Bitcoin – $75K or $55K? Here’s where BTC will go next

- Bitcoin shaped a smaller vary throughout the vary.

- Bullish conviction has weakened significantly, and promoting stress might quickly dominate.

Bitcoin [BTC] continued to commerce between $73k and $60.7k, forming a variety.

In an earlier evaluation, AMBCrypto had reported that bulls have to defend the $64.5k assist zone to push above the $66k resistance.

This didn’t happen, as an alternative, we noticed a rejection at $67k and a transfer to $62.8k. This growth got here at a time when whale exercise and ETF inflows have been each slowing down.

Subsequently, an argument for continued short-term consolidation was legitimate.

The larger-picture metrics that fueled BTC progress have declined

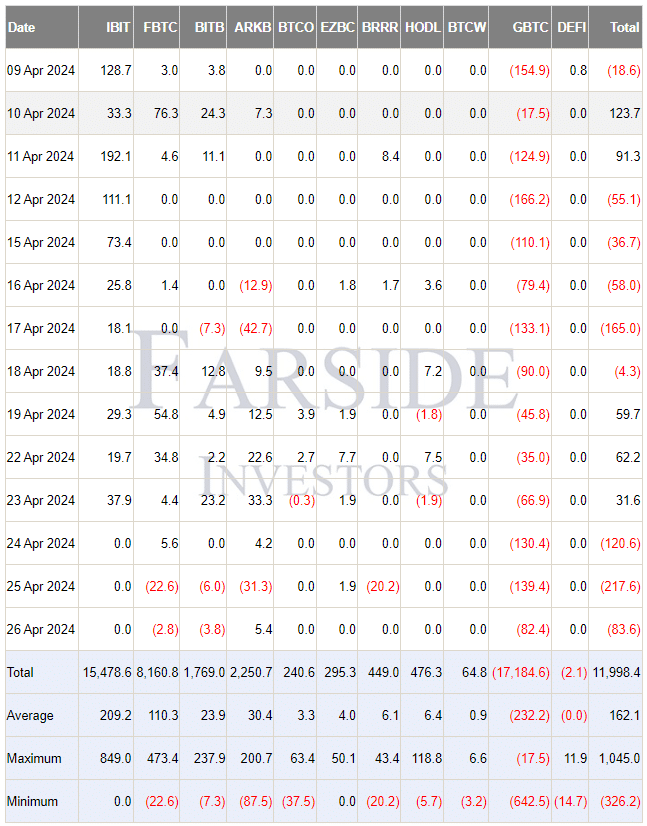

In a post on X (previously Twitter), crypto analyst Whale Panda famous that Bitcoin ETF flows have been damaging for the third consecutive day on Friday the twenty sixth of April.

Blackrock’s ETF IBIT noticed a 3rd day of zero inflows after receiving the most important inflows earlier this month.

Supply: Farside Investors

A scarcity of demand is seen right here. Solely Grayscale Bitcoin ETF (GBTC) noticed constant outflows, however some others resembling ARKB joined it on the twenty fifth of April.

This was a mirrored image of the shortage of bullish conviction after the halving.

Supply: Ali_charts on X

Crypto analyst Ali Martinez introduced one other interesting factor into the dialog. The whale transaction rely has been in decline since mid-March.

The worth of Bitcoin additionally misplaced its increased timeframe bullish impetus in the course of the previous month.

What do the futures markets reveal about Bitcoin market sentiment?

