All the reasons why Cardano’s price might rally by 40% soon

- Cardano’s symmetrical triangle sample may result in a significant worth surge or draw back threat

- Whale exercise and broader market developments will form the altcoin’s subsequent worth motion

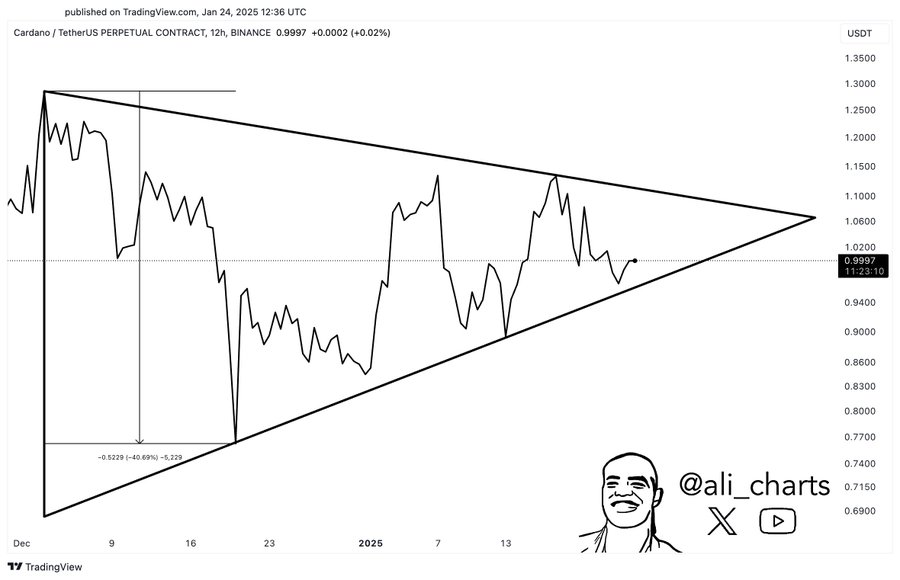

Cardano [ADA] finds itself at a pivotal juncture, with its worth motion narrowing right into a symmetrical triangle sample – One that usually precedes a big breakout. This era of consolidation has caught the eye of market watchers, who forecast a possible 40% worth surge if momentum shifts to the upside.

Whereas the sample leaves room for each bullish and bearish eventualities, the tightening vary appeared to point that heightened volatility could also be imminent. With ADA’s subsequent transfer prone to set the tone for its brief to mid-term trajectory, the market is carefully anticipating indicators of a decisive breakout.

Why symmetrical triangles usually precede worth breakouts

Symmetrical triangles kind when an asset’s worth consolidates on the charts, creating decrease highs and better lows. This sample displays a stability between patrons and sellers, progressively narrowing the vary till a breakout happens.

Symmetrical triangles don’t inherently sign course, however usually precede sharp worth actions as a result of buildup of market stress.

Supply: X

Fashionable analyst Ali Martinez highlighted ADA’s worth motion inside such a triangle, with the assist close to $0.83 and resistance round $1.06.

The extended consolidation appeared to align with historic precedents, one the place the breakout course sometimes matches the prevailing development. Given ADA’s setup, the market is now awaiting a breach of both boundary. This might set off a 40% transfer within the breakout’s course.

