All Tron cohorts now in profit – Can a TRX ETF keep the rally alive?

- CBOE BZX Trade filed a 19b-4 proposal with the SEC to record shares of the Canary Staked TRX ETF.

- TRX investor sentiment turned bullish for the yr with 115% good points over 1 yr as Tether mints 1B USDT.

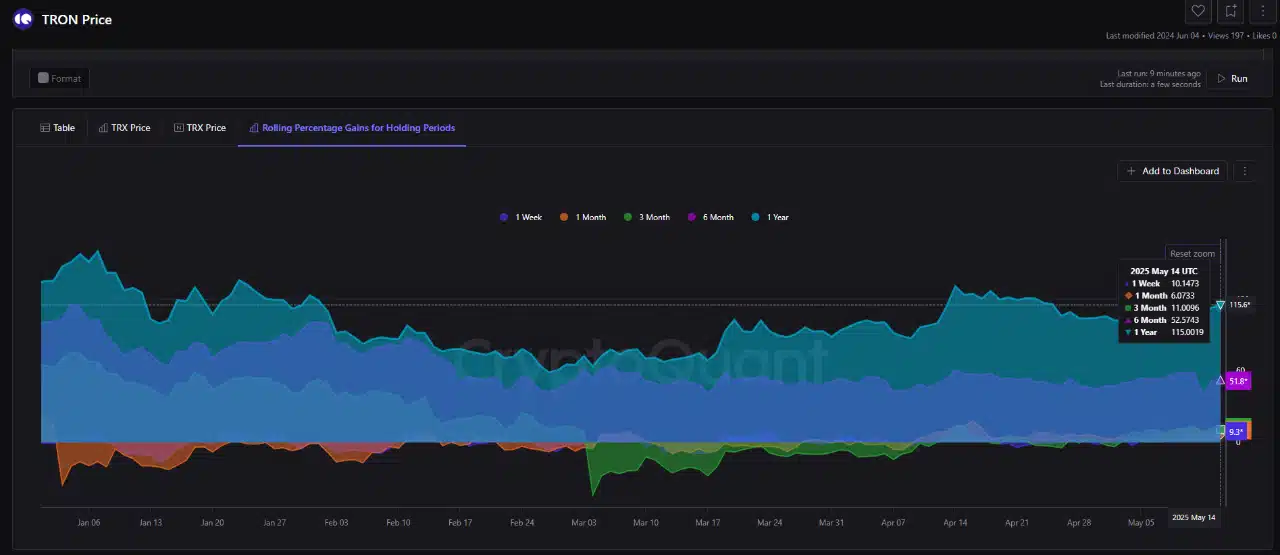

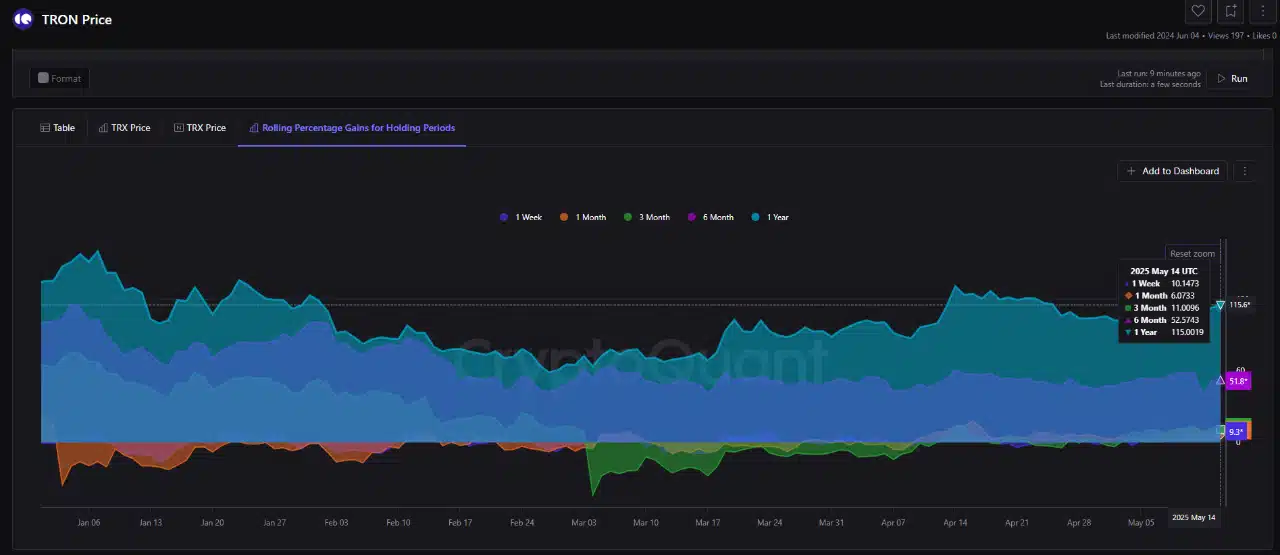

This yr marked an necessary occasion for all Tron [TRX] traders, as they had been making income.

