Analysts divided: Will Ethereum break the $3,400 barrier soon?

- A outstanding crypto analyst recommended that ETH may get away of a bullish sample, doubtlessly triggering a big value surge.

- On-chain metrics inform a special story, with rising investor warning and elevated promoting exercise casting doubt on a rally.

Over the previous month, Ethereum [ETH] delivered a notable 18.66% acquire, however its upward trajectory has since slowed. Weekly efficiency confirmed a marginal 0.02% enhance, whereas every day positive factors stay modest at 0.20%.

AMBCrypto’s evaluation recommended that ETH is extra prone to face a downturn than obtain the bullish breakout many have hoped for, as market alerts stay largely bearish.

Is Ethereum bullish sufficient to hit $3,400?

In accordance with Carl Runefelt’s chart analysis, ETH is buying and selling beneath a descending resistance sample—a formation that usually alerts an impending value rally.

Primarily based on this sample, ETH may doubtlessly climb to $3,420, the height of the formation, representing an 8.55% acquire from its present place.

Supply: X

Runefelt remarked,

“Ethereum wants to interrupt above this descending resistance to regain bullish momentum.”

Nevertheless, additional evaluation means that market sentiment stays divided in favor of the bears, with no clear consensus supporting a breakout above the resistance stage simply but.

Traders offload ETH, including downward strain on value

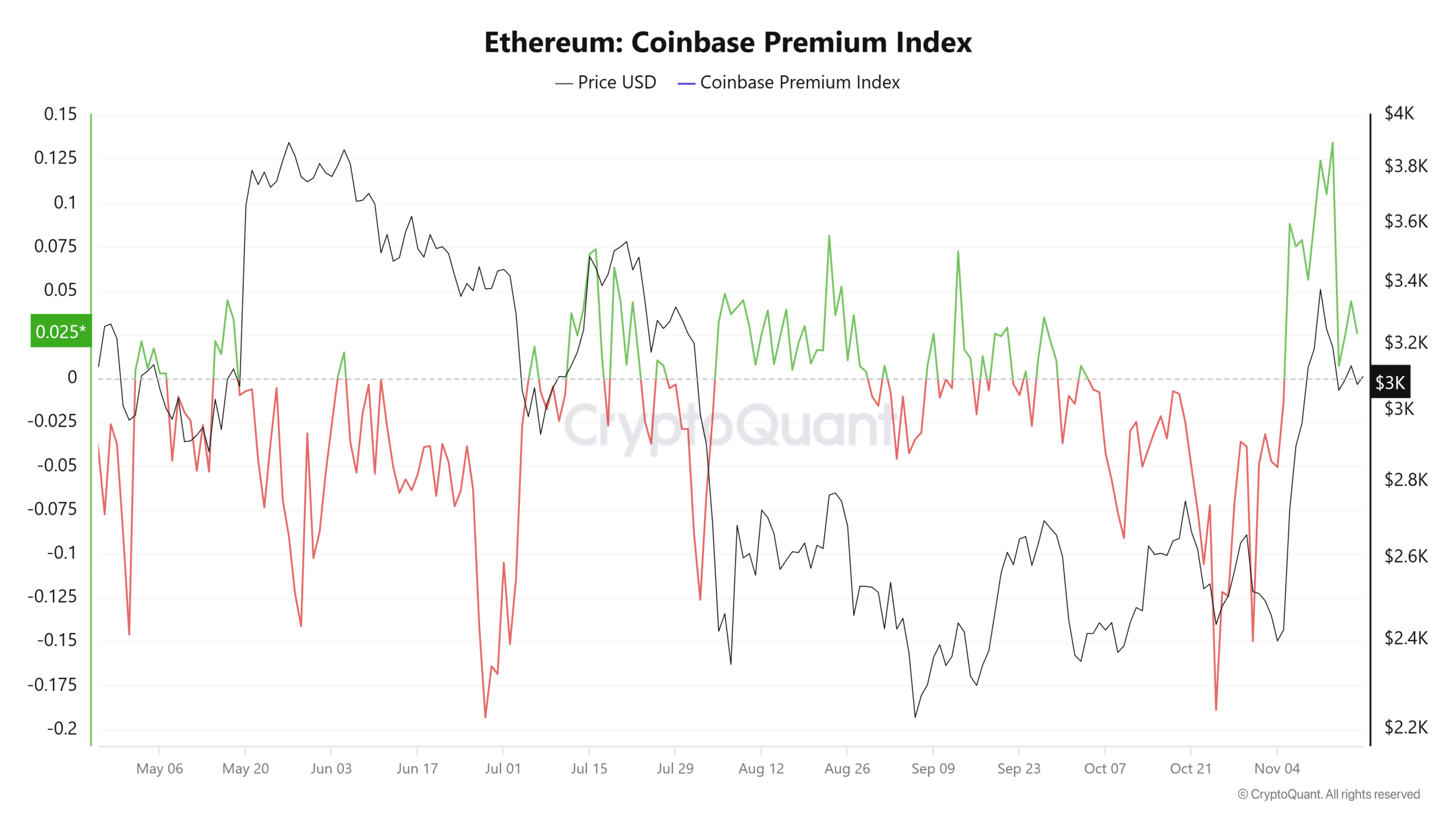

Information from CryptoQuant reveals that U.S. buyers are promoting their ETH holdings, which factors to waning curiosity within the asset and diminishing expectations for a rally.

