Crypto Mining Pools 101: Types, Rewards and How They Work

Mining cryptocurrencies has grow to be way more aggressive than in Bitcoin’s early days. As a substitute of working alone, particular person miners usually be part of “mining swimming pools”—teams that mix their computing energy to seek out legitimate blocks quicker and share mining rewards. This information explains what a mining pool is, how the mining course of works, and what to look at for when miners take part, from reward fashions to charges and operator insurance policies.

What Are Crypto Mining Swimming pools?

A crypto mining pool is a collective of miners who mix their computing energy to extend the probabilities of efficiently mining a block. As a substitute of working alone and competing towards the complete community, miners in a pool share assets and rewards. When the pool finds a block, the payout is distributed amongst contributors primarily based on their contribution, normally measured by hashrate.

Mining swimming pools emerged as block issue and competitors grew, making solo mining much less worthwhile. They permit smaller miners to earn extra predictable rewards, turning mining right into a steadier earnings stream relatively than a uncommon, high-value occasion.

Enjoyable reality: The primary mining pool, Slush Pool, was launched by Marek “Slush” Palatinus in November 2010, establishing right this moment’s customary of pooled coordination for Bitcoin miners.

How Crypto Mining Swimming pools Work

A mining pool acts like a cooperative “super-miner.” It combines the processing energy of many contributors and connects to the blockchain as a single node. Particular person miners run mining shoppers or specialised firmware that connects their {hardware} to the pool’s server.

The pool’s server assigns every miner a small slice of the cryptographic work, validates the outcomes, and submits profitable block options to the community. That cryptographic work largely consists of operating a hash perform many trillions of occasions per second to attempt to discover a legitimate block header.

When a block reward is earned, the payout is shared amongst members based on their contribution. This turns the uncommon, unpredictable rewards of solo mining right into a steadier earnings stream.

Learn extra: Is Bitcoin Mining Authorized?

The Position of Hashrate in Pool Mining

Hashrate is the measure of what number of cryptographic calculations a miner performs per second. Inside a pool, this determine determines your weight within the payout. A rig that contributes 2% of the full pool hashrate can count on about 2% of the reward after charges. The extra legitimate shares your machine submits, the clearer your contribution and the bigger your lower.

Mining Pool Charges

Swimming pools aren’t free. Typical expenses vary from 0.5% to three% of earnings. For instance, the ViaBTC Bitcoin mining pool charges a 2% fee rate, on the PPLNS payout mannequin.

On the whole, you must look out for:

- Infrastructure charges that preserve servers operating.

- Transaction-fee coverage, with some swimming pools passing block charges to miners (FPPS), and others conserving them.

- Hidden prices like minimal payout thresholds or withdrawal charges.

Decrease charges don’t at all times imply greater internet earnings if uptime or assist is weak.

How Work Is Divided

The pool breaks every block candidate into “jobs” and fingers them out to miners:

- The server creates a modified block header with a decrease “pool issue.”

- Every miner hashes till it finds a sound share at that issue.

- The pool tracks shares to measure contribution.

- When a share additionally meets the total community issue, the pool submits the block and distributes rewards.

This technique lets even small rigs take part successfully with out competing head-on at full community issue.

Often, two miners discover legitimate blocks at practically the identical time. Just one results in the longest chain; the opposite is named an “orphan block” (or stale block). Orphan blocks don’t earn the total block reward, so swimming pools monitor and report them individually.

Sluggish block propagation (when information of a newly discovered block spreads slowly by the community) will increase the possibility that one other miner finds and broadcasts a competing block first, which may create orphan blocks and misplaced rewards.

What Is the Goal of Mining Swimming pools

Mining swimming pools exist to scale back payout variance throughout proof-of-work networks. As a substitute of ready a very long time for a solo block, miners mix hashrate so blocks are discovered extra incessantly and rewards will be break up proportionally. This delivers steadier money stream for electrical energy and {hardware} prices, whether or not you’re doing Bitcoin mining (SHA-256), mining Monero (RandomX), Litecoin/Dogecoin (Scrypt), or different PoW cash.

Learn extra: What’s Proof-of-Work?

Past smoothing earnings, mining swimming pools function the coordination layer: they assemble block-candidate “jobs,” confirm shares, and deal with accounting and payouts (e.g., PPS, FPPS, PPLNS). Swimming pools may unlock further income or broader participation.

