Altcoin season index: Will Bitcoin’s dominance slow the alt rally?

- The altcoin sector sell-off pushed the funding charges to wholesome ranges for a rebound.

- However BTC dominance strengthening was a danger issue for the continued rally.

After a exceptional rally, the altcoin sector noticed its first main shake-out because the US elections.

With the huge sell-offs prior to now two days, unnerved buyers are elevating key questions like – Is the altcoin season momentum sustainable?

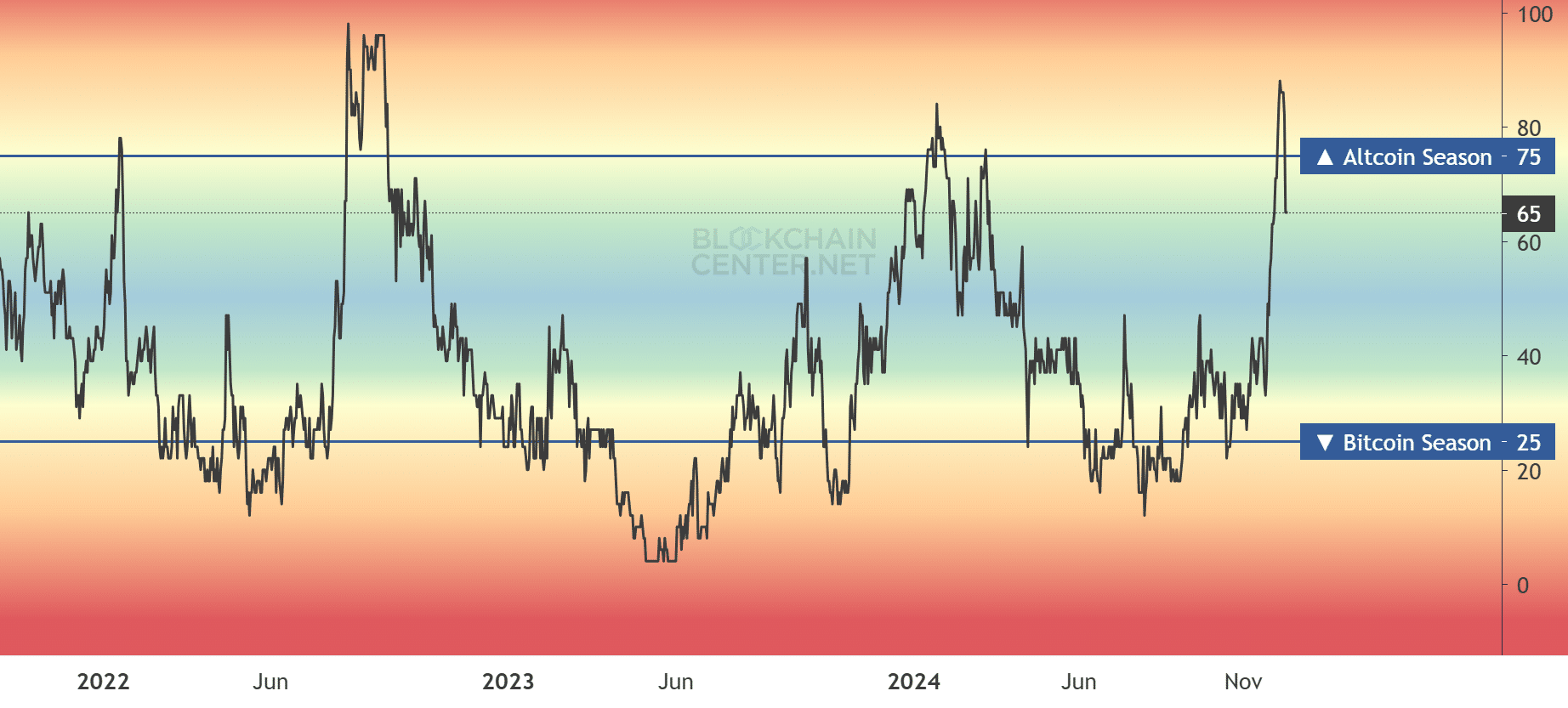

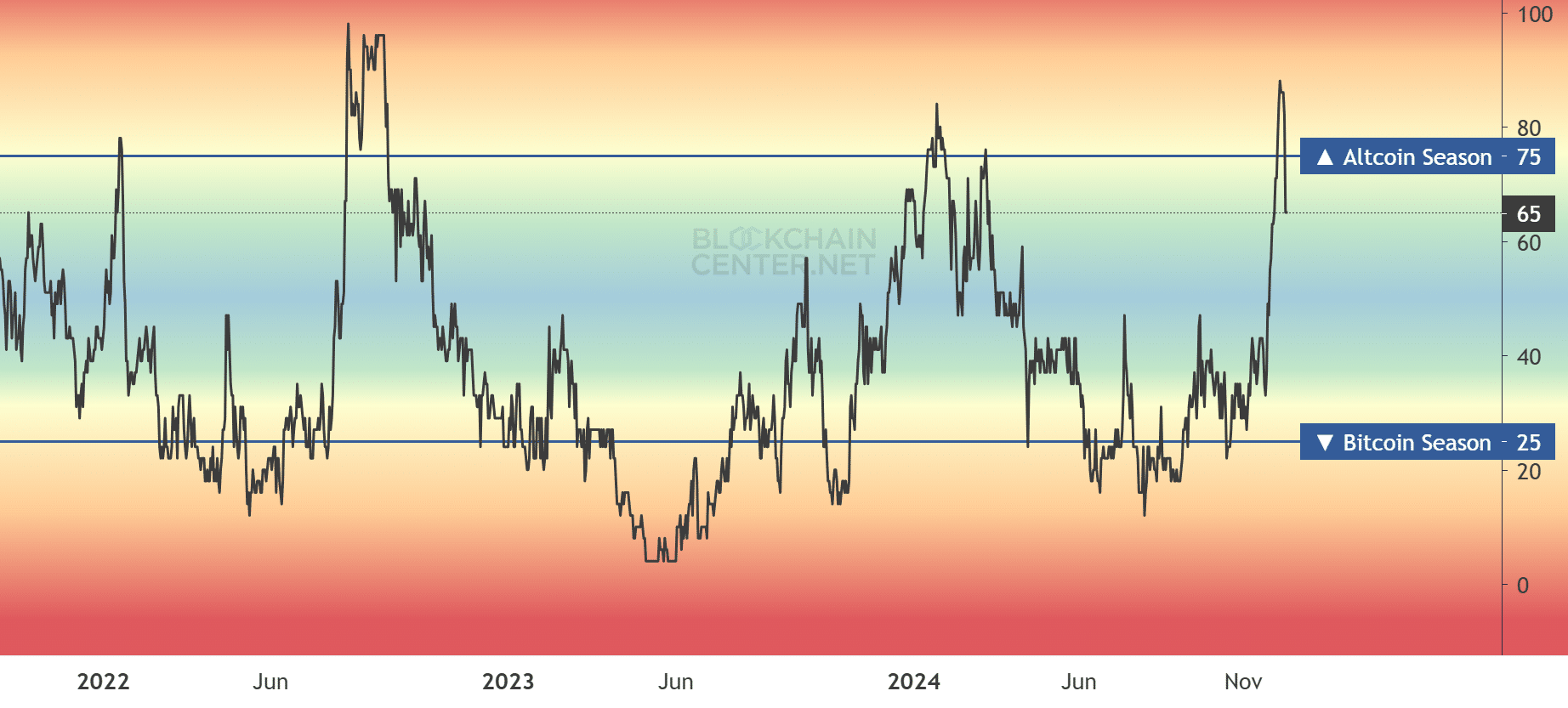

Over the identical interval, the altcoin season index declined from 88 to 65, indicating the alt season momentum slowed.

Supply: Blockchain middle

What’s subsequent for altcoins?

The sell-off and ensuing liquidation wasn’t stunning given final week’s overheated market, as funding charges hit a 9-month excessive.

