AAVE eyes 30% rally despite key hurdles – How it can happen

- AAVE is on the verge of a rally, however two main obstacles forward may hinder its progress.

- Liquidity movement to Aave has been excessive, with market individuals putting bets.

Aave [AAVE] is starting to recuperate after recording a serious market lack of 30.91% prior to now month.

Press-time information confirmed that previously week alone, the asset has rallied 6.66% and has added one other 1.40% prior to now 24 hours.

Evaluation reveals that rising liquidity into the Aave protocol has contributed to this progress, and the asset may benefit additional as soon as it overcomes main boundaries which may hinder its potential upward rally.

Rocky path forward for AAVE

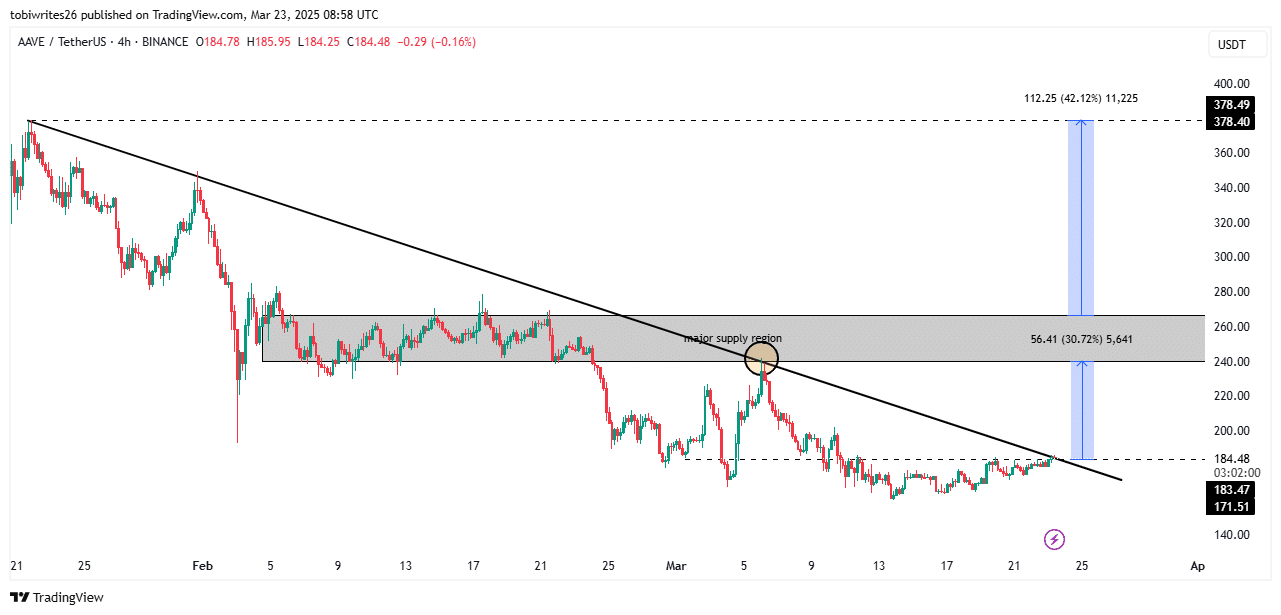

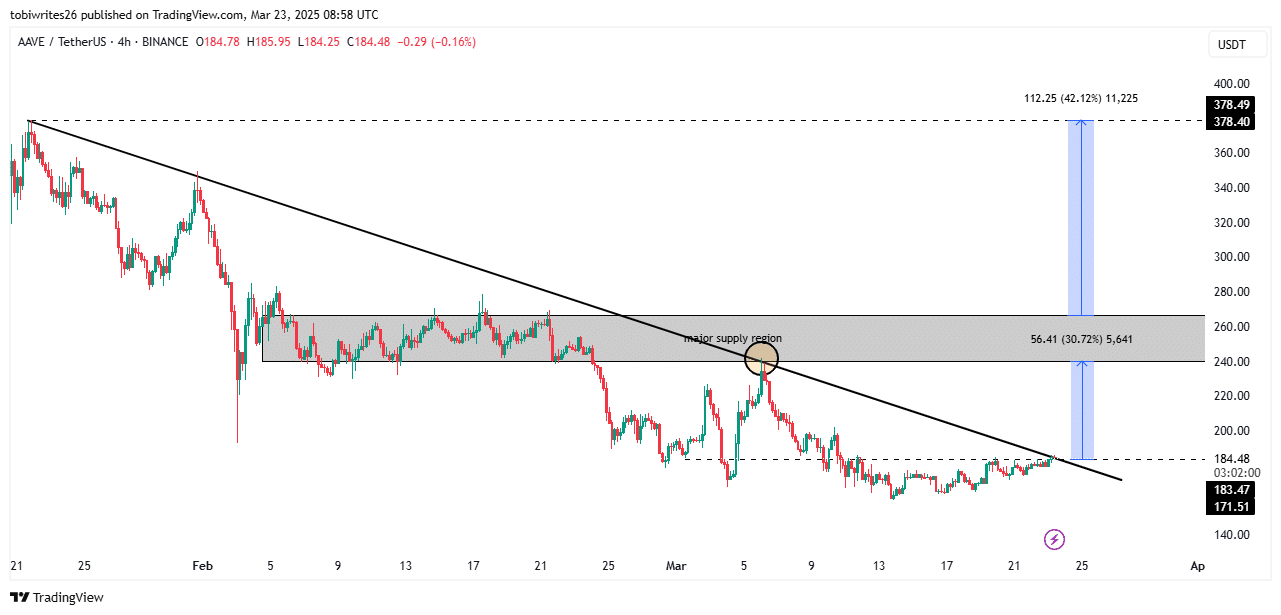

AAVE is at a serious crossroads because it makes an attempt to breach the descending line sample that has shaped on its 4-hour chart. This sample tends to be bullish in most cases when it types available in the market.

If AAVE takes a bullish path, then the asset would want to breach the descending line—its first impediment—after which rally at the least 30.72% to the subsequent main barrier, the provision area marked on the chart.

This stage is critical because it induced the present AAVE decline that started on the fifth of March.

Supply: TradingView

AAVE may see additional declines from the provision stage or consolidate inside the area, as seen on the left facet of the chart.

If market momentum stays excessive and AAVE exits this provide area, it may make one other leg up, rallying 42%.

Ecosystem grows as promoting strain drops

AMBCrypto analyzed AAVE’s potential to breach the present descending-line impediment forward and located that liquidity movement into its ecosystem would play a key position in reaching this.

The market capitalization-to-total worth locked (TVL) ratio is a metric used to evaluate the ecosystem’s worth relative to its value progress.

When low, it implies the ecosystem is increasing with extra interplay from individuals, which has a long-term impact on value.

At press time, this ratio stood at 0.15, suggesting ecosystem progress. So, it could solely be a matter of time earlier than AAVE rallies.

