AAVE: THESE factors could drive the coin to $351

- Aave’s ecosystem thrived with sturdy consumer engagement, rising transactions, and diversified protocol adoption.

- Governance and bullish technical indicators solidified Aave’s management and highlighted sustained market confidence.

Aave [AAVE], a dominant platform in Decentralized Finance (DeFi), continues to set the tempo for innovation with its sturdy ecosystem. With $22 billion in whole worth locked (TVL), it stands as a cornerstone of the DeFi house.

The platform’s strategic strikes, comparable to introducing the GHO stablecoin and integrating wrapped belongings like WETH and WBTC, spotlight its concentrate on liquidity diversification and flexibility to market calls for.

At press time, Aave was buying and selling at $331.01, reflecting a 13.05% surge prior to now 24 hours. This value enhance raises a vital query: Can Aave maintain its development and management?

Are customers driving AAVE’s ecosystem ahead?

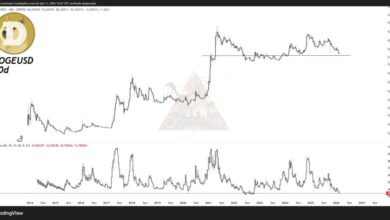

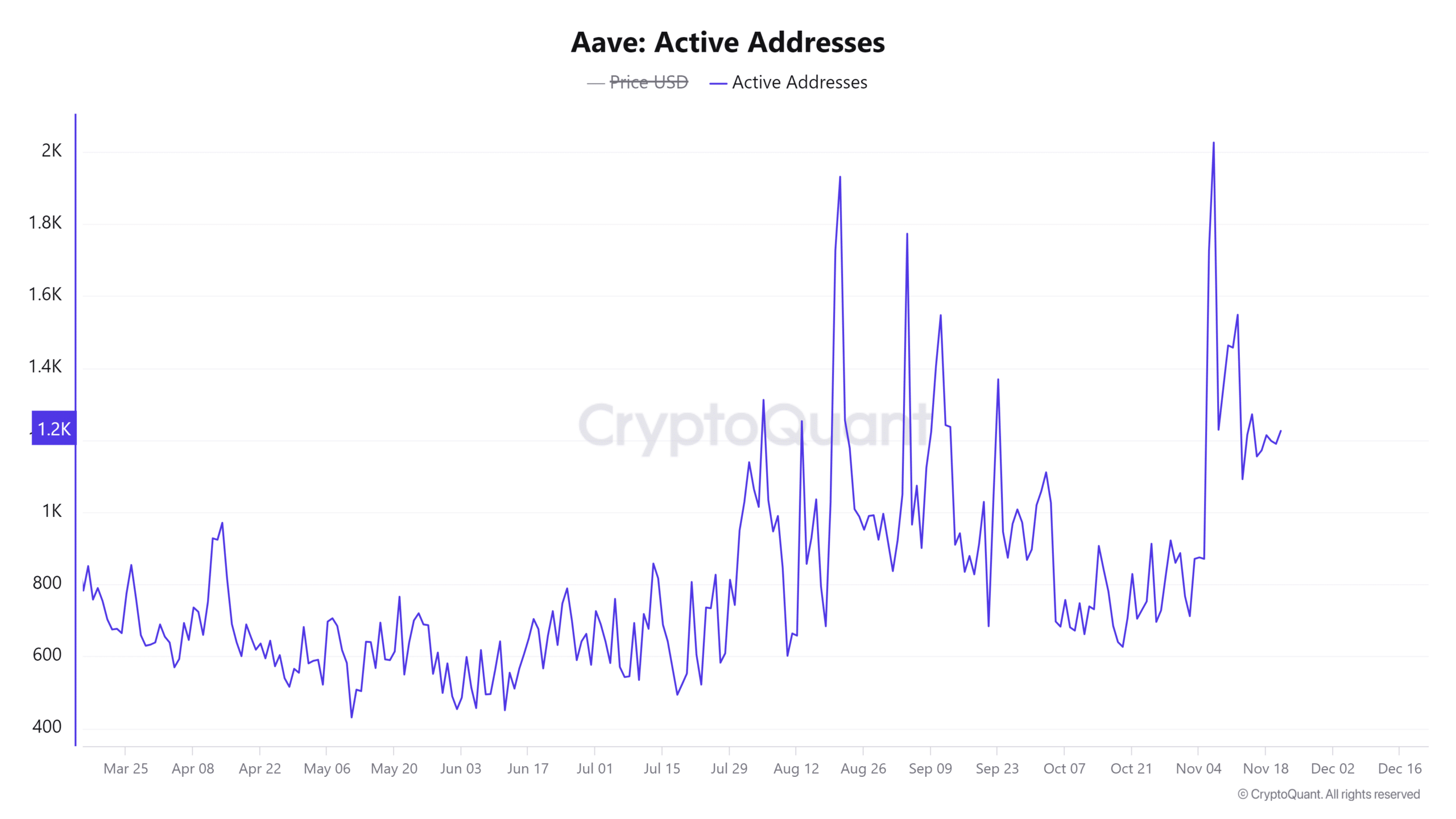

Consumer engagement stays a important consider Aave’s success. Energetic handle metrics present a 1.09% development over the previous day, with 168.75 distinctive lively addresses at the moment interacting with the protocol.

This constant exercise demonstrates consumer belief within the altcoin’s choices. Moreover, the platform recorded a 1% enhance in transaction depend, with 5,772 transactions within the final 24 hours.

These figures underline the regular enlargement of its consumer base and rising interplay throughout the ecosystem, highlighting the platform’s relevance and reliability.

Supply: CryptoQuant

How AAVE protocol adoption helps enlargement

The protocol’s adoption has been pushed by its capacity to innovate and provide versatile options. The GHO stablecoin has bolstered liquidity, offering customers with a steady, decentralized asset possibility.

Moreover, integrating wrapped Ethereum (wETH) and Bitcoin (wBTC) broadens its enchantment by enabling conventional cryptocurrency customers to seamlessly take part in DeFi.

Subsequently, Aave’s steady concentrate on protocol utility ensures it stays engaging to various customers whereas positioning itself as a bridge between centralized and decentralized finance.

