Aave calls on Ethereum to deploy stablecoin GHO

- Aave plans to launch its stablecoin on the Mainnet with Ethereum actively concerned.

- A brand new infrastructure was in place to deal with governance and abstraction.

Aave [AAVE], the decentralized lending and borrowing protocol, has introduced its plans to deploy GHO, its native stablecoin, on its Mainnet. In accordance with the governance proposal, the launch could be accompanied by two preliminary facilitators. This contains Aave V3’s Ethereum [ETH] facilitator and the FlashMinter facilitator.

Practical or not, right here’s AAVE’s market cap in ETH’s phrases

This transfer underscores Aave’s dedication to leveraging Ethereum’s sturdy infrastructure. It additionally factors to the goal of reaching widespread adoption of GHO.

Two facilitators in play

The introduction of facilitators shouldn’t be a brand new idea to GHO. In its growth stage, the Aave builders talked about that the facilitators would assist in minting and burning GHO tokens.

For the Aave V3 Ethereum pool, its perform is to help with bootstrapping the GHO provide in a decentralized and permissionless. FlashMinting, alternatively, would allow arbitrage and liquidity provision.

Launched in February 2023, Aave applied the Testnet for the GHO stablecoin mechanism as a cryptocurrency collateral for customers who stake within the Aave protocol.

Moreover, one in every of GHO’s aims was to permit customers to borrow the stablecoin whereas nonetheless incomes the yield on their locked belongings on the protocol.

In the meantime, the proposal talked about the use case of GHO may transcend that. The proposal learn,

“If accredited, the introduction of GHO would make stablecoin borrowing on the Aave Protocol extra aggressive and generate further income for the Aave DAO by offering to the DAO treasury 100% of the curiosity funds made on GHO borrows.”

Moreover, the proposal talked about that the borrow could possibly be 1.5% whale staked Aave [stkAAVE] low cost fee may go as much as 30%.

a.DI seems as TVL improves

In one other growth, Aave geared towards bettering its infrastructure. Stani Kulechov, the protocol’s founder, integrating the brand new Aave Supply Infrastructure (a.DI), would guarantee cross-chain communication amongst a number of bridges.

Cross-chain consensus messaging signifies that Aave Protocol and governance infrastructure shouldn’t be going to depend on single bridge however truly a consensus of a number of bridges mitigating the dangers related to cross-chain messaging and bridging. https://t.co/MI5EeDU4xX

— Stani.lens (🌿,👻) (@StaniKulechov) July 10, 2023

Developed by Bored Ghosts Growing (BGD) Labs, the brand new infrastructure, would guarantee emergency restoration through Ethereum. Moreover, BGD Labs talked about that it could tackle consensus and generic abstraction. BGD famous that,

“As a side-effect of the opposite options, a.DI additionally turns into an abstraction layer, hiding the mixing particulars of the underlying bridges and simplifying the DevX of individuals writing proposal payloads for the Aave governance.”

How a lot are 1,10,100 AAVEs price at this time?

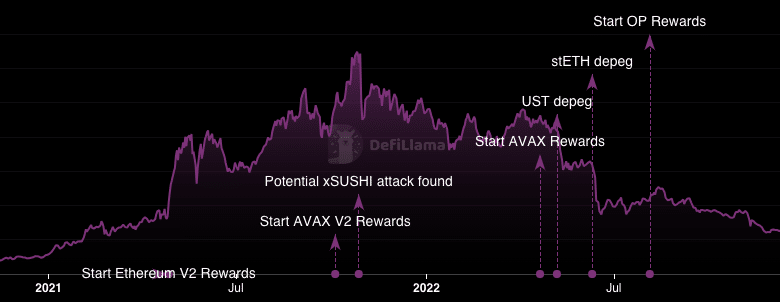

In the interim, DefiLlama showed that Aave’s Complete Worth Locked (TVL) elevated by 12.75% within the final 30 days. The metric measures your entire worth of digital belongings locked or staked in a distributed utility (dApp).

When the TVL decreases, it signifies that liquidity going into the locked good contacts underneath Aave has decreased. Subsequently, the excessive TVL means market individuals’ belief within the Aave protocol has improved.

Supply: DefiLlama