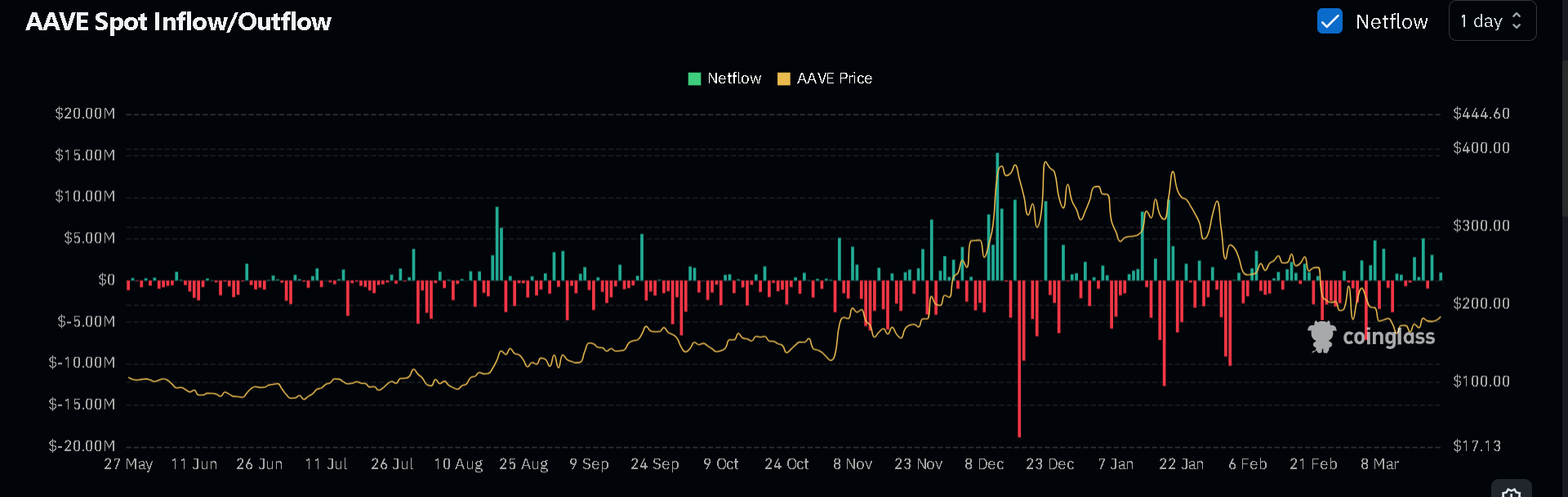

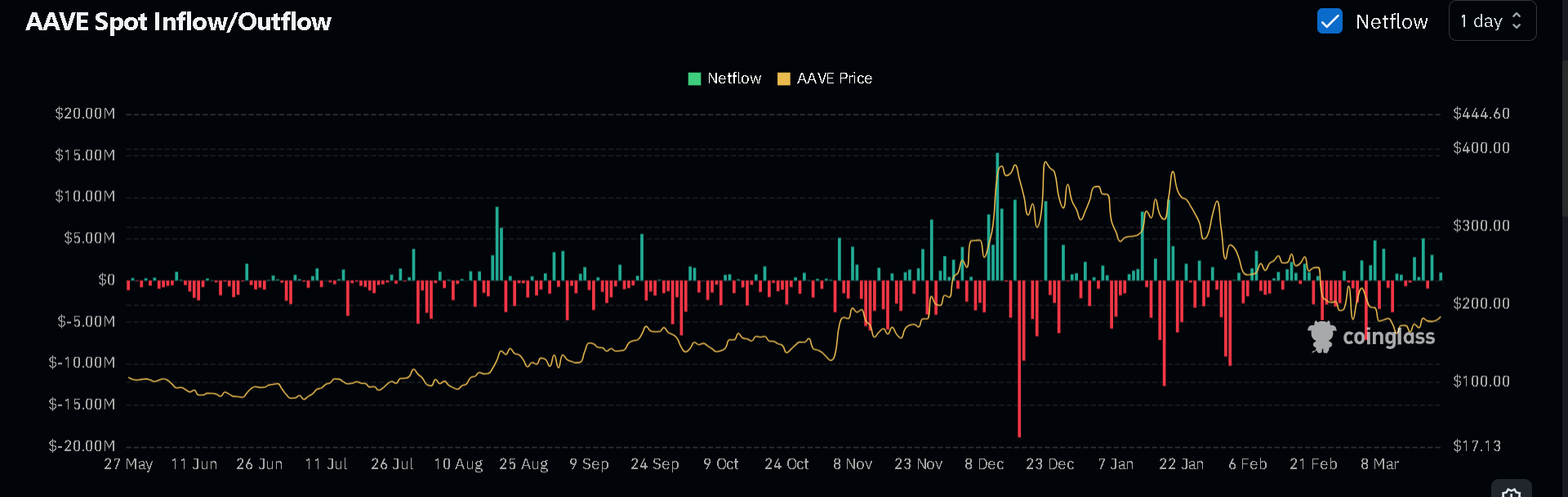

Supply: Coinglass

Within the spot market, promoting strain has declined amongst merchants who have been beforehand extremely bearish.

As of the nineteenth of March, these merchants bought $5.5 million value of AAVE, a pattern that continued within the following days with a number of extra tens of millions bought.

Press time information reveals that promoting has dropped to $110,000 value of AAVE—a notable decline. Such a shift implies that sellers are decreasing, and shopping for may quickly start.

Consumers taking cost of the market would play an vital position in AAVE reaching its 30.72% rally mapped on the chart.