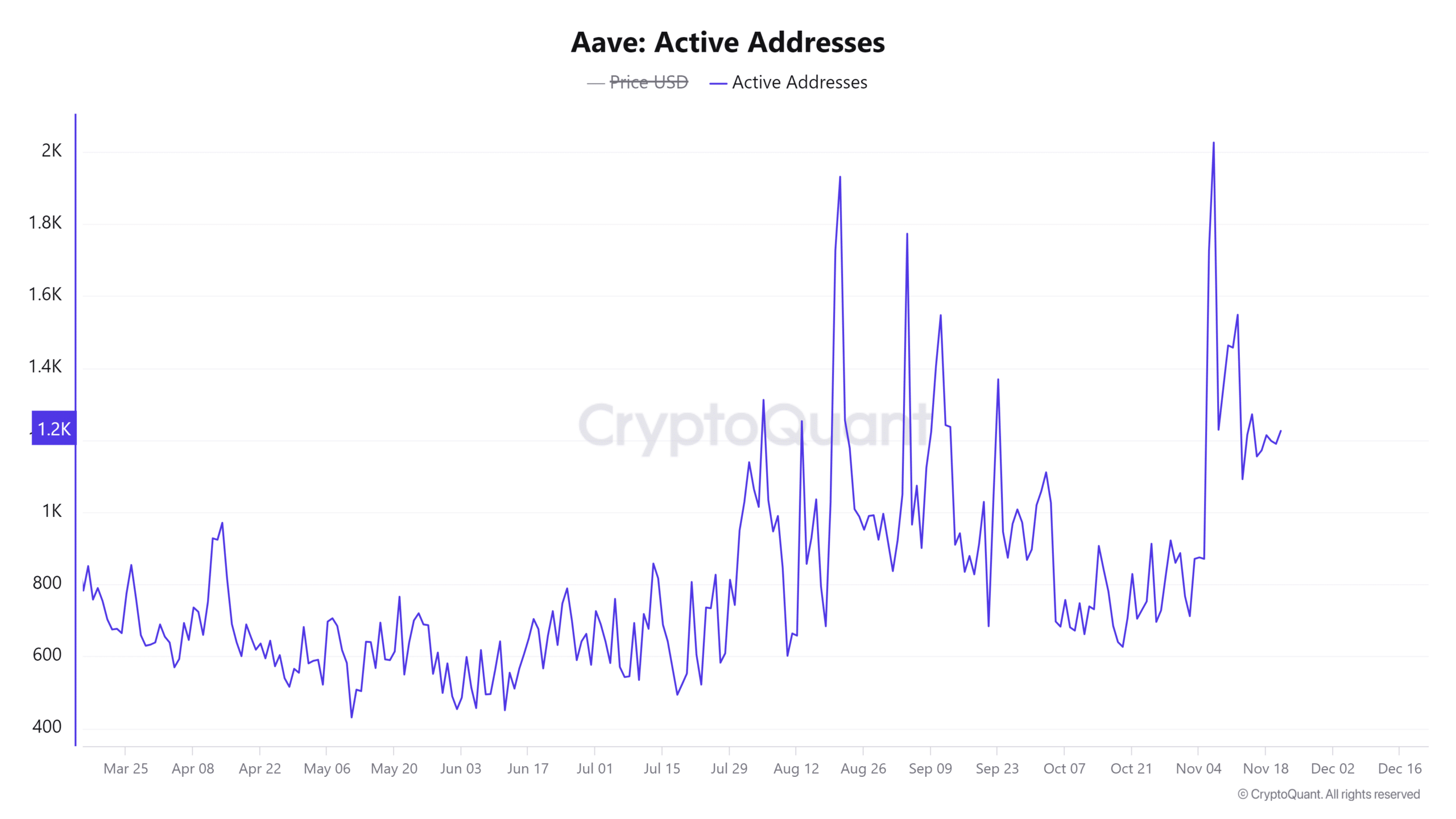

Transaction and liquidity information present further insights into its operational well being. The whole transaction depend has elevated by 1% prior to now 24 hours, reflecting heightened consumer exercise.

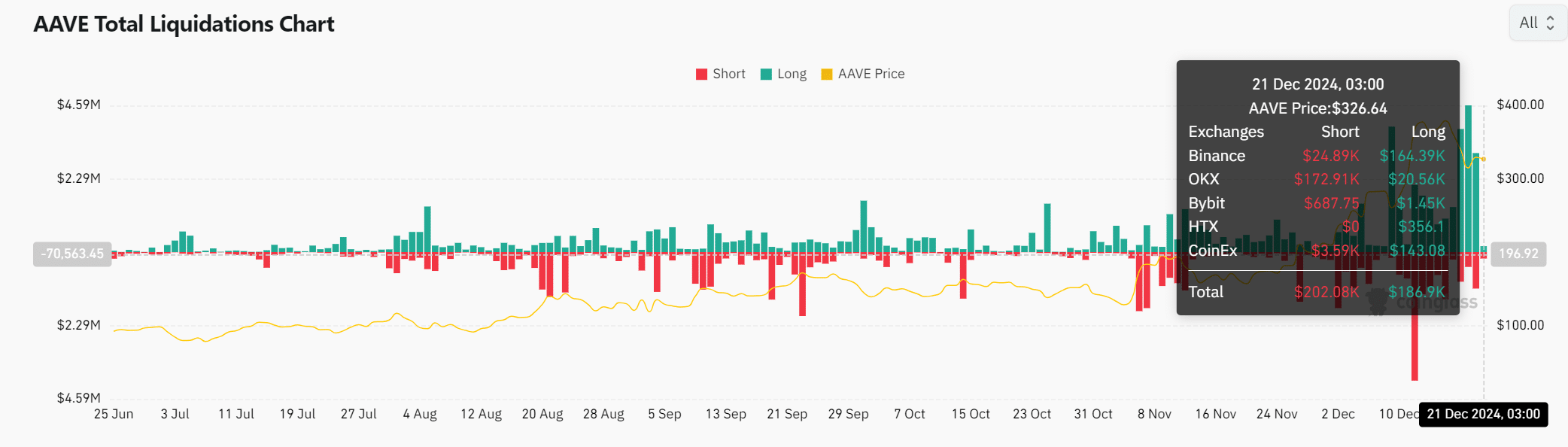

Moreover, the liquidation information signifies balanced market exercise, with $186.9K in lengthy liquidations in comparison with $202.08K in shorts, reflecting a strong equilibrium in market sentiment.

Supply: Coinglass

What do the charts say about value tendencies?

