A new Bitcoin all-time high before the halving: is it possible?

Bitcoin price is buying and selling above $60,000, placing it inside putting distance of setting a brand new all-time excessive. This might be an unprecedented transfer for the highest Cryptocurrency by market cap, which traditionally has solely made a brand new value report solely after every halving occasion.

Might BTC set a brand new report in additional methods than one: by reaching a brand new all-time excessive earlier than the halving for the primary time ever? Let’s check out the info.

Why the Bitcoin halving is necessary

The Bitcoin halving is among the most anticipated and impactful occasions for the Cryptocurrency. It reduces the availability of recent cash coming into circulation. The halving cuts the reward miners obtain for processing blocks in half. This implies fewer new BTC are created over time, making the availability extra scarce.

Lowered provide paired with regular or rising demand can result in increased costs based on financial ideas. Many buyers see halvings as potential catalysts for bull runs. Nevertheless, this time round, there are distinctive components impacting provide and demand.

Unprecedented value motion in Crypto

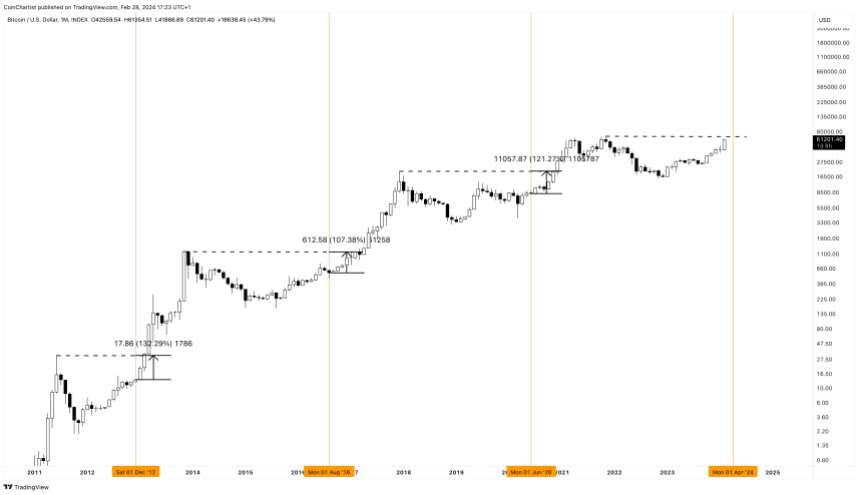

In contrast to previous Crypto market cycles, which have been suspected to be primarily pushed by the availability and demand dynamics created post-halving, Bitcoin value finds itself in an uncommon spot: slightly below all-time excessive costs.

In all earlier market cycles, BTCUSD had over 100% or extra to realize on the time of every halving earlier than setting a brand new all-time excessive. In actual fact, it took anyplace between two to seven months after the halving earlier than new all-time highs had been set. But this time, Bitcoin is round 10% away from making a brand new all-time excessive earlier than the halving ever arrives.

What’s behind the change in dynamics?

Since market cycles are pushed by international liquidity and provide versus demand, what has modified in 2024 that wasn’t an element up to now? For one, China has begun injecting liquidity into the worldwide financial system in an try to avoid wasting its monetary markets.

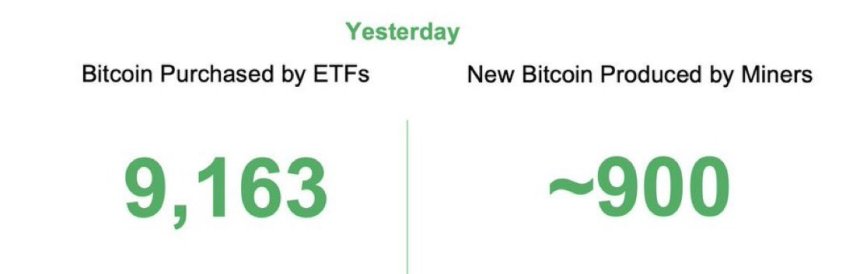

Extra importantly, is the affect of the brand new spot BTC ETFs which are starting to select up in demand and web flows. Every ETF supplier should buy a corresponding quantity of Bitcoin primarily based on the demand for ETF shares. This week, ETFs bought a grand whole of 9,163 BTC in a single day. The identical day, BTC miners solely produced round 900 BTC. This means that ETFs are at the moment exceeding the brand new provide of Bitcoin by ten instances a day.