In accordance with CryptoQuant, 1-week and 1-month holders noticed 10% and 6% good points, respectively, whereas 3-month holders pocketed 11%.

Those that bought and held Tron for six months and a yr loved will increase of 52% and 115%, respectively.

Supply: CryptoQuant

At press time, TRX traded at $0.2766, exhibiting continued energy. These in revenue would possibly announce it, encouraging many others to start investing in TRX.

For the value motion of TRX, it was virtually touching the resistance zone between $0.2950 and $0.31. The extent noticed its earlier promoting exercise.

If TRX managed to interrupt $0.30, there could be little or no resistance above, and the coin might goal as excessive as $0.38 and even increased.

Supply: TradingView

So, if the value was turned again at this wall, it might fall once more to assist at $0.2450, and extra promoting might see it decline to $0.2320 and even to $0.2150.

One can infer from the buildup in quantity that bulls had been nonetheless pushing ahead.

If TRX maintained its worth above $0.27, this could possibly be considered as an indication of a possible uptrend persevering with. If $0.27 was not held, continued promoting would possibly convey a couple of lack of momentum.

ETF submitting might gas institutional demand

Including gas to the hearth, the CBOE BZX Trade has filed a request with the U.S. SEC to record and commerce shares of the Canary Staked TRX ETF beneath Rule 14.11(e)(4), which governs commodity-based belief shares.

It detailed the intention to permit for the itemizing of an ETF proudly owning staked TRX. This meant the platform would preserve the staked Tron tokens so that you can enable traders to get entangled in staking.

If given the inexperienced mild, this ETF would give each massive and small traders a approach to put money into staked TRX. By means of conventional finance platforms, this might, in flip, encourage extra individuals to undertake Tron.