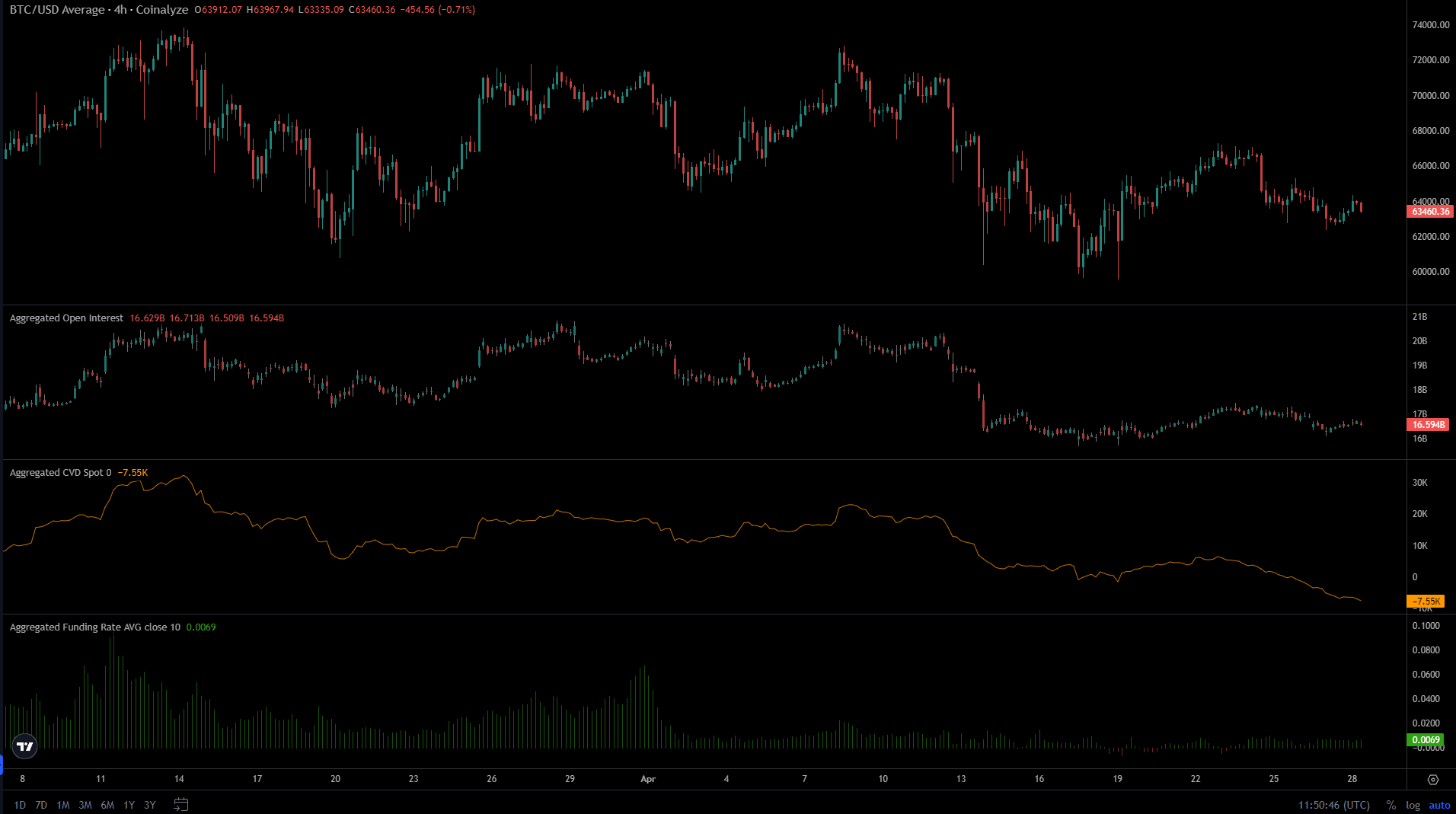

Supply: Coinalyze

The Open Curiosity in Bitcoin has been waning for the reason that tenth of April. This got here alongside the worth drop under $70k that took BTC to $60k and highlighted bearish sentiment. Speculators have been unwilling to go lengthy.

The Funding Price, which had been very optimistic in March, was solely simply over zero in April, as soon as once more displaying the speculator hesitancy.

The spot CVD climbed increased from twentieth March to the tenth of April. This meant consumers have been current within the spot market again then, giving value a cause to attempt to push above $70k.

Previously three weeks, it has been on a relentless downtrend. Subsequently, it was seemingly that we might see BTC pattern downward, or keep inside a variety.