Are establishments front-running the halving?

If ETFs are at the moment absorbing ten instances the brand new provide of BTC, then this will probably be twenty instances the quantity of recent BTC being mined if nothing modifications in demand over the following two months. When the halving happens in April, the block reward in BTC that miners obtain is slashed in half.

Understanding that the availability will quickly dwindle additional, and the way sturdy the ETF demand is, simple arithmetic means that the demand is aggressively outpacing the out there provide. The one different manner to purchase new cash is to get holders to promote. And as a result of conviction of Bitcoin holders who usually maintain for years at a time, the one resolution to get them to promote is to bid costs up increased.

Energy confirmed within the Crypto market

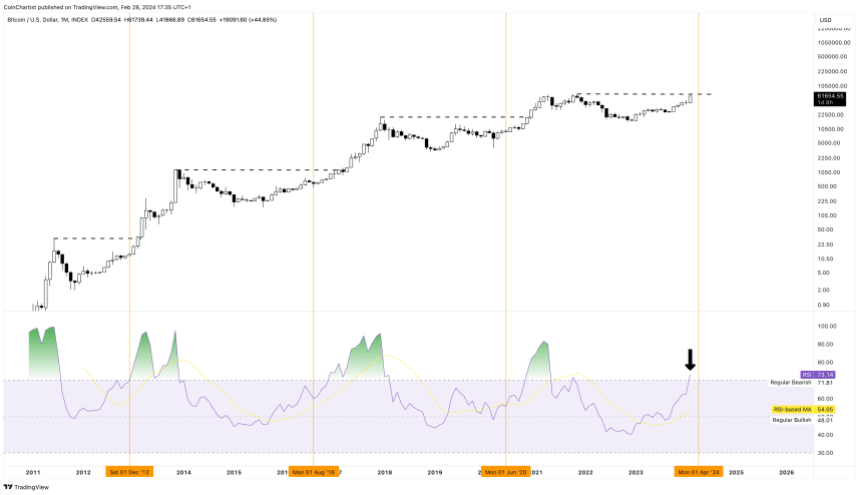

The early improve in shopping for stress will be seen in Bitcoin’s month-to-month Relative Energy Index chart. In all prior cases, BTCUSD reached over 70 on the RSI both on the halving, or within the months following. Solely in 2024 are we seeing the month-to-month RSI over this key bullish stage.

Apparently, a studying over 70 on the RSI means that Bitcoin is overbought. Nevertheless, as historical past exhibits, BTCUSD stays considerably overbought for months at a time throughout probably the most highly effective phases of every bull run. With BTC above 70 on the month-to-month RSI, and unbelievable demand and dropping provide, there isn’t a telling what may occur throughout the remainder of the yr.

Elevating returns utilizing PrimeXBT buying and selling instruments

Rising over 70 on the RSI has seen a 40% improve in Bitcoin value in a single month. Whereas this isn’t a meagre return, through the use of PrimeXBT Crypto Futures as much as 200:1 adjustable leverage, the identical 40% return may have supplied an 8,000% return on funding.

The award-winning buying and selling platform additionally contains all the chance administration and charting instruments mandatory to guard your capital and get probably the most out of the bull run earlier than it ends. PrimeXBT’s competitively low buying and selling charges, with maker and taker charges at simply 0.01% and 0.02%, give merchants extra room to maximise earnings from market strikes.

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site solely at your individual danger.