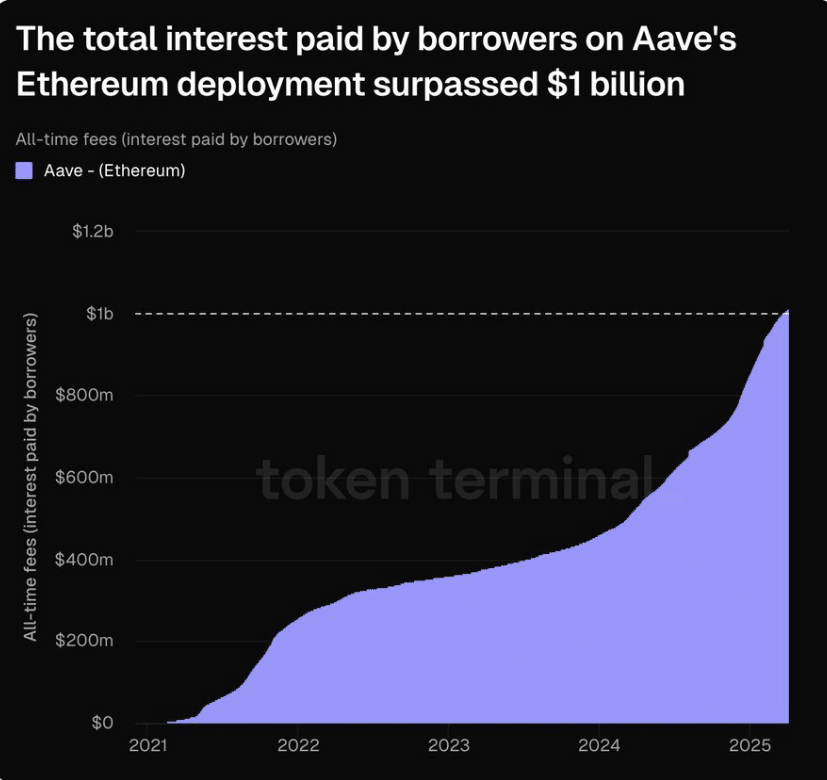

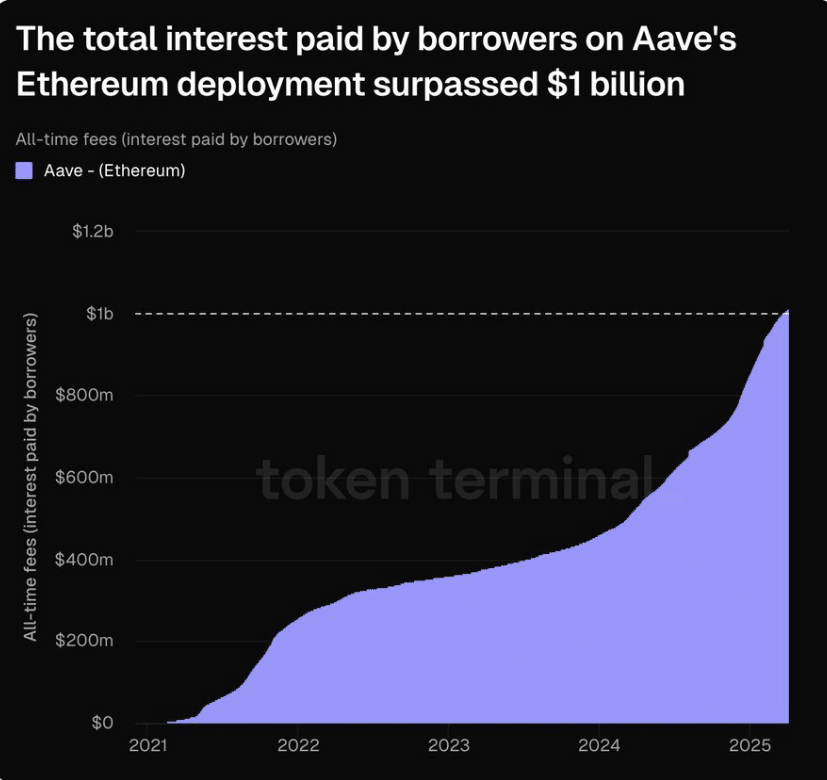

AAVE demand rises as interest paid by borrowers surpass $1 billion

- AAVE depreciated by 20.69% over the past 24 hours

- Cumulative curiosity paid by AAVE debtors on Ethereum surpassed $1 billion

In a significant milestone for the AAVE community, the cumulative curiosity paid by debtors hit a brand new file just lately.

In accordance with information from Token Terminal, AAVE debtors have paid over $1 billion in curiosity on Ethereum. Such a spike in curiosity paid is an indication of accelerating quantity, person demand, protocol utilization, and most significantly, a hike in DeFi’s maturity.

Supply: Token Terminal

What does this imply for the community?

Notably, the surge in rates of interest by AAVE debtors implies numerous issues for the community. Initially, the rise right here means that there’s important confidence in AAVE, particularly within the community’s sensible contracts and liquidity. When curiosity hikes because it has, it implies that AAVE is seeing very excessive exercise in its swimming pools. This additionally implies that AAVE’s liquidity suppliers are incomes important yields and inspiring extra deposits.

Secondly, the rise in charges paid is important for AAVE’s income and sustainability. Notably, AAVE earns a major share of income of the curiosity which implies that the community can also be producing appreciable income. This not solely helps the protocol’s sustained growth, but additionally provides worth to the token.

Rising confidence amongst customers and liquidity suppliers affords them extra room for progress. This, in flip, makes the protocol extra enticing to buyers.

May this enhance AAVE’s worth efficiency?

Whereas the AAVE protocol has been seeing a surge in demand and utilization, that is but to mirror on its worth charts. In reality, for its half, the altcoin has seen a significant downtrend snatch its worth motion.

Supply: Messari

That’s not all both.

In reality, the altcoin is recording robust underperformance on Futures and Spot market fronts. The Futures commerce rely, as an illustration, declined over the day prior to this to hit 917.23k. When the Futures commerce rely drops, it implies that fewer merchants are opening Futures positions.

Such a drop indicators a powerful insecurity as uncertainty rises. This usually results in buyers taking a step again, fearing extra losses.

Supply: Messari

This market habits of buyers sitting on the sidelines may be additional evidenced by the decline in AAVE’s Futures purchase quantity. This metric dropped to 116.65 million after a earlier spike. Subsequently, fewer merchants are prepared to purchase the asset, leaving the market to sellers.

To place it merely, sellers have overpowered patrons, leading to a powerful downtrend on the worth charts. On the time of writing, the altcoin was buying and selling at $117 following a 20% decline within the final 24 hours.