Extra merchants are betting on a breach

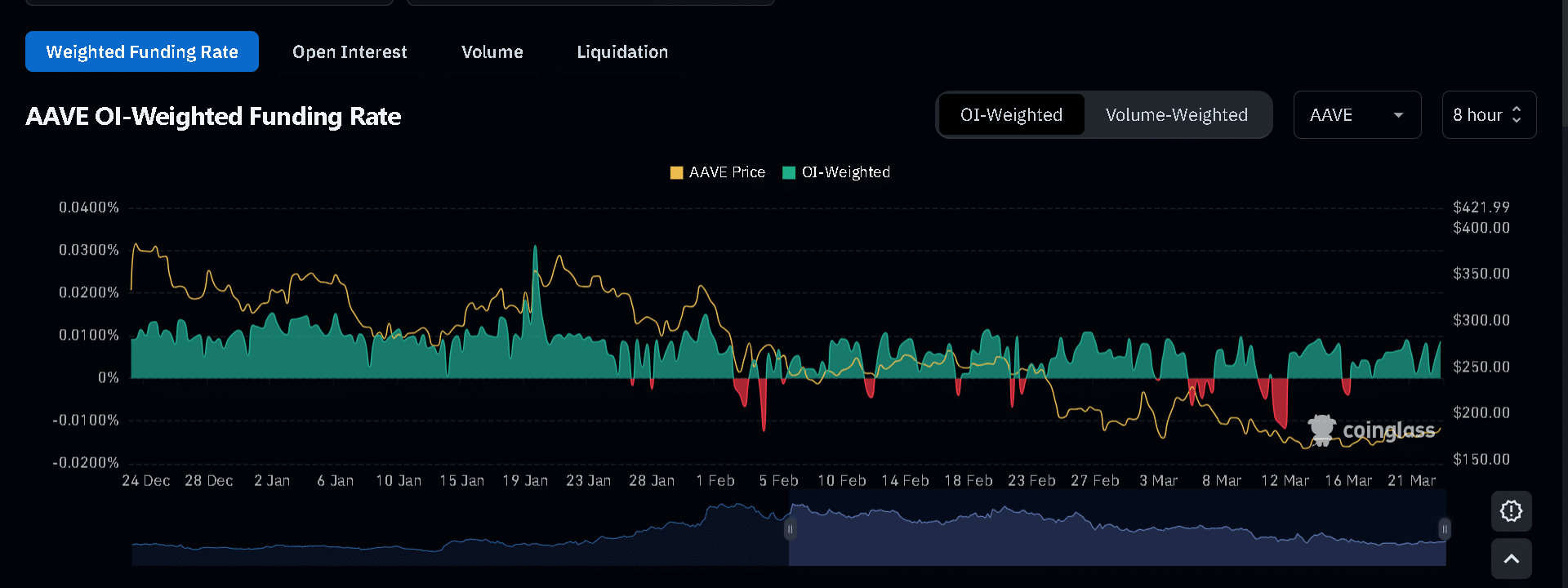

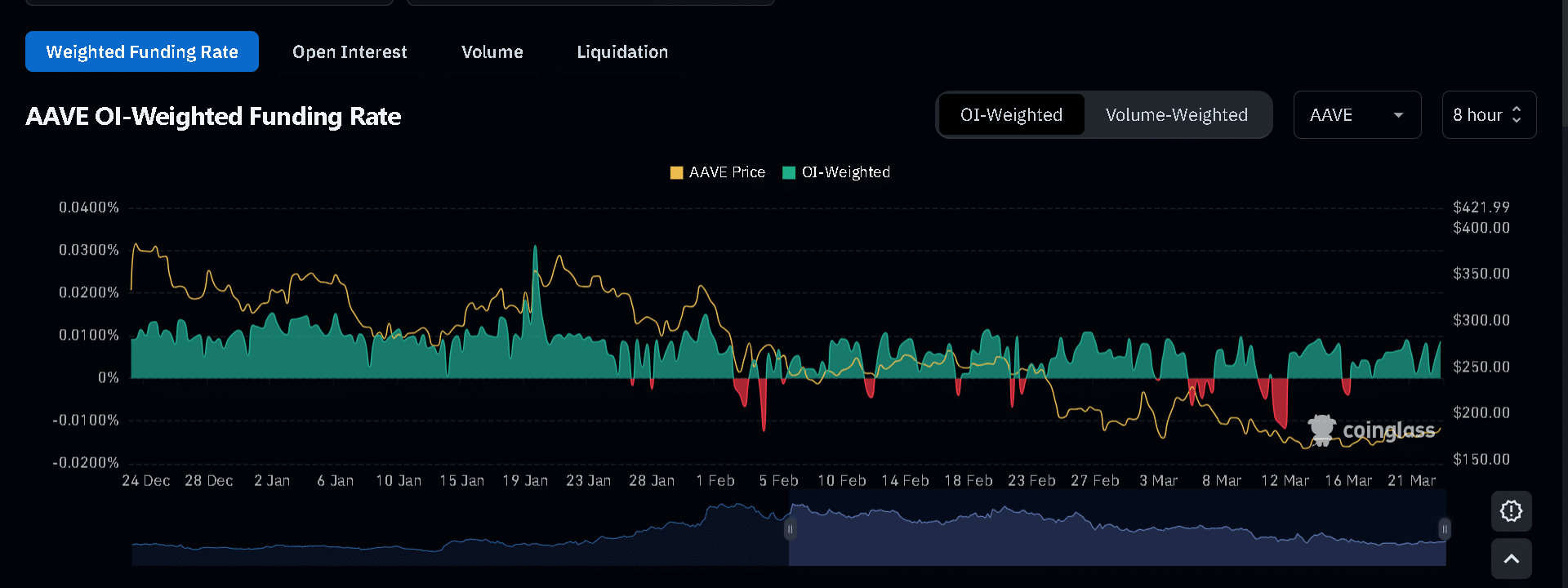

Even within the derivatives market, merchants are betting on an AAVE value rally.

On the time of writing, the OI-Weighted Funding Fee, which mixes funding and Open Curiosity to find out market sentiment, has turned constructive at 0.0087%.

Supply: Coinglass

A constructive studying implies that patrons available in the market are taking on, as extra unsettled contracts are dominated by longs, who’re paying a premium price periodically to keep up their positions.

Derivatives market quantity can also be skewed in favor of bulls, because the Taker Purchase-Promote Ratio has turned 1.0056. At any time when this ratio crosses above 1, it signifies extra shopping for than promoting inside the previous 24 hours.

If these key metrics proceed to show constructive, then AAVE may see a serious value rally transferring into the week.