Algorand: Why breaking THIS level is key for ALGO’s 60% breakout

- ALGO may very well be poised for a possible bullish breakout after a rebound from the correction.

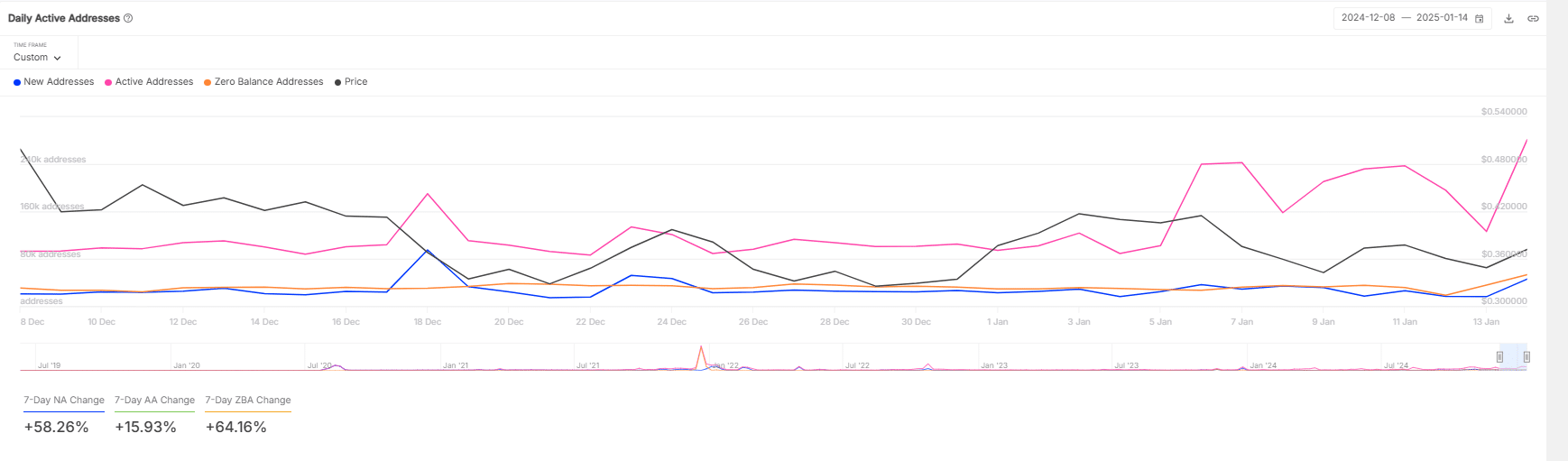

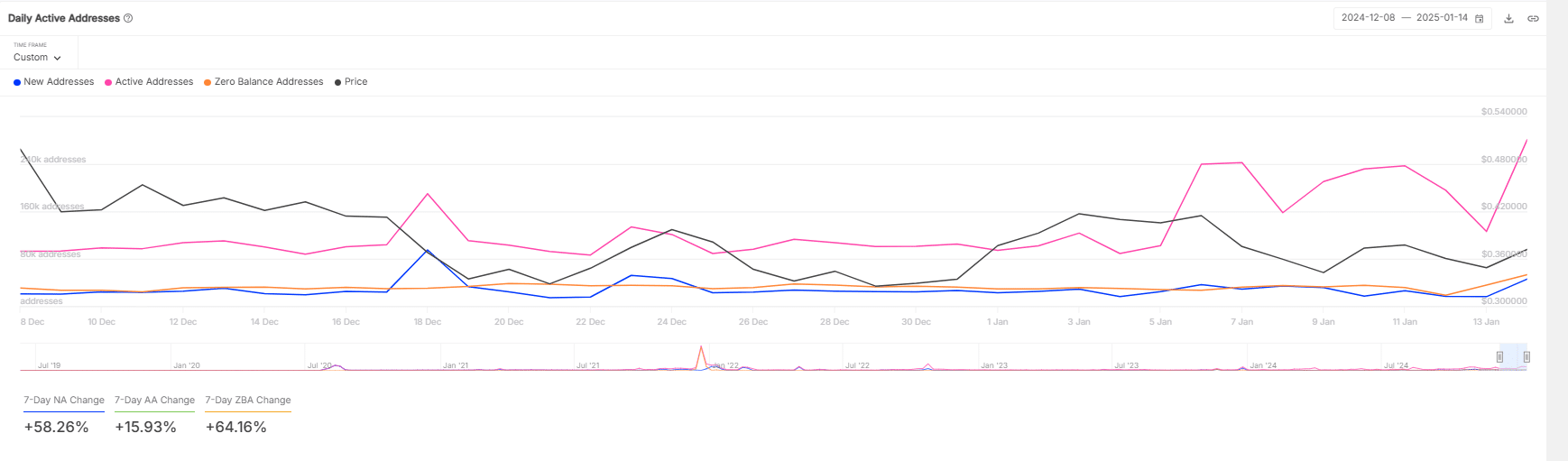

- Day by day energetic addresses beginning to rise once more steadily after being flat since July 2024.

Algorand [ALGO] gained greater than 14% whereas its each day buying and selling quantity rose by equal measure as per CoinMarketCap, aligning with the present bullish momentum within the altcoin.

ALGO has been consolidating tightly inside a vital vary of $0.39 to $0.32. In current weeks, ALGO repeatedly examined each the higher and decrease boundaries of this vary, indicating a tense equilibrium between patrons and sellers.

This sample means that ALGO is organising for a big transfer.

A definitive breakout above the $0.39 resistance may doubtlessly result in a fast 60% improve in value, aiming for greater valuations in keeping with previous momentum reactions noticed beneath related circumstances.