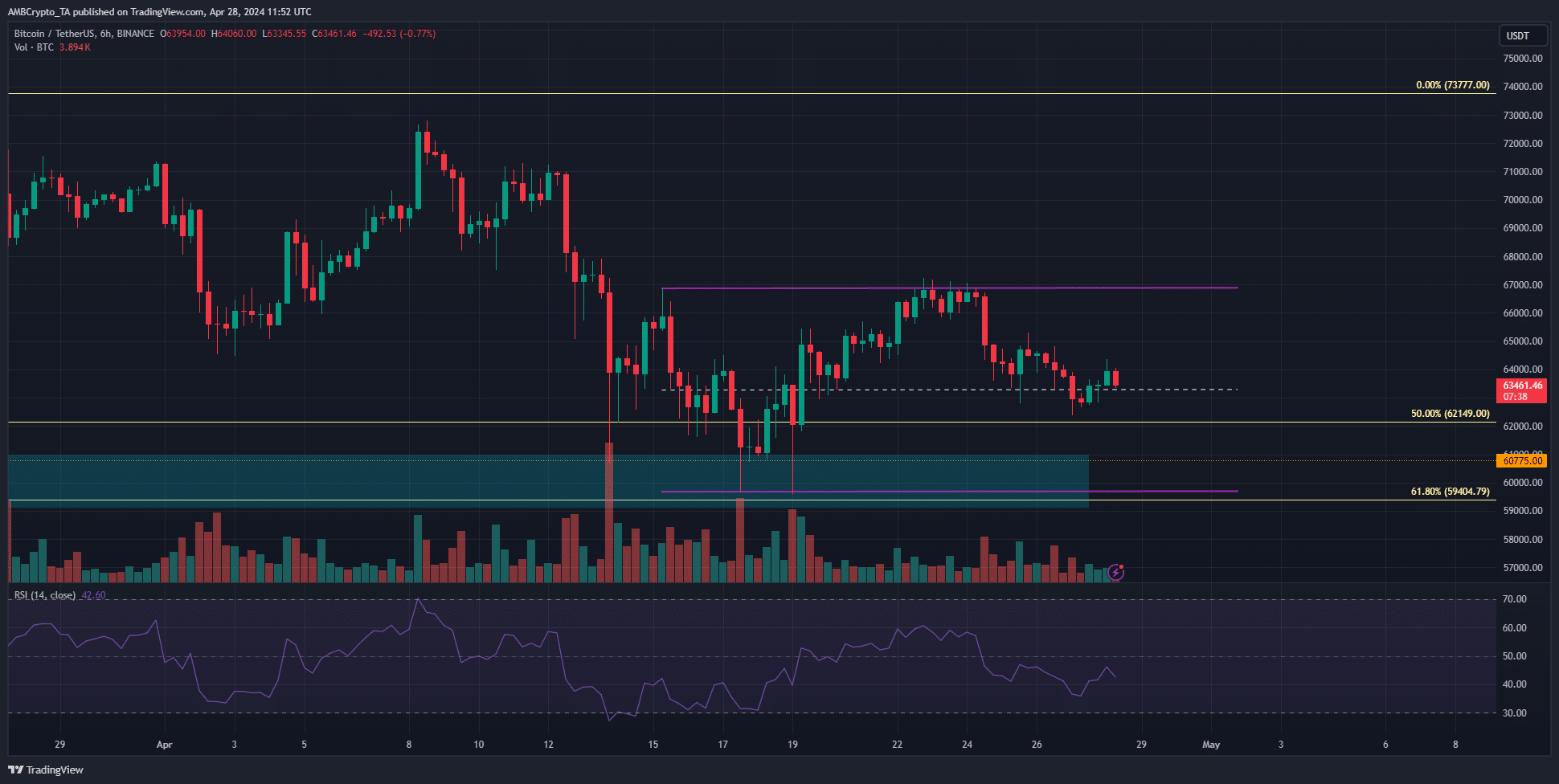

Supply: BTC/USDT on TradingView

A brief-term vary between $66.9k and $59.7k (purple) was noticed. This was on the decrease finish of the $60k-$73k vary that BTC was already buying and selling inside.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

The mid-range mark at $63.3k was breached over the weekend, and we might see one other drop to $60k later this week.

The RSI on the 6-hour chart was under impartial 50 and signaled bearish momentum. Mixed with the shortage of demand, it appeared seemingly that one other downturn would quickly be on us.