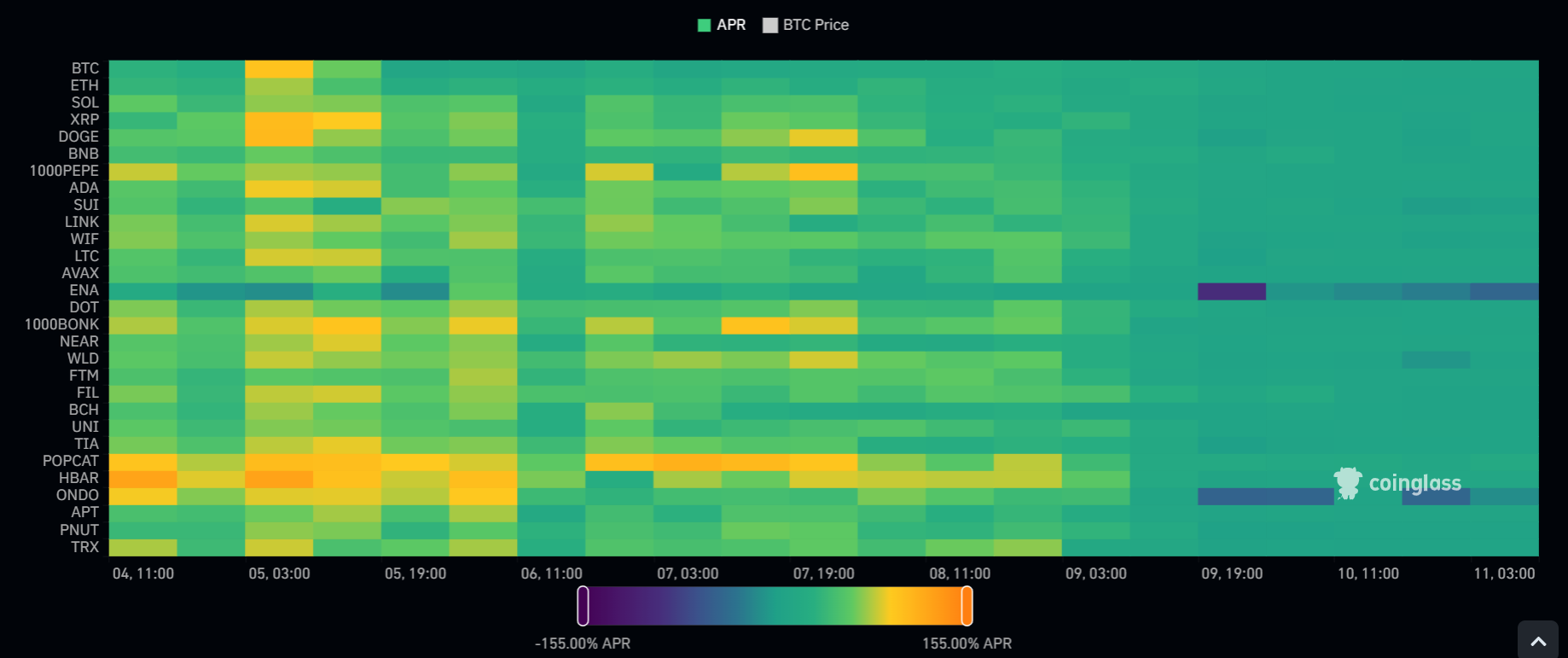

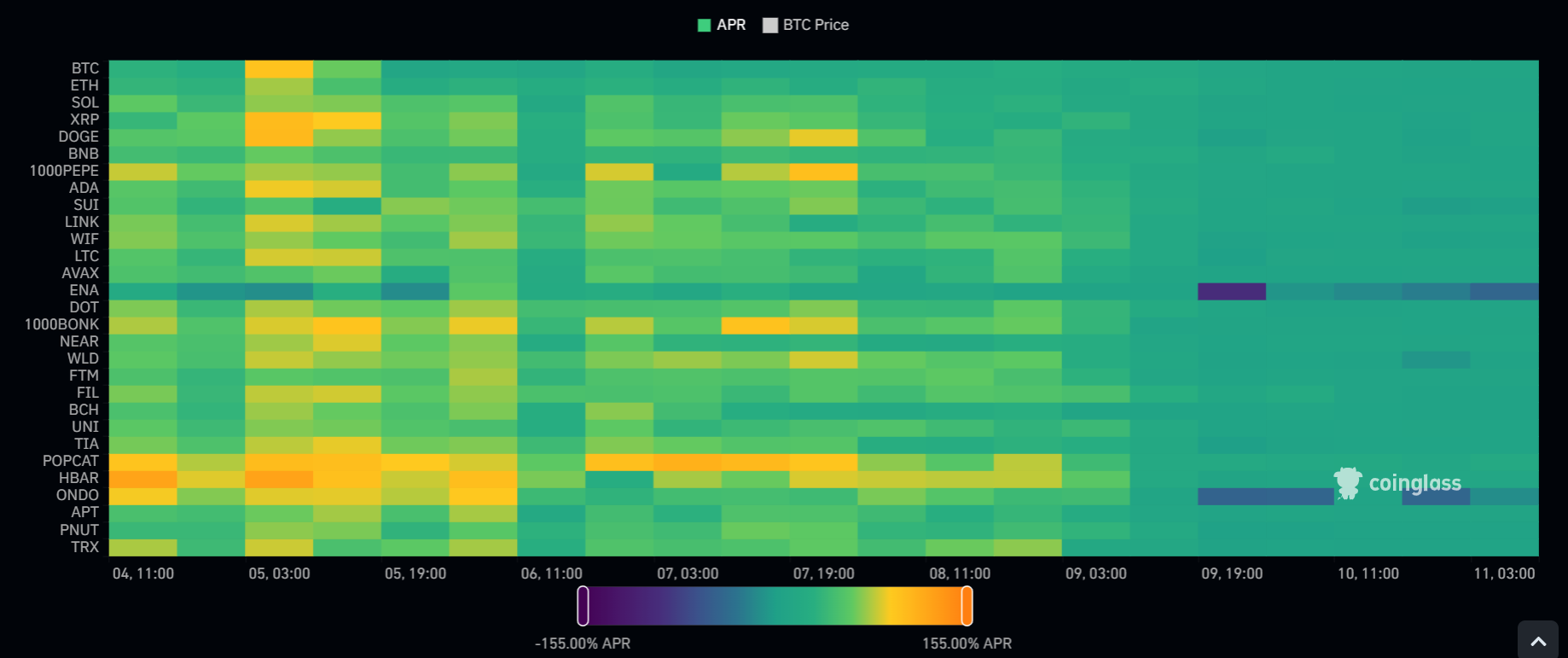

However the shake-out had reset the altcoins funding charges; a situation analysts believed was nice for a possible rebound.

Supply: Coinglass

In contrast to final week’s funding charges, which spiked to double digits (orange ranges), the speed has slipped under 10% prior to now two days. This meant leverage (utilizing borrowed funds) to wager on altcoins decreased considerably, which is a typical bullish setup.

Regardless of the potential catalyst from wholesome funding charges, Bitcoin [BTC] Dominance (BTC.D), one other key think about altcoin momentum, might be a caveat.

The explosive altcoin season of current weeks was partly pushed by a decline in BTC.D from over 60% to under 55%.

As of this writing, BTC.D has climbed above 55%. This implies buyers opted for BTC as an alternative of altcoins throughout the current huge alt sell-off.

Supply: X

Reacting to the event, analyst Benjamin Cowen noted that altcoins had been wonderful until the BTC.D climbed again to its compression vary. Briefly, continued strengthening of BTC dominance might stall the altcoin rally.

That stated, Ethereum [ETH], one other barometer of the altcoin well being, defended the $3.5K assist as analysts stay hopeful {that a} sturdy rebound was possible. If that’s the case, the altcoin season might see renewed momentum.

Learn Ethereum [ETH] Value Prediction 2024-2024

Within the meantime, some prime performers within the sectors, corresponding to Hedera [HBAR] and Ripple [XRP], had been down double digits on the weekly charts.

HBAR was down 13% to $0.28, whereas XRP shed 12% and briefly slipped under $2. Tron [TRX] was the toughest hit, with a 30% drop over the identical interval.