The trade-off is focus. Massive swimming pools make payouts predictable however can centralize hashrate underneath a couple of operators, which the group watches carefully and addresses with protocol and market selections. Miners’ choice of swimming pools (and diversification throughout them) helps keep community well being.

How Mining Swimming pools Differ from Solo Mining

Solo mining means you run your individual mining operations end-to-end: you join {hardware} to a node, construct block templates, and compete alone. In the meantime, in a pool, many miners coordinate underneath one operator that handles the mining course of, from job task and share accounting to payouts.

The selection is about variance, management, and operational complexity—however extra importantly, income. The query ‘Is mining value it?’ has been requested for some time now, and it turns into an increasing number of urgent yearly. Pool mining positively eases the upfront and maintenance prices on a singular miner, and, although it divides income amongst extra miners, it could nonetheless come out forward in some instances.

| Solo Mining | Pool Mining | |

| Competitors | One miner towards the complete community | Aggregated “digital miner” fashioned by many contributors |

| Payout Sample | Uncommon, massive wins with lengthy gaps | Frequent, smaller funds |

| Time to First Payout | Lengthy or unsure | Quick and predictable |

| Charges | None to an operator; you retain full block + tx charges if you win | Operator payment (usually ~0.5–3%); tx-fee dealing with is dependent upon PPS/FPPS/PPLNS/PPS+ |

| Management Over Block Template | Full management | Restricted; pool selects template |

| Operational Overhead | Greater: run a node, templates, monitoring | Decrease: join rigs; operator runs backend |

| Issue Goal | Full community issue | Decrease share issue set by the pool |

| Infrastructure Dependence | Your personal uptime solely | Pool uptime, coverage, and solvency matter |

Learn extra: Most Worthwhile Crypto To Mine

Kinds of Mining Swimming pools

Mining swimming pools fall into two broad fashions: operator-run (centralized) and peer-to-peer (decentralized).

There isn’t any single “finest mining pool.” The correct selection is dependent upon charges and payout methodology, uptime, transparency, geography/latency, and your tolerance for variance and operator threat.

Keep Protected within the Crypto World

Discover ways to spot scams and shield your crypto with our free guidelines.

Centralized Mining Swimming pools

Centralized mining swimming pools are operator-run companies that coordinate many miners as one massive “digital miner.” The operator builds block templates, units share issue, tracks shares, and pays miners by a said methodology. In a pool of this kind, your rigs connect with pool endpoints. The pool assigns work, verifies submitted shares, and submits blocks it finds to the community. Rewards are credited at fastened intervals per the pool’s payout coverage.

Professionals. Easy setup, frequent payouts, detailed dashboards, broad coin/firmware assist.

Commerce-offs. Operator charges and coverage threat; hashrate focus can create systemic considerations (e.g., GHash.io briefly exceeded 51% in 2014).

Finest for. Most miners, who need a predictable money stream and minimal overhead.

Decentralized / P2Pool Mining

Decentralized mining swimming pools are a peer-to-peer different with no central pool operator. Miners run nodes that type a community and mine to a shared “sharechain.” When a block is discovered, payouts are made straight primarily based on latest shares, with no custodial pool pockets. Every node builds/relays block templates and validates shares roughly each ~30 seconds. Contribution is accounted on-chain (the sharechain), so you retain custody and keep away from an operator bottleneck.

Professionals. No single level of failure, stronger miner sovereignty, clear accounting.

Commerce-offs. Extra setup and bandwidth; barely greater short-term variance than massive centralized swimming pools.

Finest for. Miners who worth decentralization and custody over comfort.

Cloud Mining Swimming pools

Cloud swimming pools are operator-run companies that promote hashrate. You lease a set quantity of energy (e.g., TH/s) and the supplier factors {hardware} to a pool, then credit your account per the chosen payout methodology. You don’t handle machines, energy, or cooling.

Right here, you pay an upfront or ongoing payment plus upkeep. The supplier aggregates prospects’ leases and mines by way of their very own or third-party pool infrastructure. Payouts depend upon contract phrases, community issue, and hashprice.

Professionals. Zero on-site operations; quick begin.

Commerce-offs. Counterparty and solvency threat, opaque payment stacks, frequent underperformance; the sector has a historical past of scams, so due diligence is crucial.

Finest for. Customers who can’t host {hardware} however settle for elevated supplier threat.

Learn extra: What Is Cloud Mining?

Widespread Reward Distribution Strategies

Mining swimming pools use completely different formulation to show your submitted “shares” into payouts. Understanding these strategies is crucial for predicting money stream and evaluating swimming pools. The commonest fashions are under.

