Analyst Explains What Could Trigger Crash To $1,800

Este artículo también está disponible en español.

An analyst has defined how dropping this on-chain demand zone may trigger Ethereum to witness a crash to as little as $1,800.

Ethereum Is At present Retesting A Main On-Chain Help Zone

In a brand new post on X, analyst Ali Martinez has mentioned about how Ethereum is trying like when it comes to investor value foundation distribution proper now, citing knowledge from the market intelligence platform IntoTheBlock.

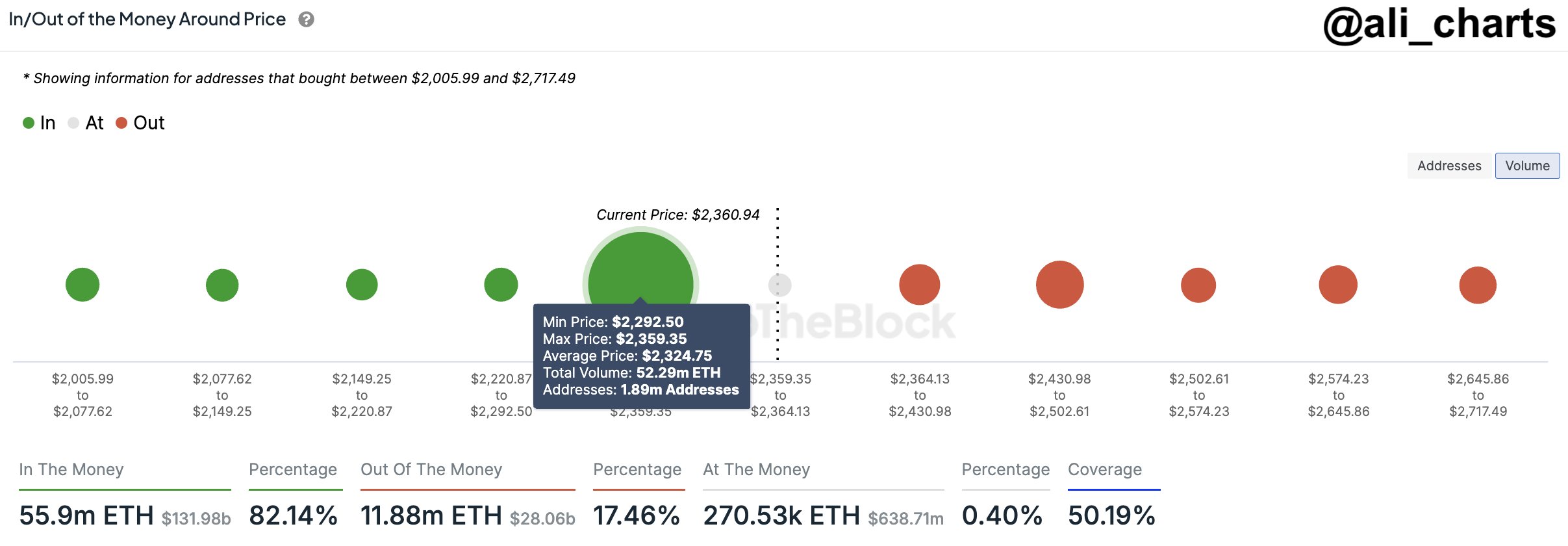

Within the above chart, the dots symbolize the quantity of ETH that was final bought by buyers or addresses contained in the corresponding worth vary. As is seen, the $2,292 to $2,359 vary stands out when it comes to the scale of its dot, suggesting that some heavy shopping for had occurred between these ranges.

Associated Studying

Extra particularly, nearly 52.3 million ETH was acquired by 1.9 million addresses inside this vary. Since Ethereum is presently retesting the vary, all these buyers could be simply breaking-even on their funding.

To any investor, their value foundation is of course an necessary degree and thus, they could be extra susceptible to creating some form of transfer when a retest of it occurs. For ranges that host the acquisition degree of solely a small quantity of holders, although, any response ensuing from a retest isn’t something too related for the broader market.

Within the case of worth ranges which are large demand zones, nevertheless, a retest could cause seen fluctuations within the asset’s worth. The aforementioned Ethereum vary naturally belongs to this class.

As for a way precisely a retest of a big demand zone would have an effect on the cryptocurrency, the reply lies in investor psychology. Retests that happen from above, that’s, of buyers who have been in revenue simply earlier than the retest, usually produce a shopping for response out there.

It is because these holders might imagine the asset will go up once more sooner or later, so getting to purchase extra at their value foundation can appear as if a worthwhile alternative. As Ethereum is presently retesting the $2,292 to $2,359 vary, it’s potential it could really feel help and discover a rebound.

Within the state of affairs {that a} break beneath it takes place, nevertheless, the cryptocurrency’s worth could also be at risk. From the chart, it’s obvious that the ranges under this demand zone solely carry the price foundation of a small quantity of buyers, so they could not be capable of stop an additional decline within the asset.

Associated Studying

“If this demand zone breaks, we may see a sell-off driving ETH towards $1,800,” notes the analyst. A drawdown to this degree from the present worth would imply a crash of greater than 21% for the coin.

It now stays to be seen how the Ethereum worth will develop within the coming days and if the on-chain help zone will maintain.

ETH Value

After retracing its restoration from the previous few days, Ethereum is again at $2,300, which is contained in the aforementioned worth vary.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com