Bitcoin Spot ETFs Register $2 Billion Inflows As Institutional Demand Surges – Details

The US Bitcoin spot ETFs logged over $2 billion in internet inflows final week, marking a three-week streak of constructive momentum. Regardless of a bearish begin to June, with $128.81 million in internet outflows throughout the first buying and selling week, investor urge for food quickly shortly rebounded. This turnaround has resulted in a cumulative $4.63 billion in deposits over the previous three weeks.

Bitcoin ETFs On Spectacular 14-Day Optimistic Streak Regardless of Market Uncertainty

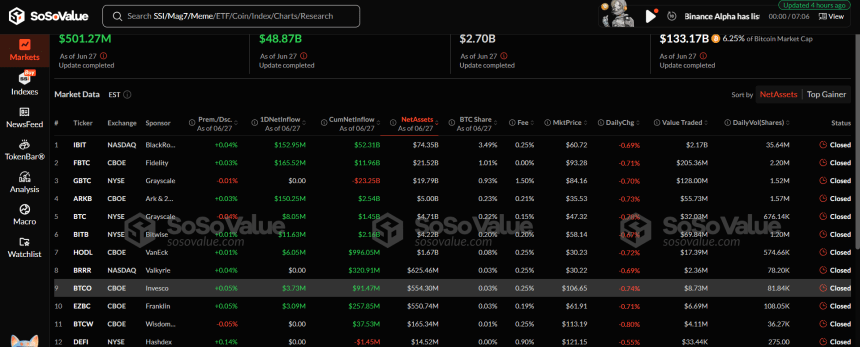

On Friday June 27, the 12 US Bitcoin ETFs registered internet inflows of $501.27 million bringing the combination deposits of the final week to a staggering $2.22 billion. In line with data from ETF tracking site SoSoValue, the clear streak of each day inflows from final week extends the ETFs’ constructive efficiency to 14 consecutive days.

In analyzing particular person ETF information from this week, the BlackRock IBIT registered $1.31 billion in internet deposits solidifying its place because the market’s unrivalled chief. In the meantime, Constancy’s FBTC and Ark/21 Shares’ ARKB additionally skilled substantial cumulative inflows of $504.40 million and $268.14 million, respectively.

Grayscale’s BTC, VanEck’s HODL, Valkyrie’s BRRR, Invesco’s BTCO, and Franklin Templeton’s EZBC additionally recorded reasonable internet flows starting from $1million – $25 million. In acquainted trend, Grayscale’s GBTC produced the one internet outflows dropping $5.69 million in withdrawals, however nonetheless retains its place because the third largest Bitcoin ETF with $19.79 billion in internet property.

Following this week, the US Bitcoin Spot ETFs have now recorded $4.50 billion in internet flows in June signaling a resolute demand from institutional traders regardless of Bitcoin market troubles. Notably, the premier cryptocurrency has witnessed intensive corrections since hitting a brand new all-time excessive of $111,790 on Might 22.

Over the past month, BTC has made no new worth discovery buying and selling largely between $100,000 and $110,000 to kind a descending worth channel. Whereas this worth efficiency displays a impartial market sentiment, the excessive inflow of capital into the Bitcoin ETFs sign a long-term confidence by institutional traders on Bitcoin’s worth appreciation prospects.

Ethereum ETFs Log $283 Million In Deposit To Shut Out H1 2025

In different developments, SoSoValue data additionally reveals that US Ethereum Spot ETFs notched up a cumulative influx of $283.41 million during the last week extending their constructive streak to seven consecutive weeks. In June alone, these ETFs noticed complete inflows of $1.13 billion, marking their largest month-to-month acquire in 2025.

As of the time of writing, the full internet property of the Ethereum ETFs stand at $9.88 billion, accounting for 3.37% of Ethereum’s market capitalization. In the meantime, Ethereum continues to commerce at $2,441 with Bitcoin costs set round $107,339.