After ETF approval, Bitcoin drops to 43k – What’s going on?

- The Bitcoin Coinbase Premium Hole went adverse on the eleventh of January.

- The following week might even see persistent promoting strain from U.S. members.

Bitcoin [BTC] noticed eleven spot ETF functions accepted on the tenth of January, and buying and selling started the following day. Some traders anticipated costs to soar larger, whereas others argued that the occasion had already been priced in.

The latter proved appropriate, a minimum of within the quick time period. BTC costs climbed to $48.9k on Binance on the eleventh of January however fell to $41.5k a day later.

Ki Young Ju, the founder and CEO of CryptoQuant, posted on X (formerly Twitter) that Grayscale despatched 21.4k BTC to a number of addresses previously 30 days.

The implications weren’t that this outflow was the only explanation for the value drop. Nonetheless, it did play a component.

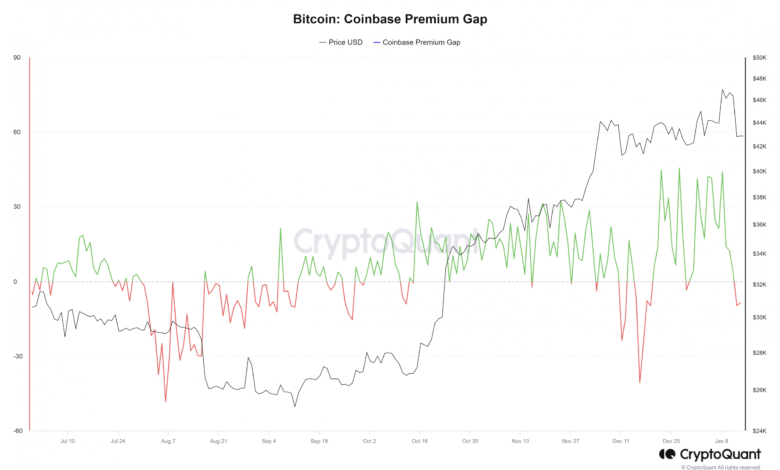

Exploring the Coinbase Premium Hole

Maarten additionally took to X to discover the implications of this BTC outflow. He famous that after the spot ETF buying and selling started, the Coinbase Premium Hole started to fall into adverse territory.

This Premium is the distinction in worth between Coinbase’s BTC/USD pair and Binance’s BTC/USDT pair. Increased values imply US traders are eager on shopping for BTC, whereas adverse values suggest that US members are promoting their BTC.

Supply: CryptoQuant

The Premium had been constructive for almost all of December and January, pointing towards sturdy demand. January specifically noticed Bitcoin breach the vary highs at $44.3k twice, however the costs fell again into the vary on each events.

Maarten additionally famous that the buying and selling quantity on Coinbase was excessive in the course of the American buying and selling hours. Alongside the dropping Premium, he instructed that this could possibly be a nasty signal for Bitcoin bulls on the following buying and selling day — the sixteenth of January.

Will the costs proceed their hunch subsequent week?

AMBCrypto analyzed the liquidation heatmap of Bitcoin to grasp the place costs may go subsequent. Since liquidity is without doubt one of the main driving forces out there, excessive liquidity pockets may help in recognizing the place tendencies may reverse.

Supply: Hyblock

The liquidity pool at $48k-$48.2k has been examined, and BTC confronted a pointy reversal close to $49k on the eleventh of January. To the north, the $50.2k, $51.2k, and $52.4k ranges have been noteworthy areas of curiosity.

Decrease on the chart, the $39.2k-$40k area has a a lot denser focus of enormous liquidation ranges.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Additional down, the $35k and $33.8k ranges have been estimated to have much more liquidation ranges. Subsequently, within the coming weeks or months, a reversal to those ranges would very possible mark an area market backside.

As issues stand, BTC is extra prone to drop seeking liquidity than to climb previous $50k.