A 500K BTC dump coming? Bitcoin’s volatility faces a new test!

- Bitcoin traders are selecting to de-risk amid uncertainty

- If historical past is any information, volatility may be an engine

Bitcoin’s [BTC] volatility is its biggest energy – and its deepest flaw. Even with establishments shopping for in, corporates holding robust, and good cash accumulating, it’s been 120 days since BTC got here near $110k.

So, what’s stopping it? As AMBCrypto flagged, traders have been locking in earnings to dodge deeper drawdowns.

Whereas which may appear bearish, it hasn’t been with none strategic upside. In that sense, Bitcoin’s volatility may be constructing momentum for the following leg up.

Lengthy-term holder distribution and volatility indicators

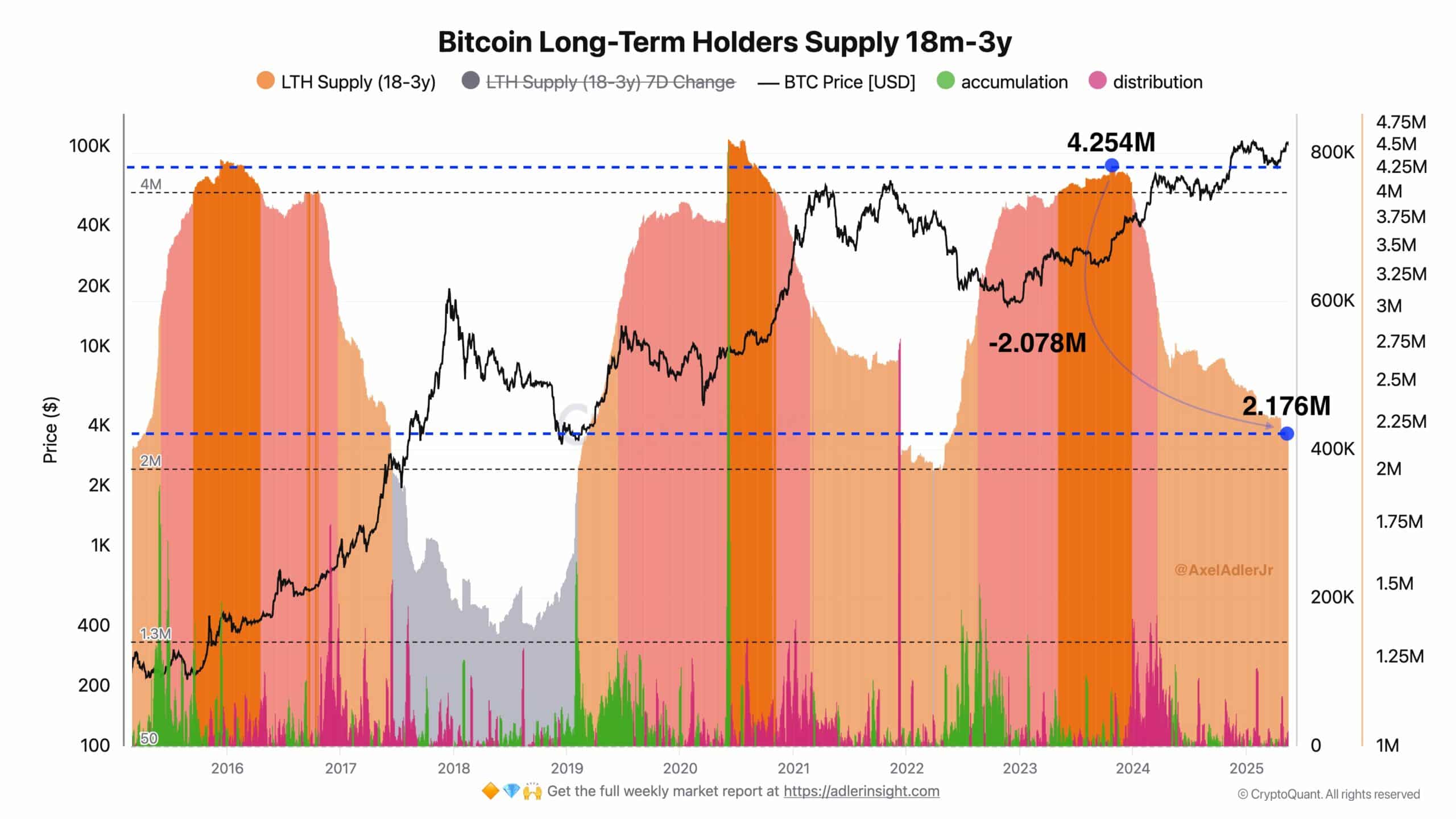

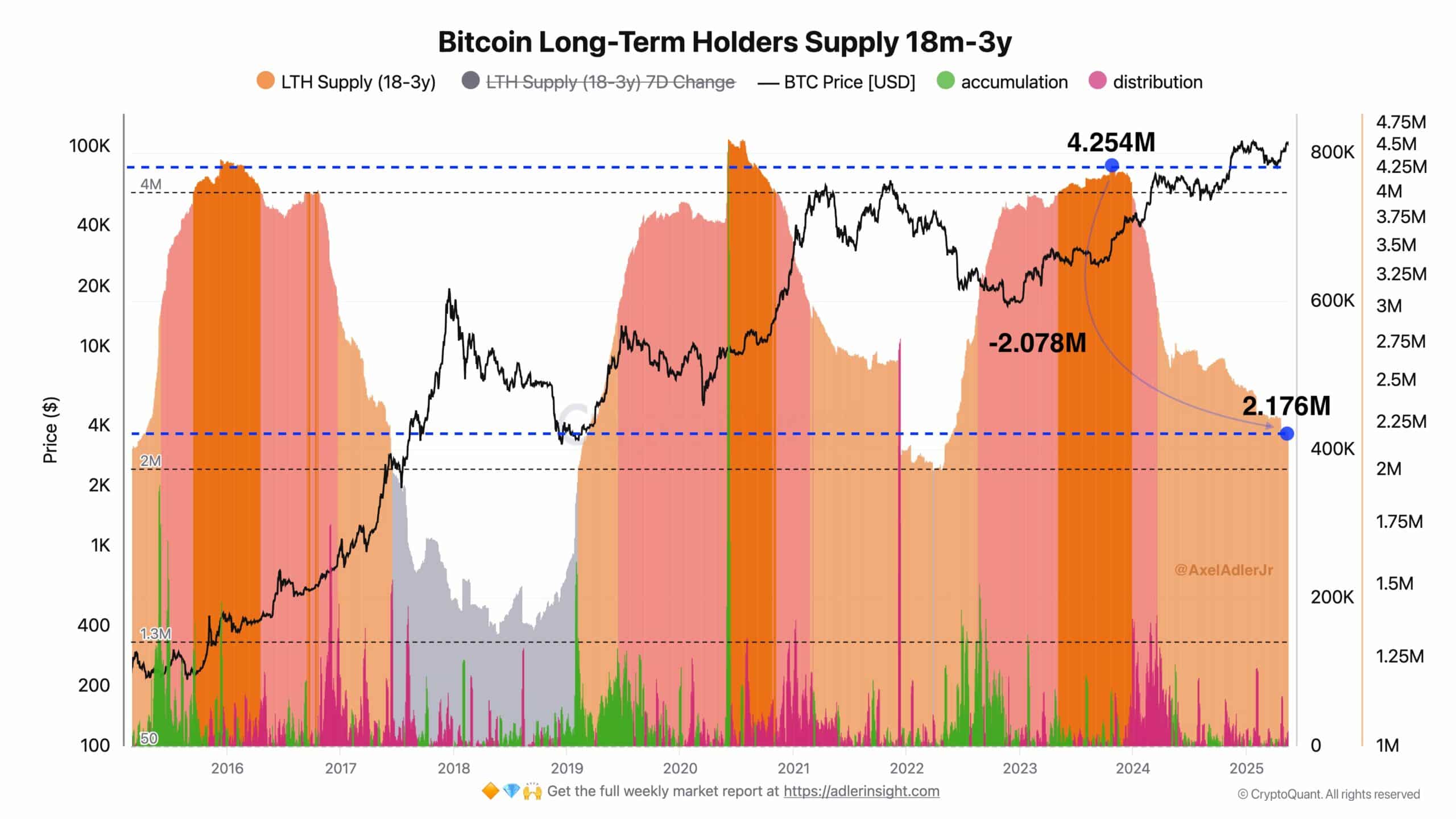

The connected chart revealed a major development.

Since November 2023, Lengthy-Time period Holders (LTHs) – these with BTC aged 18 months to three years – have offloaded over 2 million cash. They’ve netted roughly $138 billion in realized features.

Supply: CryptoQuant

This regular decline in LTH provide, from a peak of 4.254 million right down to 2.176 million BTC, is an indication of a transparent distribution part. In truth, it seems loads like what we’ve seen throughout previous bear markets.

Most notably in 2022, when an analogous sample preceded a 63% annual drop from Bitcoin’s $46,017 opening.