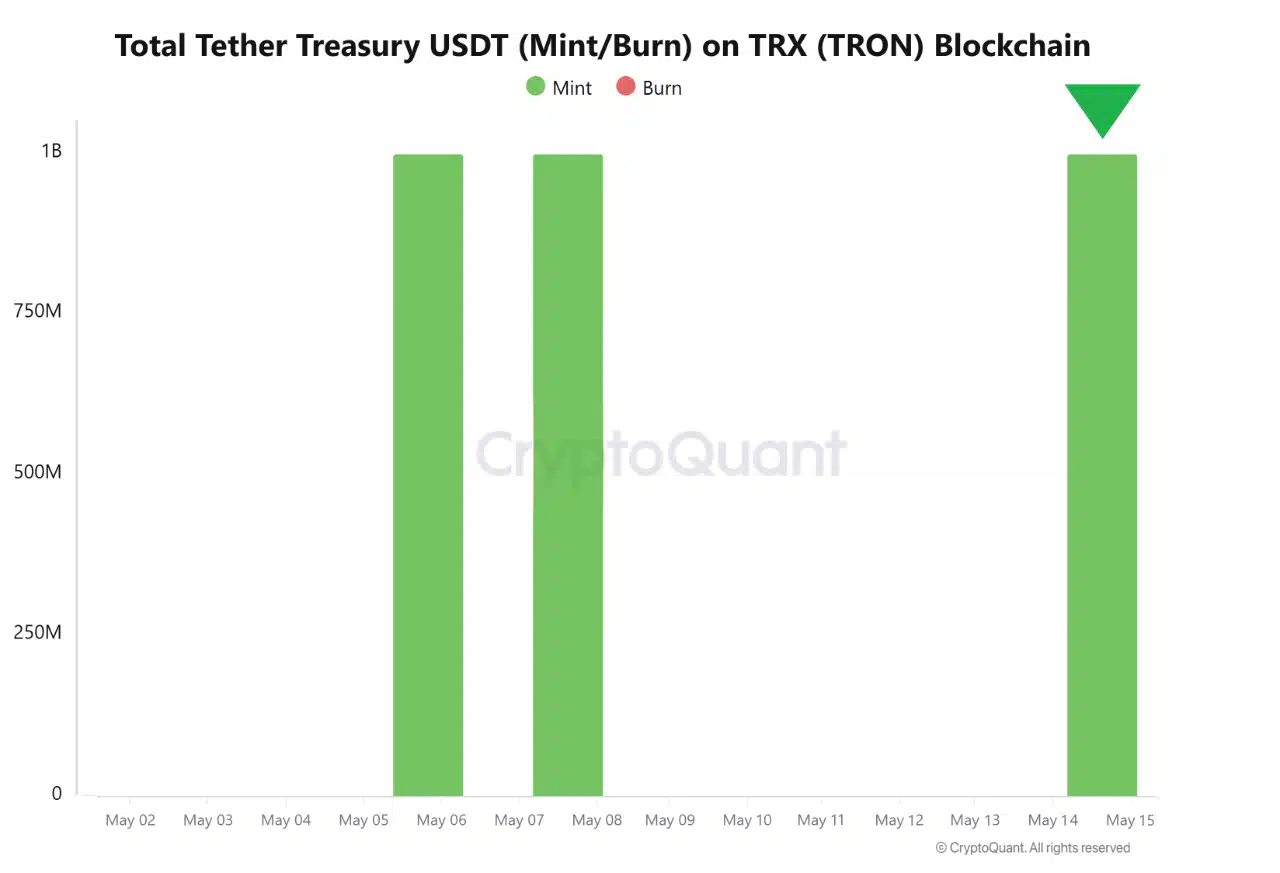

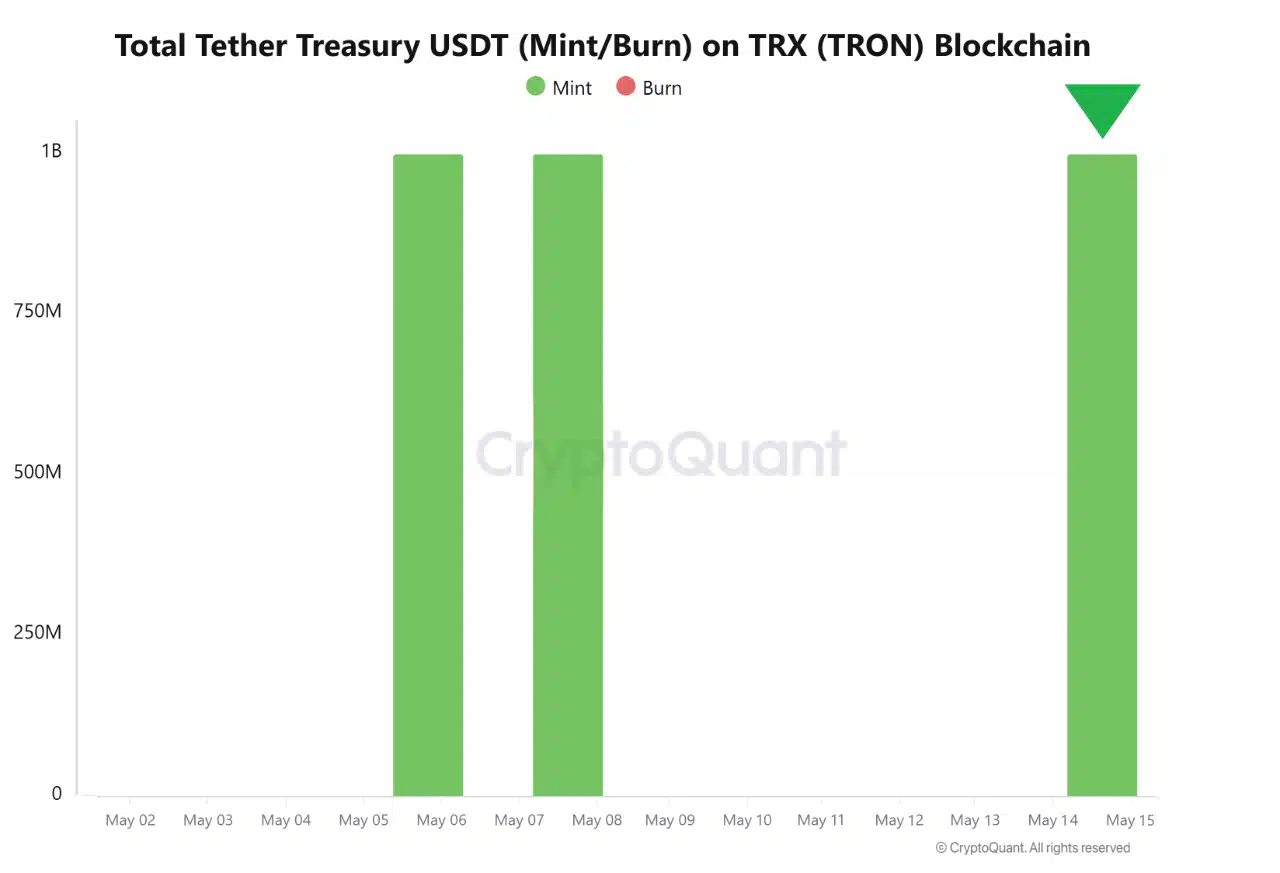

Tether’s $1B USDT mint fuels exercise

In the meantime, Tether Treasury created 1 billion USDT on the Tron blockchain following a $500 million transaction in derivatives and the removing of 8,000 BTC from Coinbase.

This confirmed that establishments had been demanding extra USDT.

Supply: CryptoQuant

Being the issuance chain, TRX additionally enhanced community utilization and on-chain engagement.

A mix of optimistic worth actions and extra Funds Influx might see TRX go up, primarily if it exceeded $0.30.

In consequence, the migration highlighted the rise in demand for stablecoins and machines that enhance threat, and Tron benefited by internet hosting extra USDT.