Supply: Ali/X

Conversely, a fall beneath $0.32 may set a bearish development, resulting in additional declines. These actions may decisively affect ALGO’s market course within the brief to midterm, providing strategic entry and exit factors for merchants.

This poised state mirrored a market on the cusp of selecting its subsequent substantial transfer, dictated by its means to both maintain above $0.39 or fall beneath $0.32.

ALGO’s energetic addresses and their profitability

Supporting this bullish outlook is the notable uptick in each day energetic addresses for ALGO, rising by 15.93% within the final week, following a flat interval since July 2024.

New addresses rose by greater than 58%, coinciding with a 64.16% rise in zero-balance addresses. This means rising curiosity and probably speculative actions out there. The surge in these metrics wants to carry for ALGO’s potential features to materialize.

Supply: IntoTheBlock

The value of ALGO, which had been hovering round $0.30, responded positively prior to now two days, reaching as much as $0.48.

This exercise signifies a possible shift in market sentiment, the place elevated handle exercise may lay the groundwork for additional value appreciation.

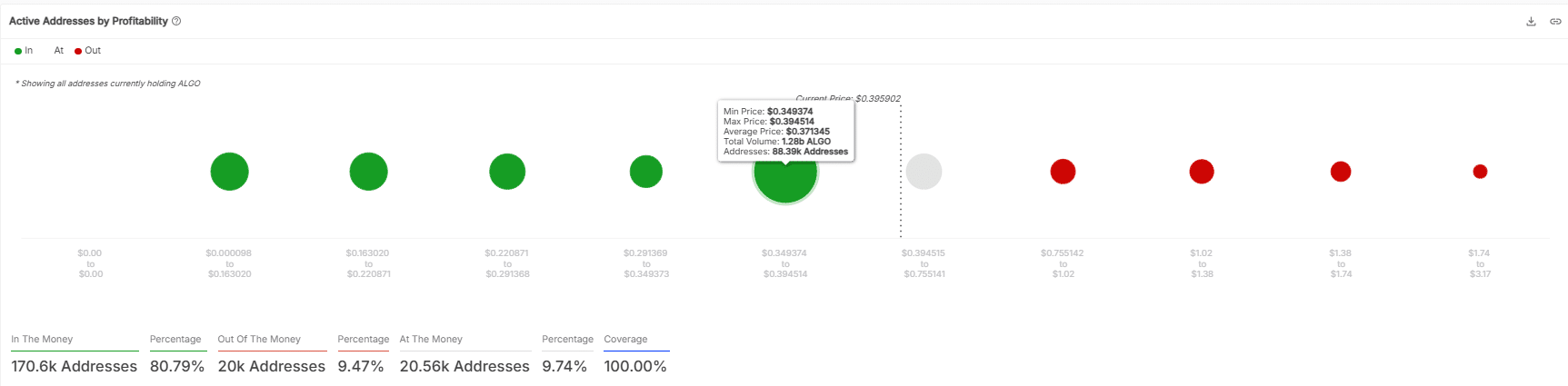

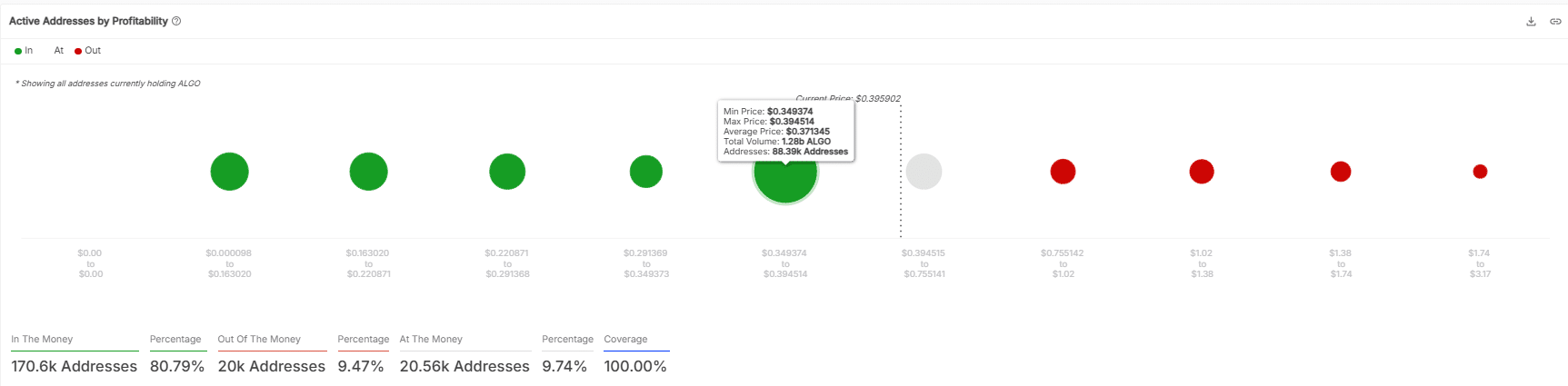

Additional evaluation of ALGO’s energetic addresses by profitability reveals that 80.79% of addresses are “within the cash,” with investments now value greater than their buy value, in comparison with 9.47% “out of the cash.”

The remaining 9.74% are at break-even. As of press time, the value of ALGO has risen from $0.34 to $0.395902 over the past two days, confirming this optimistic shift.

Supply: IntoTheBlock

Is your portfolio inexperienced? Examine the Algorand Revenue Calculator

Such a excessive proportion of worthwhile addresses sometimes indicators a powerful holder base that may resist promoting stress and assist the value. This additional helps the potential for ALGO breaking out and surging over 60%.

Nonetheless, profit-taking may happen if ALGO continues to rise, doubtlessly inflicting short-term volatility. Regardless of this, the upward development is more likely to maintain if purchaser momentum persists.