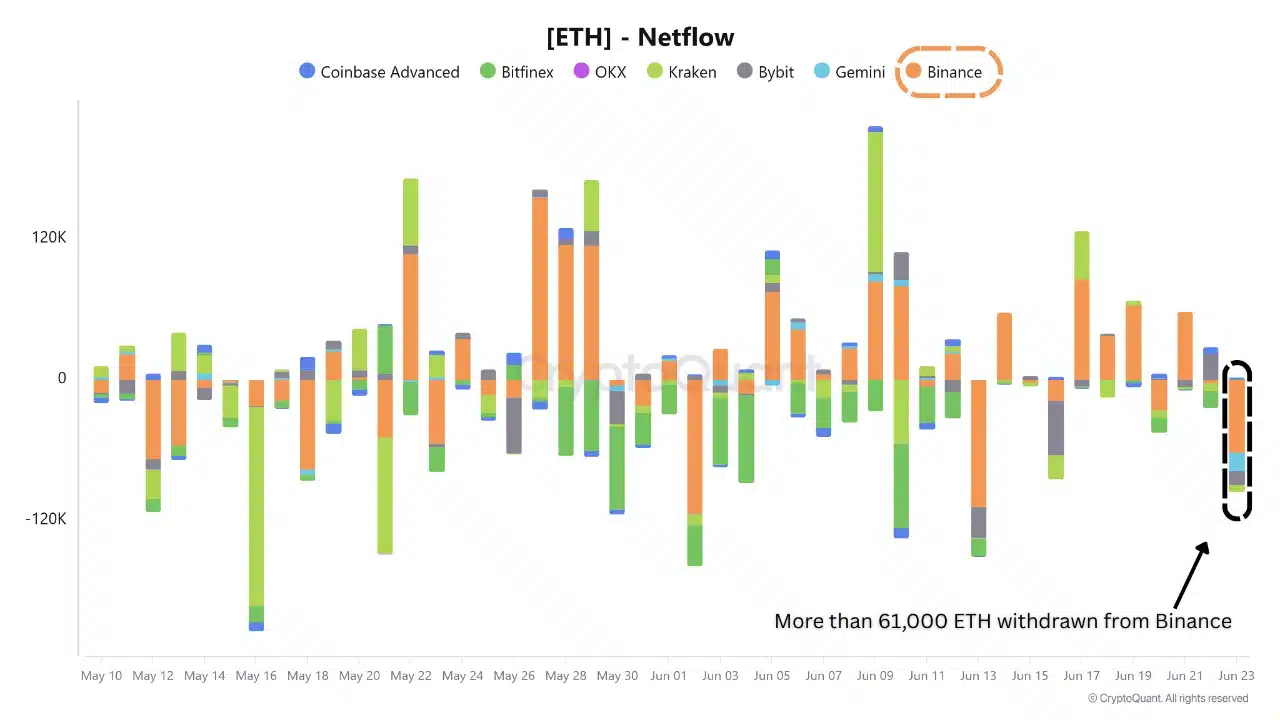

- Over 4,000 BTC and 61,000 ETH had been withdrawn from Binance amid easing geopolitical tensions.

- S&P 500 surge and oil value drop present macro assist for crypto accumulation and danger urge for food.

Bitcoin [BTC] and Ethereum [ETH] recorded vital outflows from Binance on the twenty third of June, a shift towards long-term investor confidence as world tensions ease.

The exodus got here on the heels of President Donald Trump’s ceasefire announcement between Iran and Israel, triggering a broader risk-on rally – oil costs tumbled, U.S. equities surged, and crypto markets caught the bullish bug.

Large Bitcoin and Ethereum outflows

Supply: CryptoQuant

On the twenty third of June, Binance registered sharp outflows – greater than 4,000 BTC and over 61,000 ETH – marking one of many largest single-day withdrawals in current reminiscence.

Supply: CryptoQuant

As proven in CryptoQuant’s netflow charts, Binance was the first driver of unfavourable movement whereas different exchanges remained largely impartial. This highlights an exchange-specific transfer doubtless tied to accumulation methods.

The size of those outflows suggests institutional or HNIs (Excessive Internet-Price People) repositioning away from short-term hypothesis.

This conduct is consistent with rising confidence in market stability and a choice for self-custody; usually seen in early-stage bull cycle positioning.

Ceasefire holds regardless of early tensions

The ceasefire between Israel and Iran started on shaky floor, with each side shortly accusing one another of violations.

Israeli Protection Minister Israel Katz alleged that Iran launched missiles into Israeli territory, prompting a army response. Iran denied the accusations and, in flip, accused Israel of aggression.

President Trump urged each nations to point out restraint and reiterated U.S. backing for the ceasefire.

Regardless of the tense begin, the truce stays in impact, calming market nerves and probably boosting danger sentiment throughout world and crypto markets.

Supply: TradingView

Main crypto property responded to the bettering sentiment, with Bitcoin and Solana [SOL] rebounding into optimistic territory.

In distinction, Ethereum and Binance Chain [BNB] remained comparatively flat, signaling a selective market restoration and a tentative return of investor confidence.

Macro circumstances strengthen

Supply: Cryptoquant

The S&P 500 surged previous the 6,000 mark for the primary time since February 2025, exhibiting investor confidence and a transparent shift towards danger property.

Concurrently, West Texas oil costs plunged over 14%, a transfer that reinforces the worldwide disinflation narrative.

Supply: CryptoQuant

These indicators recommend a backdrop of easing geopolitical tensions, declining price pressures, and robust development urge for food.

For crypto, this macro surroundings creates a positive setup for accumulation—particularly as digital property more and more mirror risk-on sentiment in conventional monetary (TradFi) markets.