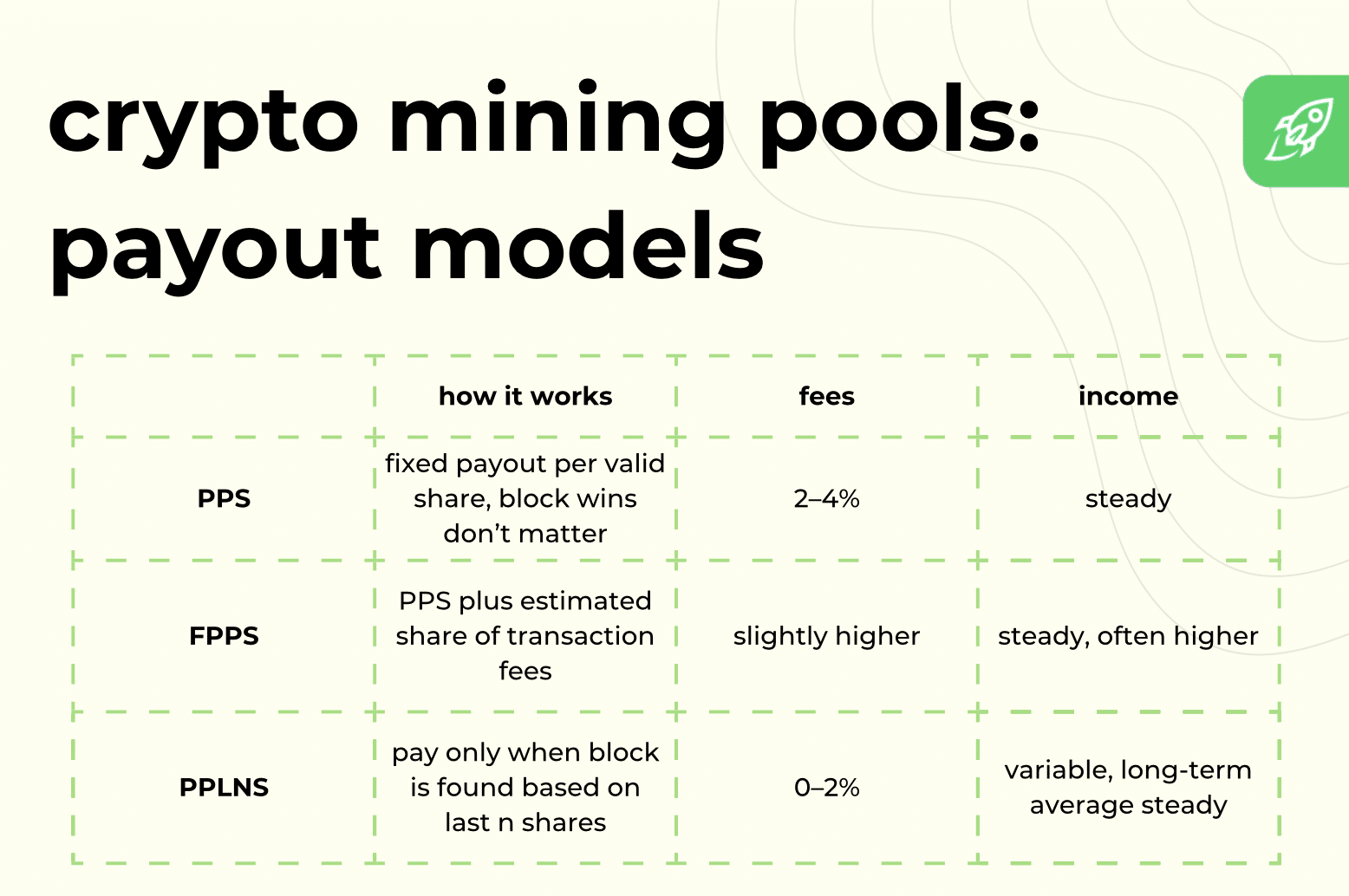

Pay-Per-Share (PPS)

PPS offers miners a set payout for each legitimate share they submit, no matter whether or not the pool really finds a block. The operator assumes the variance threat and expenses the next payment (usually 2–4%) to cowl it. This mannequin gives predictable, regular earnings, which is right for miners who need stability and easy accounting.