What makes the present cycle completely different is the result. Regardless of comparable ranges of long-term distribution and profit-taking, Bitcoin has continued to development larger. It’s up practically 200% throughout the identical part.

That tells us one thing’s modified. As an alternative of inflicting a crash, all this promoting and volatility may be shaking issues up and setting the stage for stronger, smarter accumulation.

Bitcoin’s subsequent huge alternative

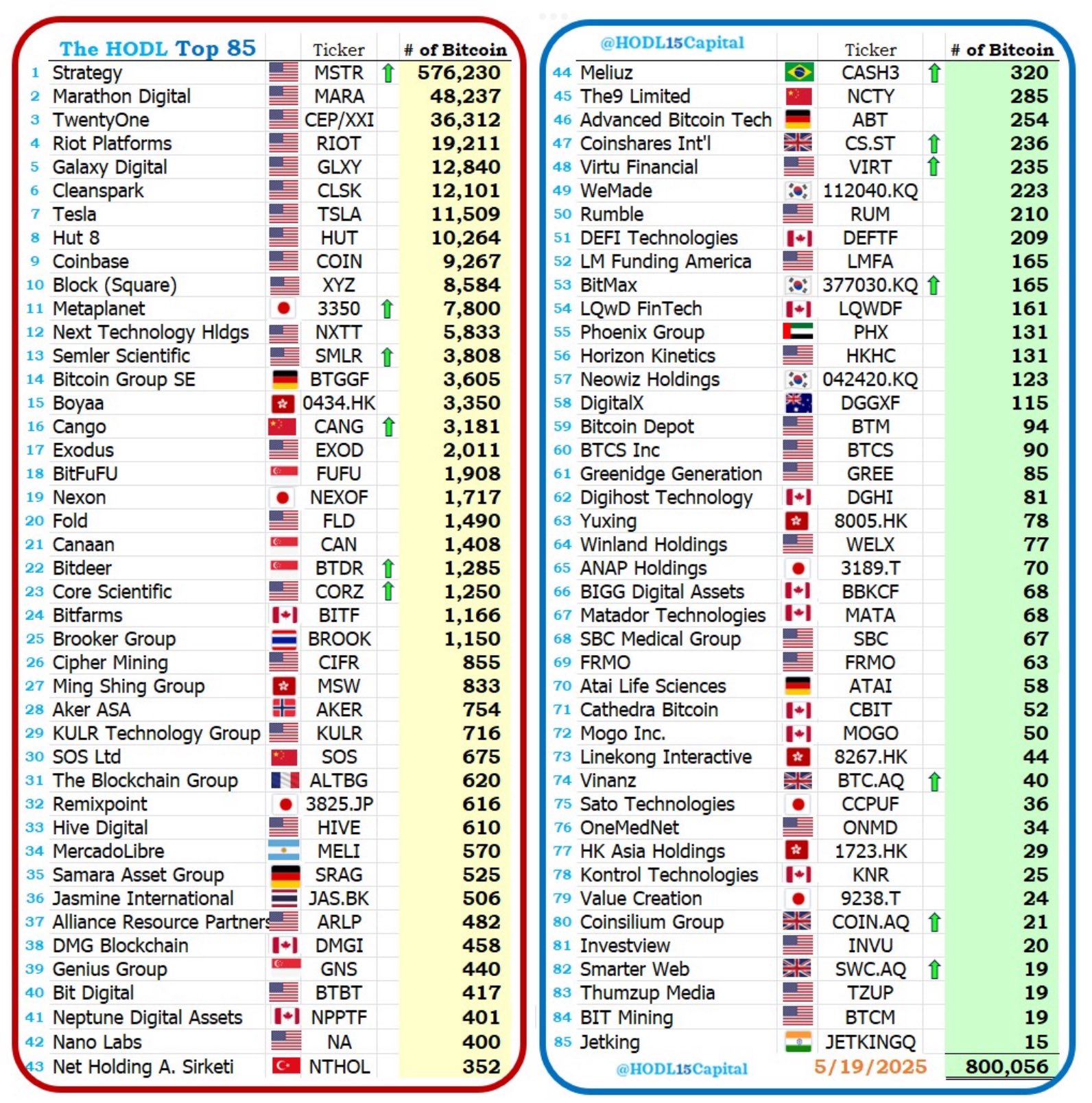

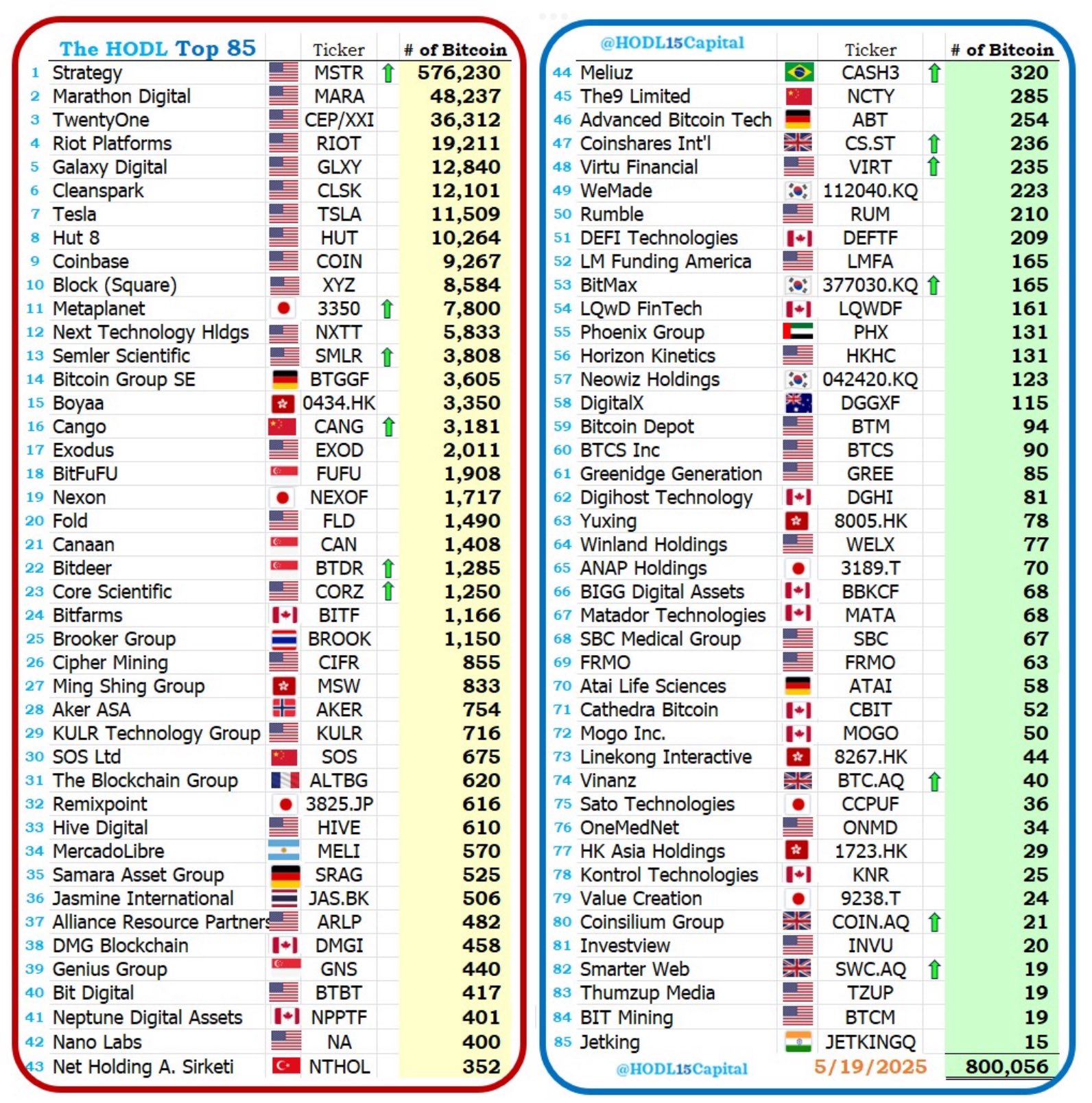

Monitoring this cohort carefully is important. Primarily based on their present BTC treasury, data-driven evaluation from a leading expert projects that as much as 500k Bitcoin might enter the market by year-end.

This might imply the buildup of a major wave of exit liquidity beneath the floor.

In accordance with AMBCrypto, such a launch will inevitably put Bitcoin’s volatility beneath renewed strain. Therefore, testing the market’s capability to soak up large-scale distribution with out disrupting the broader uptrend.

Nevertheless, with institutional and company curiosity in Bitcoin now surpassing ranges seen within the 2023–24 cycle, this volatility may be much less like a menace. As an alternative, it may very well be extra like one other alternative.

Supply: X

If historical past is any information, Bitcoin might as soon as once more show its resilience, providing bulls a strategic entry and setting the stage for additional value discovery.