Bitcoin and Ethereum succumb to TradFi – What now?

- The U.S. debt ceiling choice propelled S&P 500 and gold costs, surpassing Bitcoin and Ethereum.

- Bitcoin and Ethereum had been buying and selling at a revenue on a day by day timeframe at press time.

In an interesting flip of occasions, the costs of the S&P 500 and gold have taken a leap, outshining Bitcoin [BTC] and Ethereum [ETH]. This outstanding shift might be attributed to the U.S. Congress’s choice on 1 June, whereby they opted to droop the nation’s debt ceiling.

Bitcoin and Ethereum beneath conventional shares

The United States Congress has efficiently endorsed an settlement that will increase the federal government’s borrowing restrict to avert the potential calamity of defaulting on debt repayments. The Senate handed the deal on 1 June, and the Home of Representatives authorized it the day earlier than.

As soon as signed into legislation by President Joe Biden, this settlement will allow the federal authorities to borrow funds till after the following presidential election in November 2024.

The development of cryptos and equities

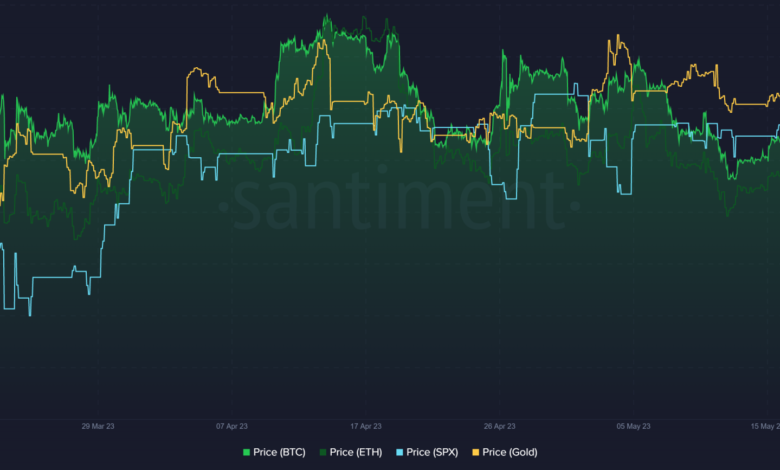

Fascinating insights from Santiment revealed that the choice to lift the debt ceiling profoundly impacted the worth actions of varied property.

Conventional shares, as exemplified by the S&P 500, witnessed a outstanding surge, reaching their highest stage since August. Furthermore, the worth of gold additionally skilled an upward elevate, as indicated by the chart.

As of this writing, the S&P 500 value had surpassed the $4000 mark, whereas gold exceeded $1,900.

Supply: Santiment

Then again, the chart demonstrated that cryptocurrencies, together with Bitcoin and Ethereum, had been trailing behind equities. They had been experiencing a relatively decrease efficiency than conventional shares, exhibiting a weak correlation.

Bitcoin and Ethereum value development

Bitcoin has lately witnessed a collection of fluctuations, oscillating between highs and lows however persistently remaining beneath the $30,000 value threshold. As of this writing, Bitcoin was buying and selling at roughly $27,160, showcasing a modest achieve of over 1%.

It was exhibiting a bearish development at press time, as indicated by its Relative Power Index (RSI) on a day by day timeframe. Nonetheless, there was a noticeable uptrend in its RSI line, due to a value enhance.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

In an analogous vein, Ethereum has additionally been buying and selling with a revenue. Its worth on the time of writing stood round $1,890, reflecting a achieve of over 1.5%. In contrast to Bitcoin, Ethereum was experiencing a bullish development, in response to its RSI line.

Supply: TradingView

As for the longer term, it stays unsure whether or not there might be a stronger correlation between the worth actions of Bitcoin, Ethereum, the S&P 500, and gold within the coming days.