Ethereum Prognose: Vorübergehende Schwäche und Chance?

Ethereum zählt nicht umsonst zu den wichtigsten Kryptowährungen der Welt. Die aktuelle Nummer 2 der Kryptowelt punktet vorwiegend mit seinen Anwendungen für ein dezentralisiertes Finanzwesen.

Hier stehen die sogenannten „Good Contracts“ im Mittelpunkt des Interesses der Wirtschaft. Die „automatisierten“ Verträge benötigen keine zentrale Instanz mehr und schließen Banken zunehmend aus dem Finanzkreislauf aus.

Kurskorrektur vor dem nächsten Aufschwung

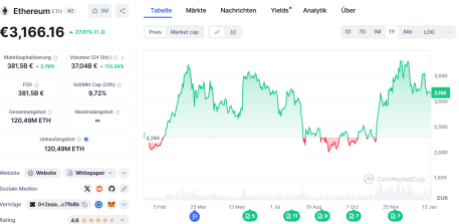

Angesichts dieser Innovation ist es nicht verwunderlich, dass das Ethereum-Netzwerk als zukunftssicher gilt. Trotzdem musste dessen Kryptowährung Ether zuletzt einen Einbruch von rund 10 Prozent hinnehmen. Jetzt befürchten die Anleger einen weiteren Kursrutsch.

Angesichts der bevorstehenden Amtsübernahme von Donald Trump in den USA hatten viele Investoren gehofft, dass es ab sofort nur noch bergauf gehen würde. Doch der Backlash kam, wie erwartet, schließlich gehören Korrekturen zur hohen Volatilität bei Kryptos.

Zusätzlich sorgte ein Ethereum-Wal für Unruhe, er schien die Geduld verloren zu haben und trennte sich von einem Teil seiner Positionen und nahm damit sogar Verluste in Kauf. Das ist erstaunlich, schließlich scheint die Krypto-Zukunft zumindest auf dem Papier rosig zu sein.

Kursgewinne vorweggenommen

Ethereum kann schließlich, genau wie Bitcoin, auf die ersten zugelassenen Spot-ETFs verweisen, die für eine stärkere Durchdringung der Märkte mit Ether sorgen sollten. Der ehemals unerbittliche Gegner Gary Gensler, seines Zeichens Chef der amerikanischen Wertpapierbehörde SEC, ist zurückgetreten und Donald Trump will alles unternehmen, um Krypto in den USA zu stärken.

Trotzdem zeigt Ethereum Schwäche und ist von seinem Allzeithoch weit entfernt. Mit der Zulassung des ersten ETH-Spot-ETFs stieg der Kurs zwar kurzfristig über die 4.000-Greenback-Marke, doch seither ging es bergab.

Lediglich vor einer Woche erlebte Ethereum wieder einen Aufstieg, der jedoch nur von kurzer Dauer struggle. Doch diese Entwicklung struggle auch bei der Zulassung der ersten Bitcoin-Spot-ETFs zu beobachten.

Die Märkte hatten die erhofften Kurssteigerungen schon zuvor vorweggenommen und benötigten einige Zeit, um die weiteren Entwicklungen zu analysieren und darauf zu reagieren. Das wird bei Ethereum offenbar nicht anders sein.

Neuer Schub nach Amtseinführung von Trump?

Die Geschichte von Ethereum zeigt jedenfalls, dass sich ETH im Januar eines Jahres zumeist als bullish erweist. Angesichts dieser Historie käme es nicht überraschend, wenn der Coin in den nächsten zwei Wochen wieder zulegen würde.

Zahlreiche Analysten zeigen sich jedenfalls optimistisch, dass mit der Inkraftsetzung der ersten Deregulierungsmaßnahmen der neuen US-Regierung der Kryptomarkt und damit auch Ethereum wieder deutliche Kursgewinne einfahren werden.

Various Solaxy

Wer als Investor hingegen eine Various zu Ethereum sucht, der könnte einen Blick auf den neuen Meme-Coin Solaxy ($SOLX) werfen. Dieser absolviert derzeit seinen Presale auf Ethereum, bildet jedoch aufgrund seiner technischen Ausgestaltung eine Brücke zur Blockchain von Solana.

Dort nutzt er als Multi-Chain-Coin günstige Kosten und Geschwindigkeit, um das Beste aus beiden Welten für sich zu generieren. 10 Millionen Euro sind innerhalb kürzester Zeit in das neue Projekt geflossen, das beweist, dass die Anleger an die Idee von Solaxy glauben.

Mit einem Preis von nur 0,0016 Greenback für 1 Solaxy ($SOLX) ist der Token noch preiswert, das könnte sich dramatisch ändern, wenn der Coin erst einmal auf einer der Kryptobörsen zum Kauf gelistet wird.

Alle Informationen zu Solaxy ($SOLX) finden sich auf den entsprechenden Seiten von X und Telegram.