Solana (SOL) Price Falls Below $100

The Solana (SOL) worth has regularly fallen since reaching a excessive of $126 on December 15, 2023.

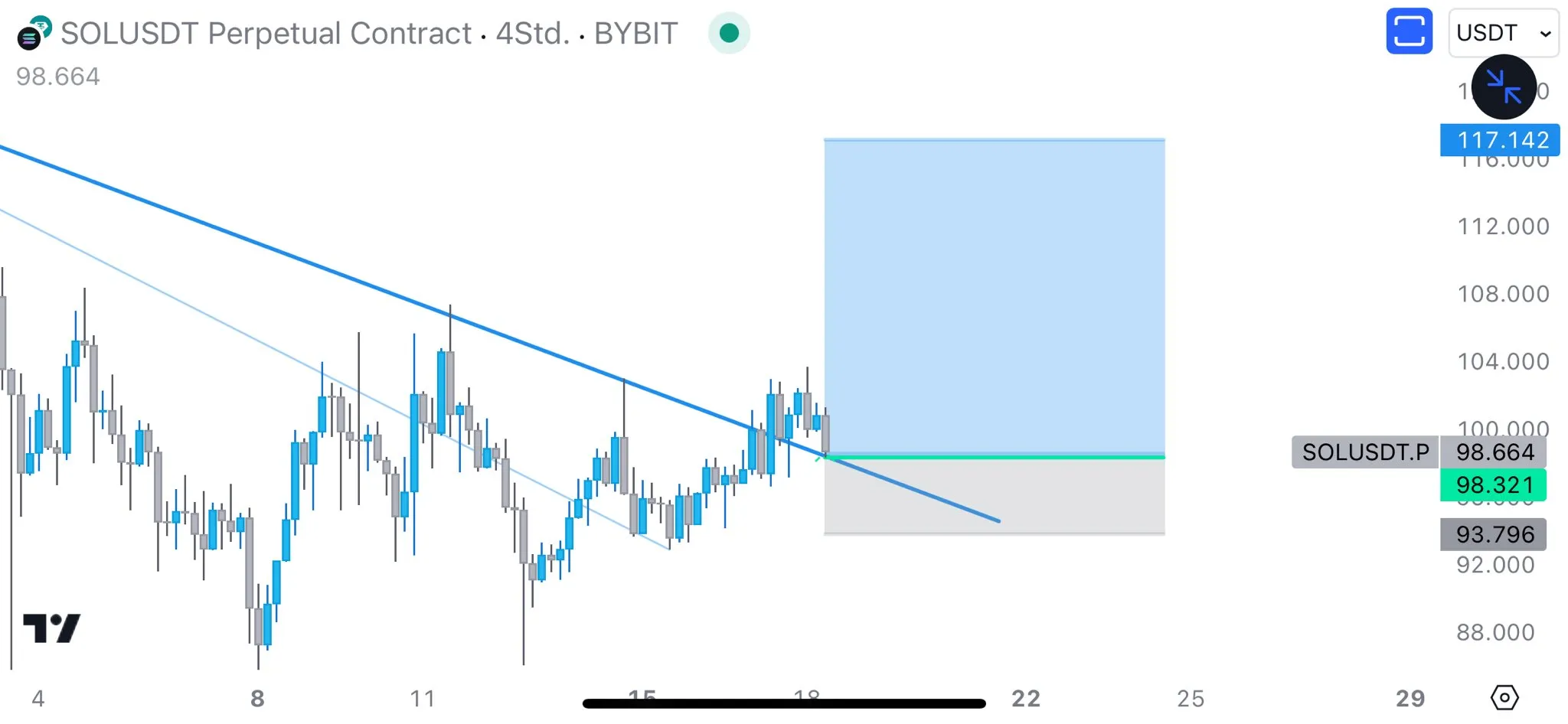

SOL broke out from a descending resistance pattern line right now however nonetheless trades inside a symmetrical triangle sample.

Solana Makes an attempt to Cease Bleeding

The technical evaluation of the day by day time-frame reveals that the SOL worth has elevated alongside a steep ascending assist pattern line since October 2023. The upward motion culminated with a excessive of $126 in December.

The value has fallen since, creating a number of lengthy higher wicks (crimson icons).

Regardless of the lower, the Solana worth bounced on the ascending assist pattern line and trades above it. To this point, the pattern line has existed for 95 days.

The day by day RSI leans bearish. The RSI is a momentum indicator merchants use to judge whether or not a market is overbought or oversold and whether or not to build up or promote an asset.

Readings above 50 and an upward pattern counsel that bulls nonetheless have a bonus, whereas readings under 50 point out the alternative.

The indicator generated a bearish divergence (inexperienced) earlier than the drop. A bearish divergence happens when a momentum lower accompanies a worth improve. It typically results in bearish pattern reversals. The RSI has fallen since and trades proper at 50.

Learn Extra: The right way to Purchase Solana (SOL) and Every little thing You Want To Know

What do Analysts Say?

Cryptocurrency merchants and analysts on X have a blended view of the long run pattern.

MuroCrypto is bullish. He tweeted a breakout and retest, predicting that the value would improve.

Altcoin Sherpa believes the Solana worth will fall, tweeting:

$SOL: nonetheless pondering this one goes decrease total however I’m going to simply maintain my bag for a bit. Bullish on this in 2024

Nonetheless, Bluntz Capital is also bullish, noting the identical breakout and retest as Muro Crypto as to why SOL will improve.

Learn Extra: What’s Solana (SOL)?

SOL Worth Prediction: What to Make of the Worth Motion?

A more in-depth have a look at the six-hour time-frame doesn’t assist decide the course of the SOL pattern because the worth motion reveals blended indicators.

On the bullish aspect, the value motion reveals a breakout from a descending resistance pattern line and its validation as assist.

Nonetheless, a short-term symmetrical triangle can be in place (dashed). The triangle typically acts as a continuation sample. Because it transpires after a downward motion, it’s going to doubtless result in a breakdown.

Moreover, the potential of a SOL worth breakdown aligns with the wave rely.

Technical analysts make the most of the Elliott Wave concept to determine the pattern’s course by learning recurring long-term worth patterns and investor psychology.

The most probably wave rely means that the triangle is a part of the B wave in an A-B-C corrective construction (white). Giving waves A:C a 1:0.618 ratio will result in a low close to $78.

That is near the primary horizontal assist space at $75. An analogous goal is given by projecting the triangle’s size to the breakdown degree. A lower of 25% is required to achieve it.

Regardless of the bearish SOL worth prediction, a breakout from the triangle will imply the native backside is in. Then, SOL can improve 18% to the subsequent resistance at $117.

For BeInCrypto’s newest crypto market evaluation, click on right here.

Disclaimer

According to the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.