September Crypto Crash Drives Biggest Crypto Liquidations of 2025

The crypto market has endured its most risky week in months, culminating within the largest liquidation occasion since December 2024. As the worldwide market cap stands at $3.78 trillion (up 1% in 24 hours), worry lingers amongst traders, with the Concern & Greed Index sitting at a cautious 34. This newest shakeout noticed each main and altcoin costs spiral downward, sending leveraged merchants scrambling and forcing exchanges to shut over $1.7 billion in positions in a single sweep.

The Week’s Market Meltdown

September 2025’s “Purple September” proved brutal for bulls. Ethereum was hit hardest, diving roughly 12% on the week and tumbling under its essential $4,000 help, a decline unmatched since June.

Bitcoin misplaced about 5%, retreating to close $109,000, whereas Dogecoin and Solana every clocked weekly losses of 21%. In whole, practically $300 billion in worth was erased from the sector in a matter of days, highlighting the acute threat and fragility triggered by extreme leverage and skinny liquidity.

Highest Liquidations: ETH Takes the Lead

The week’s brutal selloff noticed over $1.65 billion in leveraged positions forcibly liquidated, with lengthy bets making up nearly 88% of the full clear-out. Ethereum dominated the liquidation charts, chargeable for greater than $309 million of closed positions, outstripping Bitcoin’s $246 million in liquidations. This was the biggest wave of compelled closures within the crypto market since December 2024.

“Largest liquidation within the Crypto market since December ninth, 2024… These are leveraged positions closed by pressure. Most have been longs on #ETH.”

Which Sectors Bought Hit the Hardest?

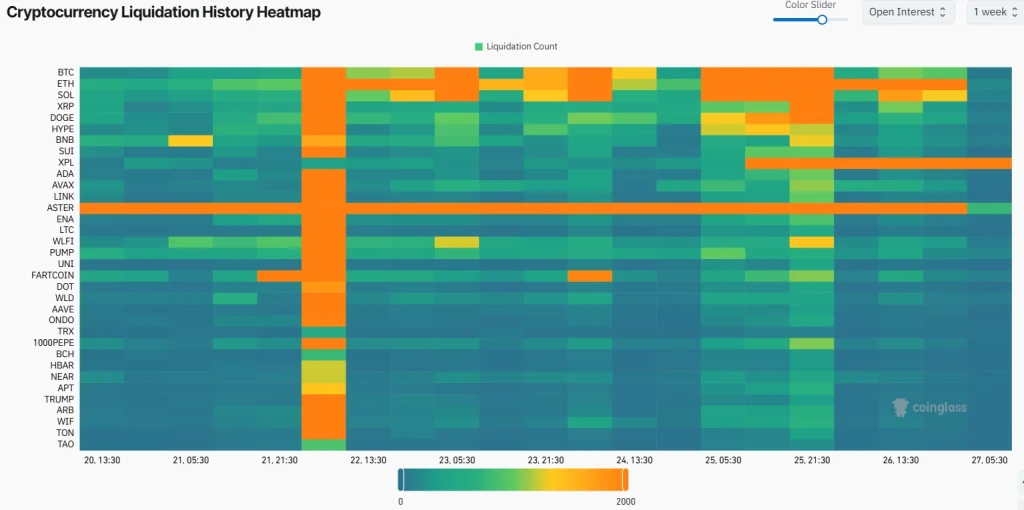

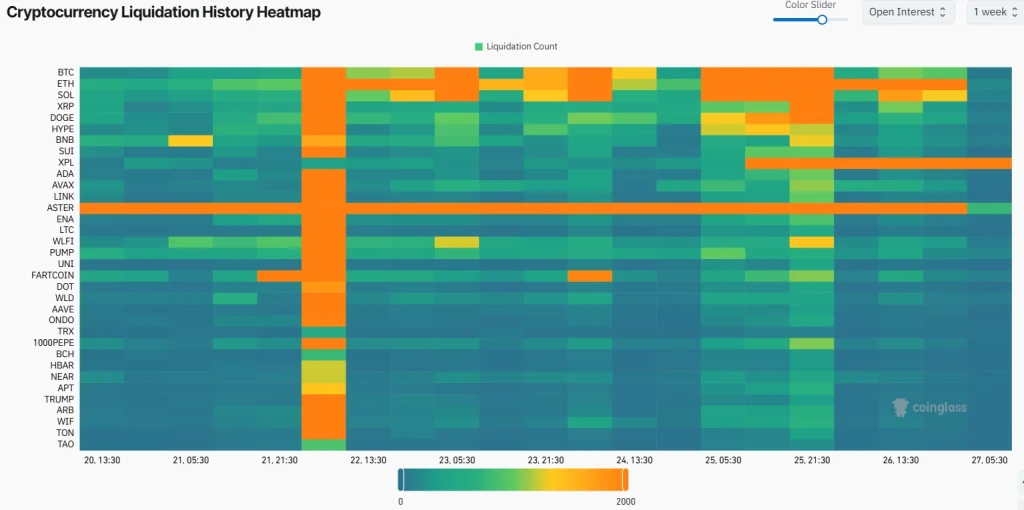

Inside the broader market, the DeFi class bore the brunt of the ache as massively leveraged futures positions have been “deleveraged” in a cascading impact. The common crypto Relative Energy Index (RSI) slid to 44.95, echoing widespread weak point. Liquidation heatmaps reveal giant clusters centered round main altcoins and tokens favored by retail merchants and funds.

“Excessive leverage + volatility = recipe for liquidation… Monetary schooling means studying about threat administration – it’s not non-obligatory – and recognising that market drops additionally train beneficial classes.”

What Analysts Are Watching Subsequent?

Consultants agree this cleaning flush of leverage has the potential to stabilize market positioning, however till threat urge for food revives, volatility might persist. With the Altcoin Season Index at 70/100, altcoins stay comparatively robust, however the lesson is evident: unbridled leverage can quickly flip bullish optimism into panic-driven selloffs.

FAQs

The spike is by a pointy drop in main cryptocurrencies like Ethereum and Bitcoin, and by excessive leverage. This compelled exchanges to shut out greater than $1.7 billion in dangerous positions, principally longs.

Ethereum noticed the steepest drop, falling about 12% and registered the very best liquidation quantity at over $309 million.

The DeFi sector and leveraged futures took the most important hit, as nearly all of liquidations got here from overleveraged lengthy bets.