This development is mirrored within the Coinbase Premium Index, which measures the worth distinction between ETH/USD on Coinbase Professional (a U.S. centric trade) and ETH/USDT on Binance (a globally centered trade).

The index has sharply dropped from 0.1346 in April to 0.0256, which alerts weaker demand for ETH amongst U.S. buyers in comparison with world markets.

Supply: Cryptoquant

The sell-off coincides with a surge in Change Netflow, which measures the motion of ETH throughout exchanges.

Constructive Netflow signifies elevated inflows to exchanges, sometimes for promoting, whereas unfavourable Netflow suggests buyers are shifting belongings to non-public wallets for long-term holding.

ETH’s Change Netflow has remained constructive for 3 consecutive days, with an enormous influx of 28,726.8 ETH previously 24 hours. This promoting strain has negatively impacted ETH’s value trajectory and would proceed in that path with extra constructive Netflow.

Sellers take management as ETH struggles

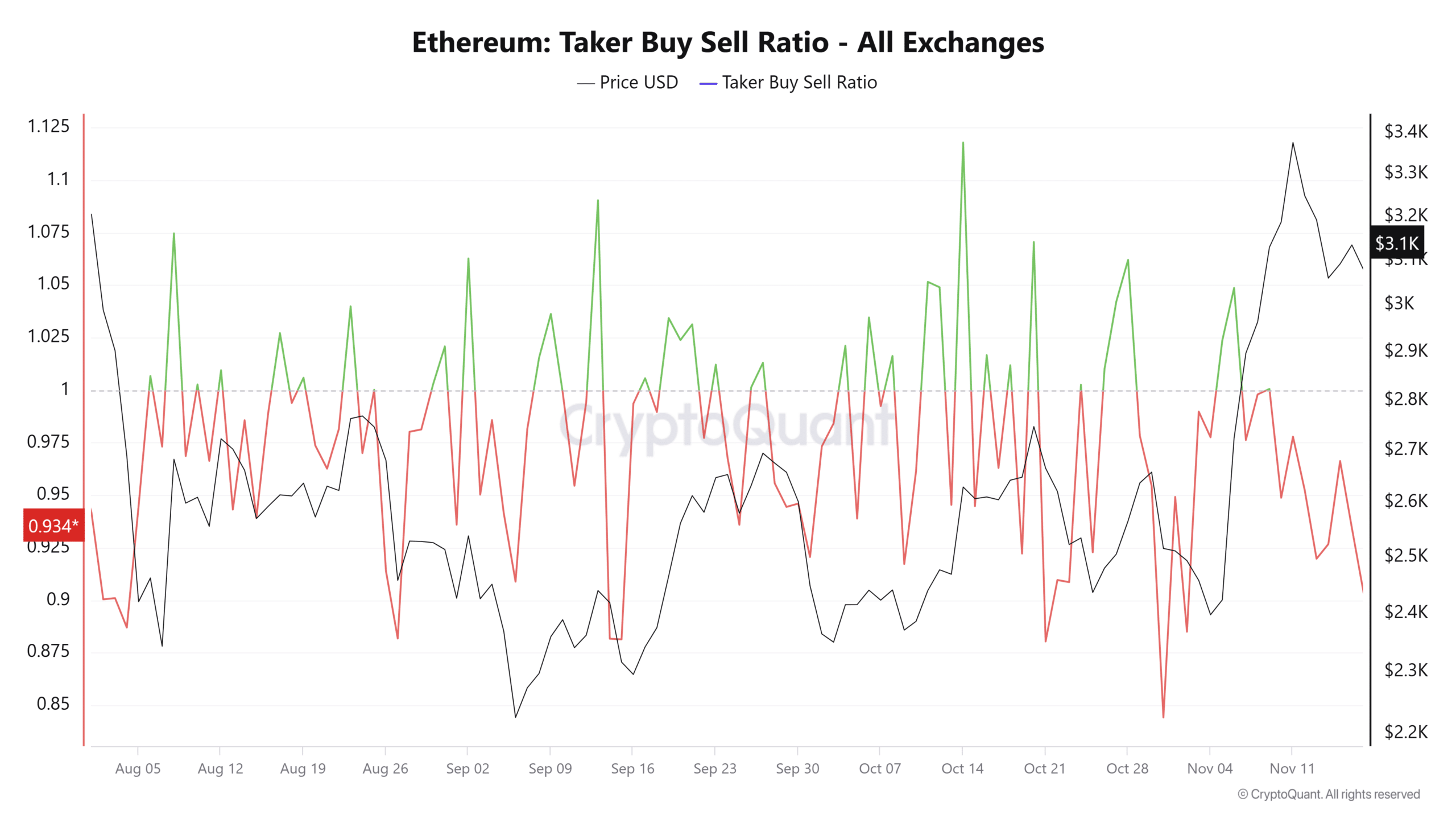

An evaluation of the Taker Purchase/Promote Ratio, a metric used to gauge whether or not consumers (bulls) or sellers (bears) dominate the market, exhibits that sellers presently maintain the higher hand.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

On the time of writing, the ratio sits at 0.9033, beneath the essential threshold of 1. This studying signifies that promoting strain outweighs shopping for exercise, as extra buyers offload their ETH holdings.

Supply: Buying and selling View

If these bearish traits throughout a number of metrics persist, ETH is unlikely to interrupt above its resistance line. As a substitute, this resistance stage may act as a value ceiling, doubtlessly triggering additional declines in ETH’s worth.