Full Pay-Per-Share (FPPS)

FPPS is like PPS however provides a calculated portion of transaction charges to the fastened payout. The pool estimates common block charges over time and pays miners for each block subsidy and charges, even when the pool didn’t win a block that spherical. Charges are normally barely greater than PPS however internet returns are sometimes greater and extra constant.

Pay-Per-Final-N-Shares (PPLNS)

PPLNS ties rewards to precise blocks discovered. When the pool mines a block, the reward is distributed primarily based on every miner’s contribution to the final N shares earlier than the discover. This lowers the operator’s threat and usually has decrease charges (0–2%), however your earnings varies with the pool’s “luck” and could also be zero if no block is discovered throughout your window. Over the long run, earnings converge to your share of hashrate however with extra short-term volatility.

Proportional Methodology

This older methodology pays miners proportionally to all shares submitted throughout a single spherical (the time between two blocks discovered by the pool). When a block is discovered, rewards are divided by the proportion of shares you submitted in that spherical. Like PPLNS, this exposes miners to variance however with easier accounting.

Hybrid Fashions

Many swimming pools combine options. Examples:

- PPS+: pays block subsidies PPS-style however distributes precise transaction charges PPLNS-style.

- Rating-based programs: weigh latest shares extra closely to discourage “pool-hopping.”

Hybrid fashions goal to stability regular payouts for miners with manageable threat for operators. When evaluating a pool, at all times examine its reward scheme, payment price, and the way it handles charges, as these straight have an effect on your internet income and payout variance.

Professionals and Cons of Mining Swimming pools

Becoming a member of a mining pool reduces payout variance and offloads coordination. The trade-offs are operator charges, reliance on the pool, and fewer management over block templates.

| Professionals | Cons |

| Steadier, extra predictable payouts | Operator charges scale back internet returns |

| Sooner time to first payout | Much less management over block templates/coverage |

| Decrease operational overhead (no node/accounting) | Dependence on pool uptime and solvency |

| Diminished payout variance vs. solo mining | Minimal payout thresholds and withdrawal delays |

| Skilled infrastructure lowers stales/latency | Centralization threat if hashrate concentrates |

| Clear dashboards, auto-payouts, alerts | Regional latency can harm efficient hashrate |

| Assist for a number of payout strategies (PPS/FPPS/PPLNS) | Charge/time period modifications can affect earnings |

| Non-obligatory merged mining on some chains | Restricted transparency with some operators |

Prime Bitcoin Mining Swimming pools in 2025

This part appears on the high 5 Bitcoin mining swimming pools: Foundry USA, AntPool, ViaBTC, F2Pool and Luxor. They have been chosen as a result of they persistently command the most important share of the community’s hashrate and symbolize a cross-section of right this moment’s main operators.

| Pool | Approx. Hashrate (EH/s) / Share | Notes |

| Foundry USA | ~280 EH/s → ~27–31% of community hashpower | Largest pool, regular progress, tiered FPPS payouts together with transaction charges. |

| AntPool | ~170–190 EH/s → ~15–19% | Backed by Bitmain; second-largest pool. |

| ViaBTC | ~120–125 EH/s → ~11–14% | Focuses on Russian areas and affords a number of payout strategies. |

| F2Pool | ~95–115 EH/s → ~12–14% | Established in 2013; helps merge mining and PPS+/FPPS/PPLNS choices. |

| Luxor | ~30–40 EH/s → ~3–4% | Smaller however rising; emphasizes clear charges and US-based infrastructure. |

Please be aware that hashrate modifications consistently. These values symbolize typical mid-2025 ranges relatively than fastened numbers.

Deciding on the Proper Mining Pool

Choosing the right mining pool is essential—in spite of everything, you’ll be dedicating a whole lot of assets so you possibly can obtain your payouts. That’s why it’s additionally vital to look past simply hashrate.

Uptime and Reliability

Constant server availability ensures that your rigs keep linked and submit legitimate shares with out interruption. Even temporary outages can result in misplaced income, particularly at excessive issue. Search for swimming pools that publish uptime statistics or have a protracted monitor file of secure operation.

Transparency of Operations

Clear reporting of hashrate, block finds, payout calculations and charges helps miners confirm earnings. Swimming pools that present real-time dashboards, share templates, and detailed accounting scale back the danger of hidden losses or manipulation.

Minimal Payout Thresholds

Each pool units a minimal quantity earlier than payouts are despatched. Excessive thresholds can delay money stream for smaller miners, whereas very low thresholds might incur greater transaction charges. Test that the brink aligns along with your anticipated output.

