Accumulation Zone Points To Upside Potential, $20 In Sight

The decentralized Oracle community Chainlink and its native token LINK have grown impressively previously month. Regardless of experiencing a correction since late December, the place LINK reached a 20-month excessive of $17.6, the token has proven indicators of renewed bullish momentum.

Key Resistance Ranges For LINK’s Value Rally

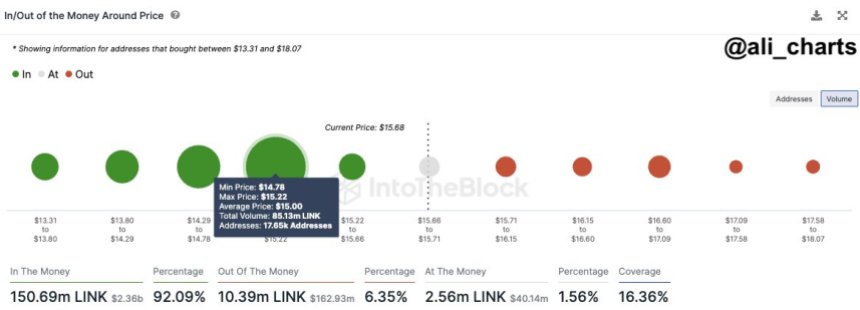

Famend crypto analyst Ali Martinez has identified a strong demand zone for Chainlink between $14.8 and $15.2, barely beneath its present buying and selling worth of $15.415.

Inside this vary, many addresses (17,650) bought 85.12 million LINK. With restricted resistance, LINK seems to be well-positioned to advance in direction of the $20 mark.

Based mostly on the analyst’s observations, if the present bullish momentum witnessed over the previous seven days persists, LINK might swiftly attain the $20 worth degree. Taking a look at LINK’s 1-day chart, the subsequent resistance ranges to beat earlier than doubtlessly climbing towards $20 are $15.55, $16.69, and $16.92. Breaching these ranges would pave the best way for a transparent path in direction of the $20 milestone.

Nevertheless, you will need to observe that within the absence of main resistance partitions, the battle for the subsequent path of LINK’s actions stays equally balanced. Within the occasion of one other worth correction or promoting stress, the token lacks important assist partitions to depend on.

Analyzing LINK’s 1-day chart, the primary assist degree within the occasion of a drop can be round $14.22. If this degree is breached, the subsequent assist stands at $13.31. An additional decline might check the assist on the $11 worth degree. A breach of this degree might signify a breakdown within the four-month bullish construction of LINK.

Chainlink Ecosystem Progress

Regardless of the battle for supremacy between LINK’s bulls and bears, the protocol’s ecosystem has proven notable development in key metrics for the reason that final replace. For instance, Chainlink’s circulating market capitalization is $8.35 billion, reflecting a constructive development fee of three.58%.

In keeping with Token Terminal data, by way of income over the previous 30 days, Chainlink has generated $11.67 thousand. Nevertheless, this determine reveals a decline of 54.16% in comparison with the earlier interval, indicating a lower in earnings throughout this timeframe.

Contemplating the absolutely diluted market capitalization, which considers the utmost variety of Chainlink tokens that would exist sooner or later, the worth stands at $14.82 billion. This metric has skilled a slight enhance of three.48% lately.

With regards to income on an annual foundation, Chainlink has generated $219.81 thousand. This represents a constructive development fee of two.64%, indicating an upward development within the firm’s earnings over a yr.

Relating to monetary ratios, Chainlink’s price-to-fully-diluted ratio is calculated at an astonishing 68,246.47x. This metric compares the corporate’s market capitalization to its absolutely diluted market capitalization. It displays the premium traders pays for every unit of potential future tokens.

Equally, based mostly on the absolutely diluted market capitalization, the price-to-sales ratio is reported to be 68,246.47x. This ratio measures the corporate’s valuation relative to its annualized income and signifies how a lot traders pays for every greenback of gross sales generated.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site totally at your personal danger.