All Signs Point To A Bitcoin Liftoff—Here’s What The Experts See

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Primarily based on stories from analyst Moustache, Bitcoin could also be gearing up for its subsequent large transfer. The world’s largest cryptocurrency climbed above $105,000 for the second time this week. At press time, it was buying and selling at practically $104,000, up 0.50% over the previous 24 hours.

Associated Studying

Historic RSI Breakouts Might Sign New Push

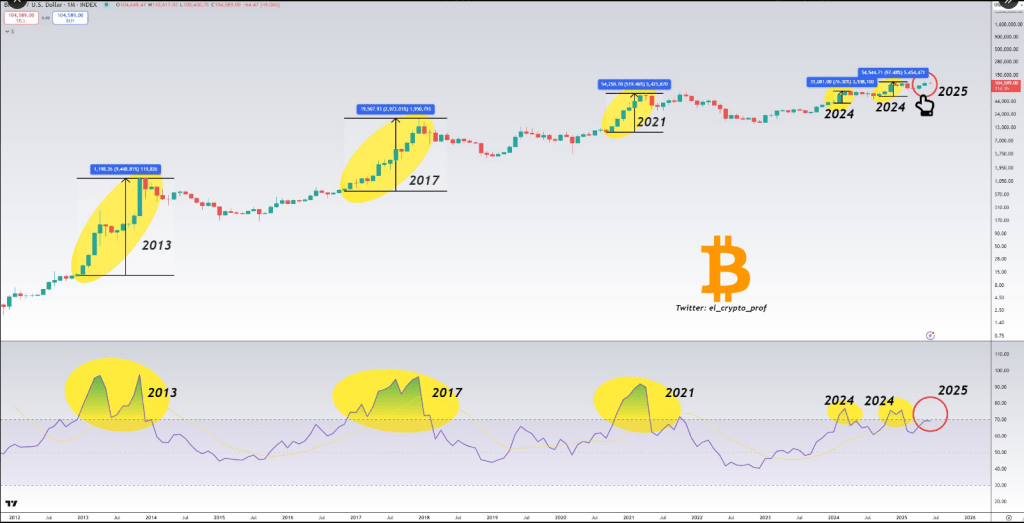

Based on the charts shared by Moustache, Bitcoin’s month-to-month Relative Power Index (RSI) tends to surge into overbought territory simply earlier than main rallies. Again in July 2013, Bitcoin sat at $66, then jumped to almost $1,120 by November because the RSI hit excessive ranges.

The same spike occurred in Could 2017, when BTC rose from about $1,300 to $19,700 by December. On April 1, 2021, Bitcoin reached $64,800 whereas the RSI once more climbed past its normal vary. In 2024, these RSI peaks got here on March 1 at $73,800 and once more in November when it cleared $100,000.

#Bitcoin$BTC month-to-month RSI is so near getting into overbought territory.

The actual run begins with this. Have a look at the previous and you recognize why. pic.twitter.com/8O1Z8RDuNs

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) June 19, 2025

Whales Stack Up Bitcoin Whereas Retail Pulls Again

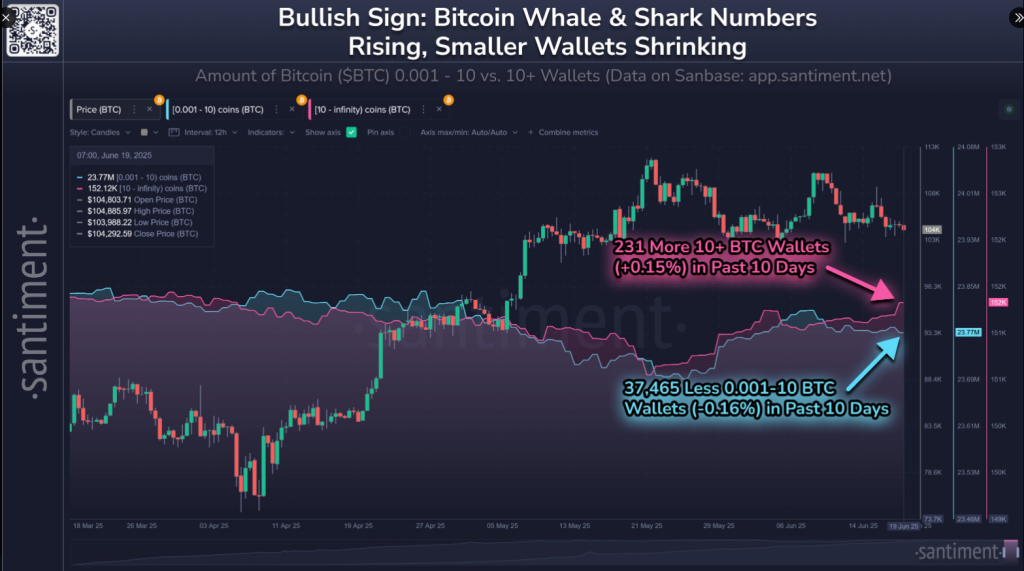

Primarily based on stories from on‑chain knowledge supplier Santiment, massive holders are scooping up cash at the same time as smaller traders step apart. During the last 10 days, wallets with at the least 10 BTC rose by 231 addresses.

On the similar time, retail wallets holding between 0.001 and 10 BTC fell by 37,460 addresses. That shift suggests large gamers are utilizing latest dips as a shopping for likelihood. In previous cycles, related strikes by whales have come earlier than sustained worth positive aspects.

📊 Bitcoin’s elite vs. mortal wallets are transferring in two completely different instructions as its market worth sits simply north of $104.3K.

🐳 Wallets with 10+ $BTC: +231 Wallets in 10 Days (+0.15%)

🦐 Wallets with 0.001 to 10 $BTC: -37,465 Wallets in 10 Days (+0.15%)When massive wallets… pic.twitter.com/uhZf6rPYvq

— Santiment (@santimentfeed) June 19, 2025

Overbought However Not Out

Analysts warn that an overbought RSI doesn’t all the time imply an on the spot surge. In previous runs, Bitcoin usually paused or pulled again for days and even weeks earlier than the actual rally received underway.

Typically the RSI stayed elevated whereas costs drifted sideways. In 2017, for instance, a correction adopted the excessive RSI however the broader uptrend stored going. Right this moment’s RSI is close to those self same ranges—and will linger there for some time.

Associated Studying

What Comes Subsequent For Bitcoin

Buyers shall be wanting past technical cues. Macro occasions, ETF strikes and regulatory bulletins might information the subsequent path. If establishments proceed to build up and retail continues to keep away from, worth strain will develop.

However a shock headline or coverage change may go the opposite path. For now, the intersection of excessive RSI and rising whale demand suggests a setup that has fueled earlier bull frenzies.

Featured picture from Unsplash, chart from TradingView