Pool Charges and Hidden Prices

Revealed payment charges (e.g., 1% PPS or 2% FPPS) are solely a part of the equation. Some swimming pools deduct transaction charges, cost withdrawal charges, or impose penalties for stale shares. Issue these into your internet income calculation relatively than focusing solely on the headline price.

Fame and Group Suggestions

A pool’s historical past and miner evaluations present early warning about coverage modifications, delayed payouts or technical points. Boards, Telegram teams, and impartial dashboards are good locations to gauge sentiment and operator responsiveness.

Supported Cash and Algorithms

Multi-asset swimming pools can level your rigs to completely different cash or merged mining alternatives with out reconfiguring {hardware}. Confirm that your algorithm (e.g., SHA-256 for Bitcoin, Ethash for Ethereum Traditional, Scrypt for Litecoin/Dogecoin) is absolutely supported and that payout strategies are clear for every asset.

Pool Dimension and Its Impression on Rewards

Massive swimming pools discover blocks extra incessantly, leading to steadier payouts however probably higher community centralization. Smaller swimming pools might ship greater variance in rewards however can assist decentralization and typically, decrease charges. Match your threat tolerance and payout must the pool dimension.

Geographic Concerns (Latency, Server Proximity)

Bodily distance between your miners and the pool’s servers impacts latency. Decrease latency reduces rejected or “stale” shares and improves efficient hashrate. Some swimming pools provide regional endpoints to attenuate delay; select the closest dependable server to your operation.

The Way forward for Mining Swimming pools

Bitcoin’s whole community hashrate crossed 1 zettahash per second in 2025, a file that strengthens safety but additionally raises prices for miners and the swimming pools that serve them. On the identical time, only a handful of operators now management nearly half of all hashpower, drawing scrutiny from regulators and the group over potential centralization dangers.

To counter this, builders and researchers are pushing decentralized pool designs comparable to FiberPool and wider adoption of the Stratum V2 protocol, which supplies miners extra management over block templates and reduces reliance on a single operator.

As block rewards proceed to shrink and issue rises, swimming pools that may decrease stale shares, run reliably, and provide versatile payout buildings are more likely to stand out. Briefly, the way forward for mining swimming pools appears extra aggressive, extra clear, and more and more formed by decentralization and sustainability developments.

Closing Phrases

Mining swimming pools at the moment are the spine of proof-of-work networks. Pool operators coordinate huge quantities of contributed processing energy so miners can earn steadier payouts and scale back variance. Understanding how these swimming pools work, what charges they cost, and the way they deal with block rewards helps miners resolve the place to direct their computing energy. By selecting rigorously and monitoring efficiency, contributors can take advantage of mining cryptocurrencies whereas sustaining management over their very own {hardware} and technique.

FAQ

Are you able to generate income with mining swimming pools?

Sure. By combining computational assets with different particular person miners, contributors earn a share of every block reward and transaction charges, turning cryptocurrency mining into steadier mining rewards than solo efforts.

Is mining bitcoin unlawful?

Bitcoin mining swimming pools and the mining course of are authorized in most nations, however rules differ. Miners ought to examine native legal guidelines earlier than taking part.

Is it higher to solo mine or pool mine?

Mining swimming pools unfold the work of discovering a sound block throughout many miners, so rewards arrive extra usually and predictably. Solo mining affords full management however requires far higher computational energy and persistence.

Do I would like costly mining {hardware} to hitch a pool?

No. Miners be part of swimming pools exactly to offset restricted computational energy; even small rigs can contribute shares and obtain proportional rewards, although income scales with hashrate.

Can I swap mining swimming pools simply if I’m sad with one?

Sure. The mining course of merely factors your {hardware} to a unique pool server, so particular person miners can change swimming pools shortly with out particular permissions.

How do mining swimming pools deal with transaction charges from blocks?

Swimming pools embody transaction charges together with the block reward. Relying on the payout mannequin (PPS, FPPS, PPLNS), these charges are both added to or shared individually in miners’ rewards.

Are mining swimming pools authorized in my nation?

In most jurisdictions, cryptocurrency mining, together with participation in bitcoin mining swimming pools, is authorized. All the time confirm present rules earlier than miners be part of.

What occurs if the mining pool is hacked or shuts down?

If a pool’s server fails or is hacked, miners lose the central coordination level however preserve their very own {hardware} and may redirect computational assets to a different pool to renew incomes mining rewards.

Disclaimer: Please be aware that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.