Value evaluation and whale exercise’s influence

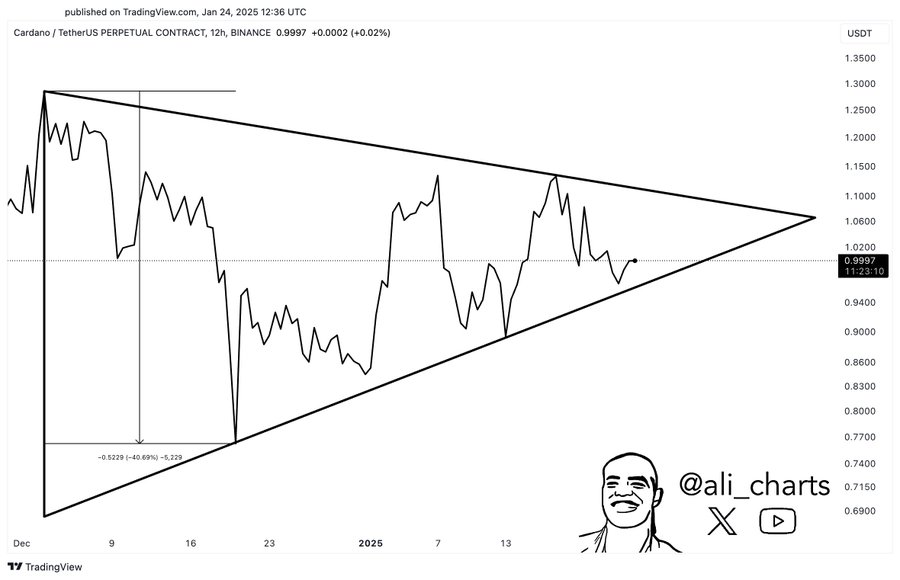

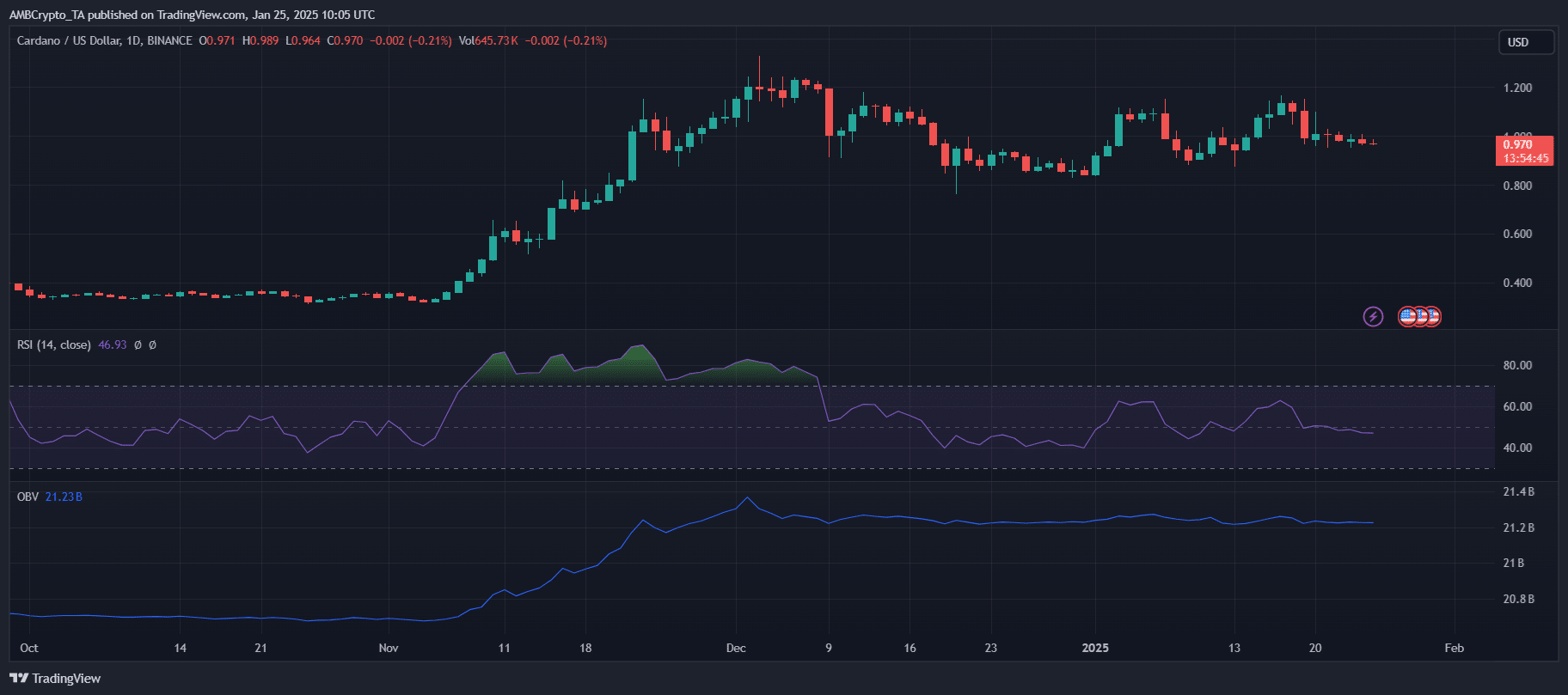

Supply: TradingView

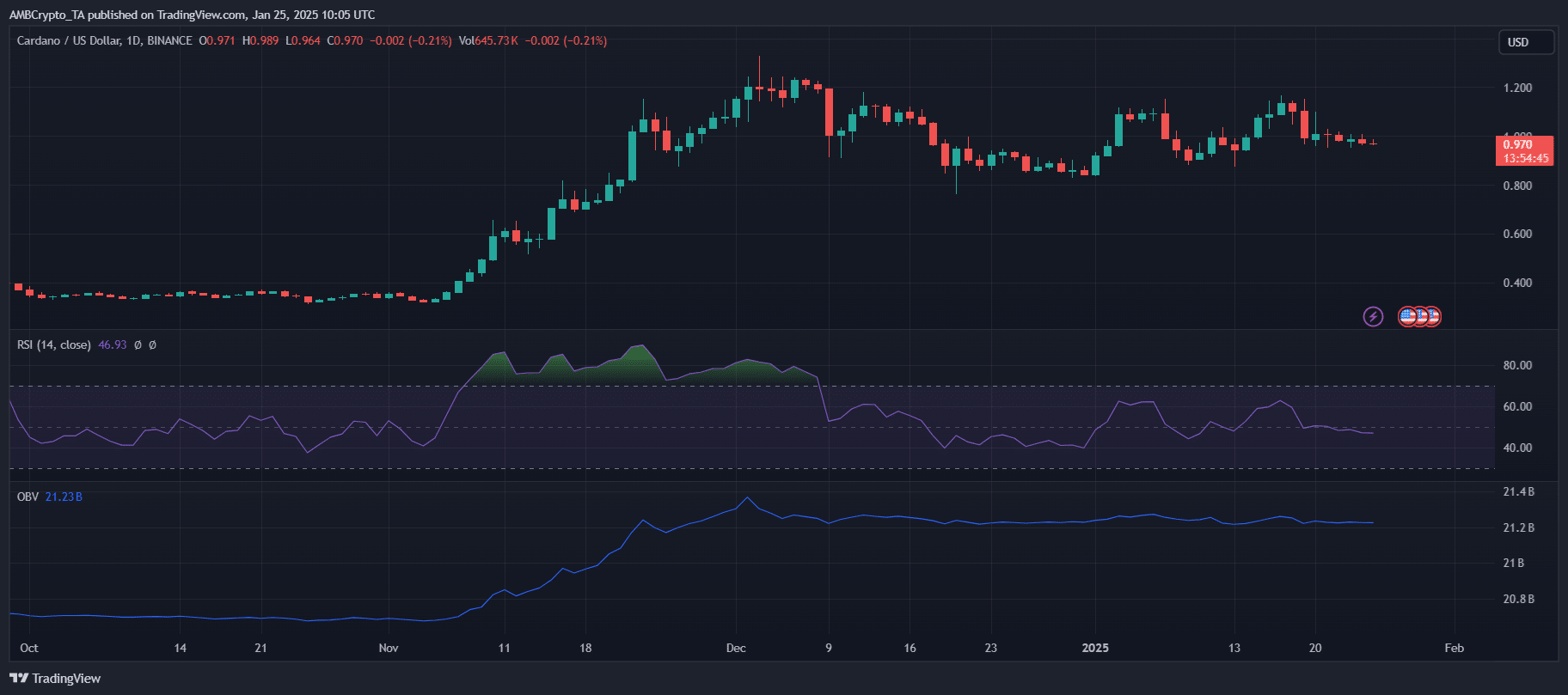

ADA’s press time worth motion appeared to be hovering round $0.97 – Sustaining a fragile stability between its $0.83 assist and $1.06 resistance ranges. The symmetrical triangle sample underlined indecision, with the volatility prone to surge upon breakout.

Supply: Santiment

Whale activity has been pivotal, with on-chain knowledge displaying that over 180 million ADA was offered by main holders over the previous week. This sell-off might have exerted downward stress on ADA, stalling its upward momentum close to $1.06. Constant outflows from wallets holding over $1 million hinted at waning confidence amongst giant buyers too.

If this development persists, it may set off a bearish breakdown under the $0.83 assist. Conversely, a halt in sell-offs may restore bullish sentiment and strengthen a push above $1.06.

Learn Cardano’s [ADA] Value Prediction 2025–2026

What may have an effect on ADA’s worth within the following weeks?

Cardano’s worth trajectory hinges on the decision of its symmetrical triangle sample. A bullish breakout above $1.06 may pave the best way for a 40% hike, probably drawing renewed curiosity from retail and institutional buyers.

Key drivers for this situation embrace diminished whale sell-offs, larger on-chain exercise, and broader market optimism.

On the flip aspect, a breach under $0.83 assist might result in important draw back dangers. Persistent whale outflows and weak market sentiment may amplify promoting stress, pushing ADA in the direction of decrease ranges. Moreover, exterior components like a normal macroeconomic uncertainty and Bitcoin’s worth motion will probably play a pivotal function in figuring out ADA’s path.