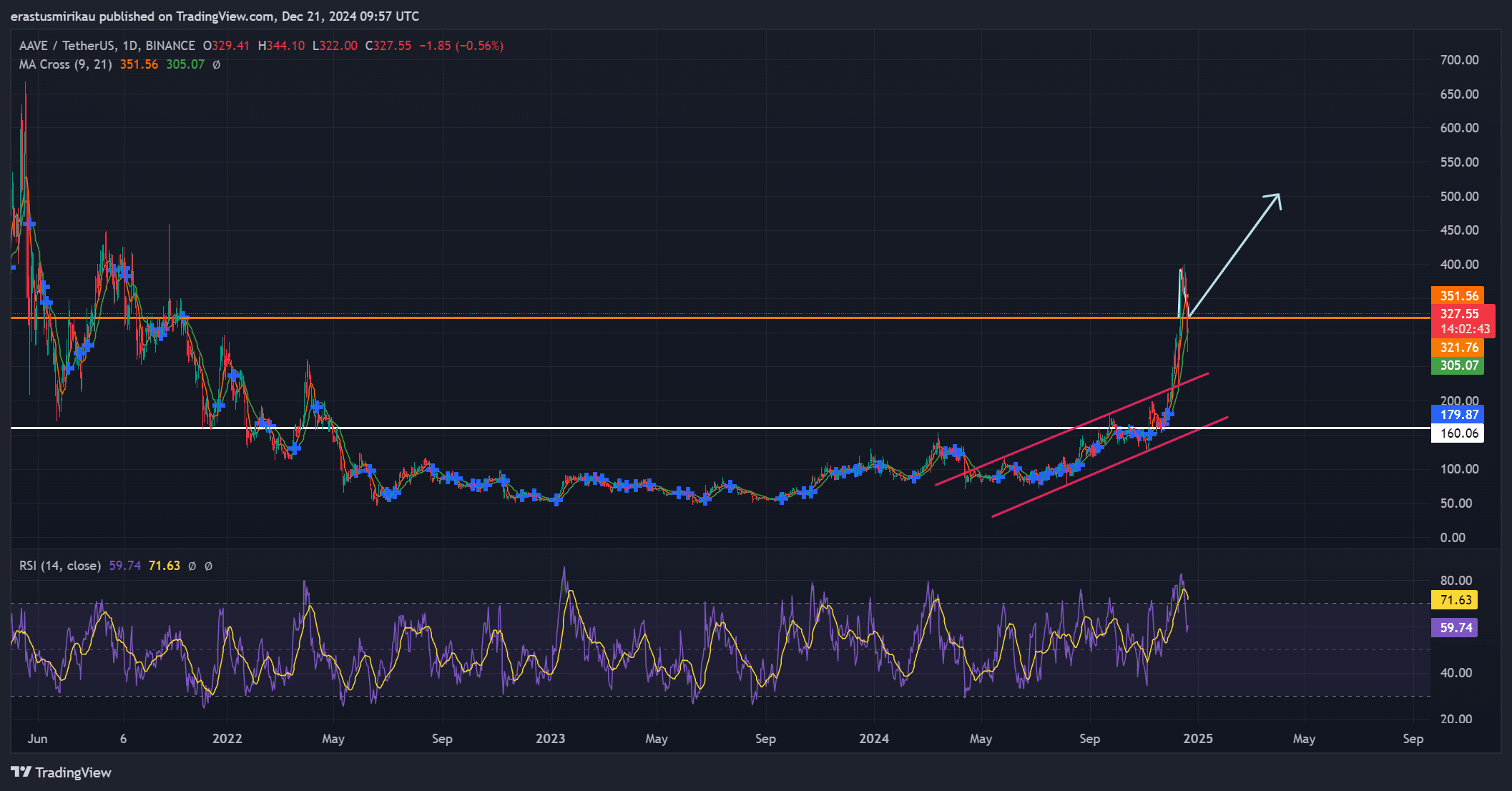

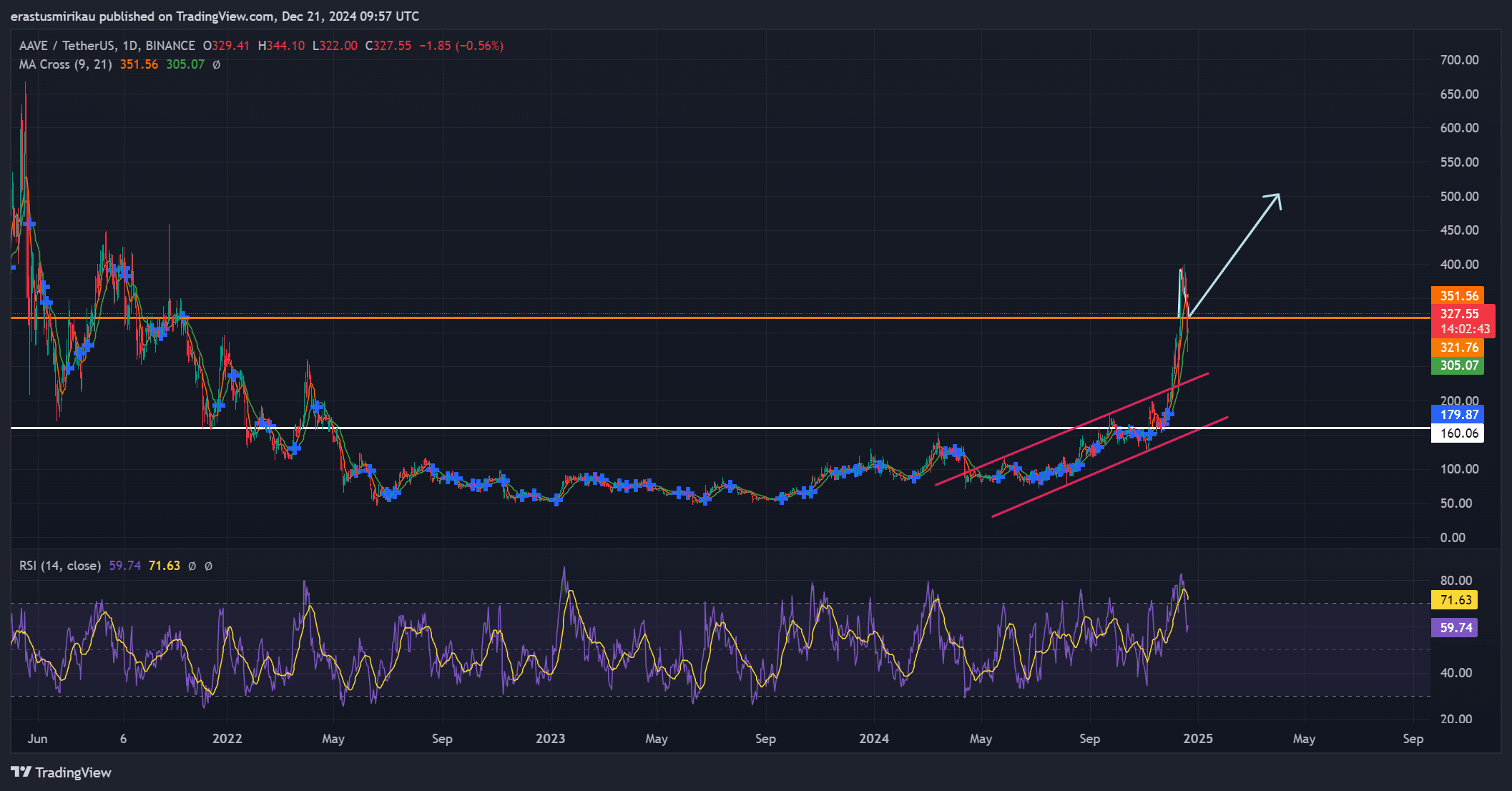

Current value efficiency highlights Aave’s bullish sentiment. The RSI of 71.63 suggests sturdy momentum regardless of nearing overbought ranges.

Moreover, the Transferring Common (MA) cross indicators continued upward tendencies, with $351.56 recognized as a important resistance stage.

Coupled with balanced lengthy and quick positions within the liquidation information, the charts counsel market confidence in altcoin’s efficiency.

Supply: TradingView

Learn Aave’s [AAVE] Worth Prediction 2024-25

Conclusively, Aave’s capacity to drive consumer engagement, innovate its protocol, and leverage decentralized governance ensures it stays a pacesetter in DeFi.

Its constant development and flexibility place it to maintain momentum and lead the house ahead.