Altcoin dominance at 9%, drops 15% in 30 days: What now?

- Altcoin dominance has declined by 15% within the final month.

- The demand for ETH remained considerably low, placing the altcoin susceptible to an extra worth decline.

Altcoin dominance has cratered by double digits within the final month. At 9.88% at press time, it has fallen by 15% up to now 30 days, in accordance with TradingView.

Altcoin dominance refers back to the relative market share of all cryptocurrencies, excluding Bitcoin [BTC]. Its decline signifies that the full market capitalization held by altcoins was reducing in comparison with BTC.

This can be as a result of traders are shifting their funds from altcoins to BTC, which they understand as a safer and extra secure funding asset.

Altcoin dominance waning?

In occasions of market consolidation like this, altcoin dominance could decline whereas Bitcoin dominance will increase, as altcoins lose worth or fail to draw traders.

Nevertheless, BTC’s dominance has but to report any vital development inside the one month thought-about. As of this writing, its worth was 55.36%, declining by 1.03% within the final month and 0.69% within the final seven days.

AMBCrypto reported earlier that this gradual decline in BTC dominance is as a result of robust resistance the coin faces on the $70,000 worth stage.

ETH stays susceptible to decline

At press time, Ethereum [ETH] traded at $3,561. In keeping with CoinMarketCap, the altcoin’s worth has surged by 14% up to now 30 days, regardless of the overall decline in altcoin dominance within the crypto market.

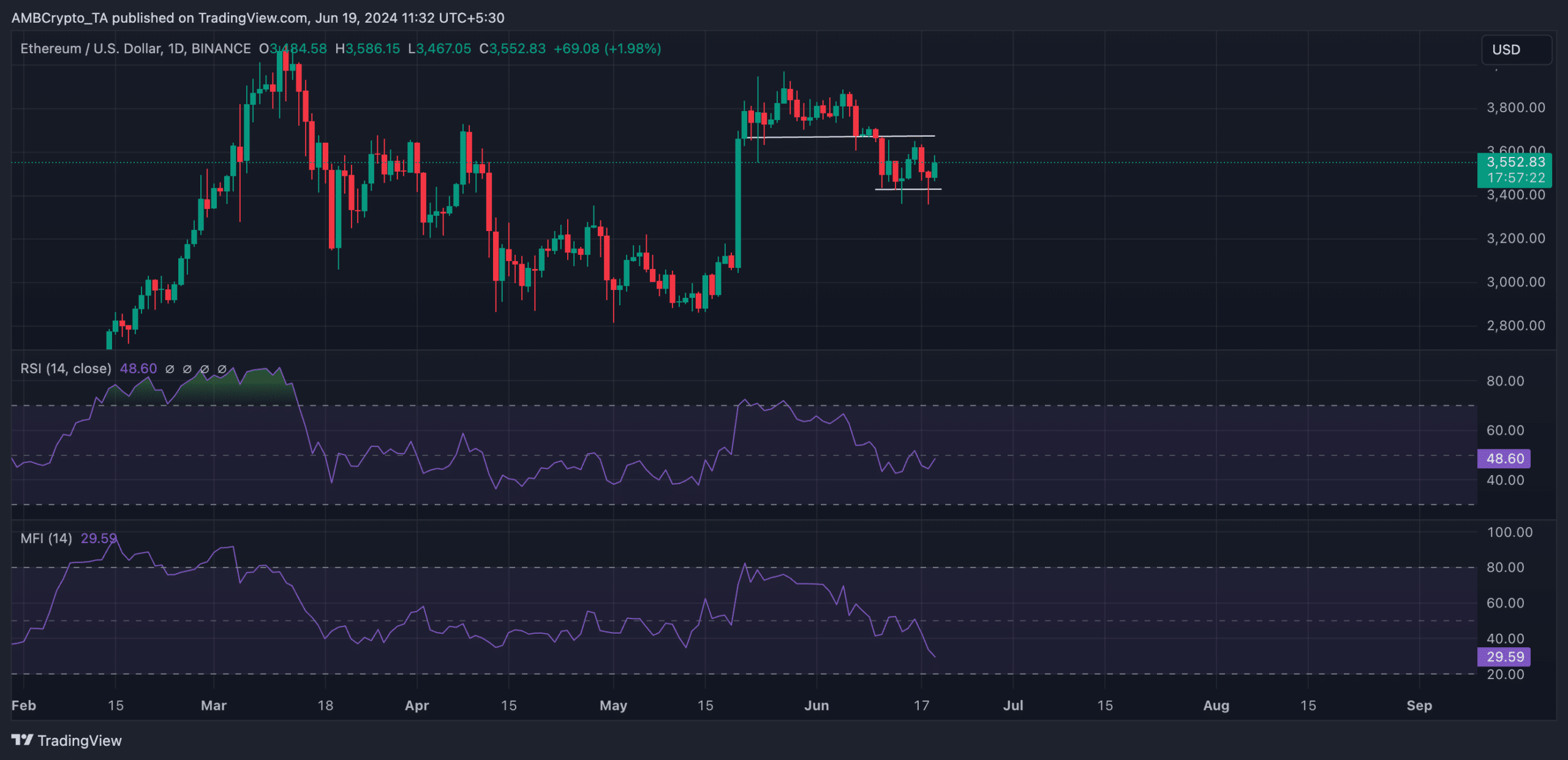

An evaluation of the coin’s efficiency on a each day chart revealed that it broke under the help stage of $3693 on 10 June and has since flipped it into resistance.

Though it has managed a mere 1% worth hike within the final week, ETH’s worth has since oscillated inside a spread, with new resistance shaped on the $3693 worth stage and help discovered at $3428.

Confirming the overall decline for ETH amongst market individuals, its key momentum indicators have been positioned under their respective middle traces on the time of writing.

For instance, ETH’s Relative Energy Index (RSI) was 48.60, whereas its Cash Movement Index (MFI) was 29.59.

Supply: TradingView

These indicators measure oversold and overbought market circumstances by monitoring an asset’s worth modifications.

At their values as of this writing, they prompt that promoting strain was considerably increased than shopping for exercise.

Learn Ethereum’s [ETH] Value Prediction 2024-2025

If the decline continues, ETH dangers falling to $3496.

Supply: TradingView

Nevertheless, if invalidated, its worth would possibly rally towards $3658.