Analyzing Bitcoin’s miner reserves, HODLing trends, and market confidence

- Bitcoin’s miner exercise demonstrated a surge in unrealized earnings, indicating bullish optimism

- A number of key bullish alerts may assist dictate how BTC does on the worth charts

Miner exercise is a vital a part of the Bitcoin ecosystem and as such, modifications in its dynamics could supply vital market insights. Bitcoin miner information collected over the previous couple of months could present a tough concept of the prevailing sentiment and stage of confidence.

In reality, a current miner analysis on CryptoQuant revealed that Bitcoin miner flows into exchanges have dipped significantly since April 2024. This statement urged that miners have been holding on to extra BTC within the hopes of promoting it at increased costs.

The identical evaluation revealed that the web unrealized revenue and loss metric was nonetheless optimistic at press time. This appeared to be affirmation that Bitcoin miners are nonetheless sitting on unrealized earnings, therefore not contributing a lot to the promote strain out there.

Are Bitcoin miners nonetheless anticipating earnings?

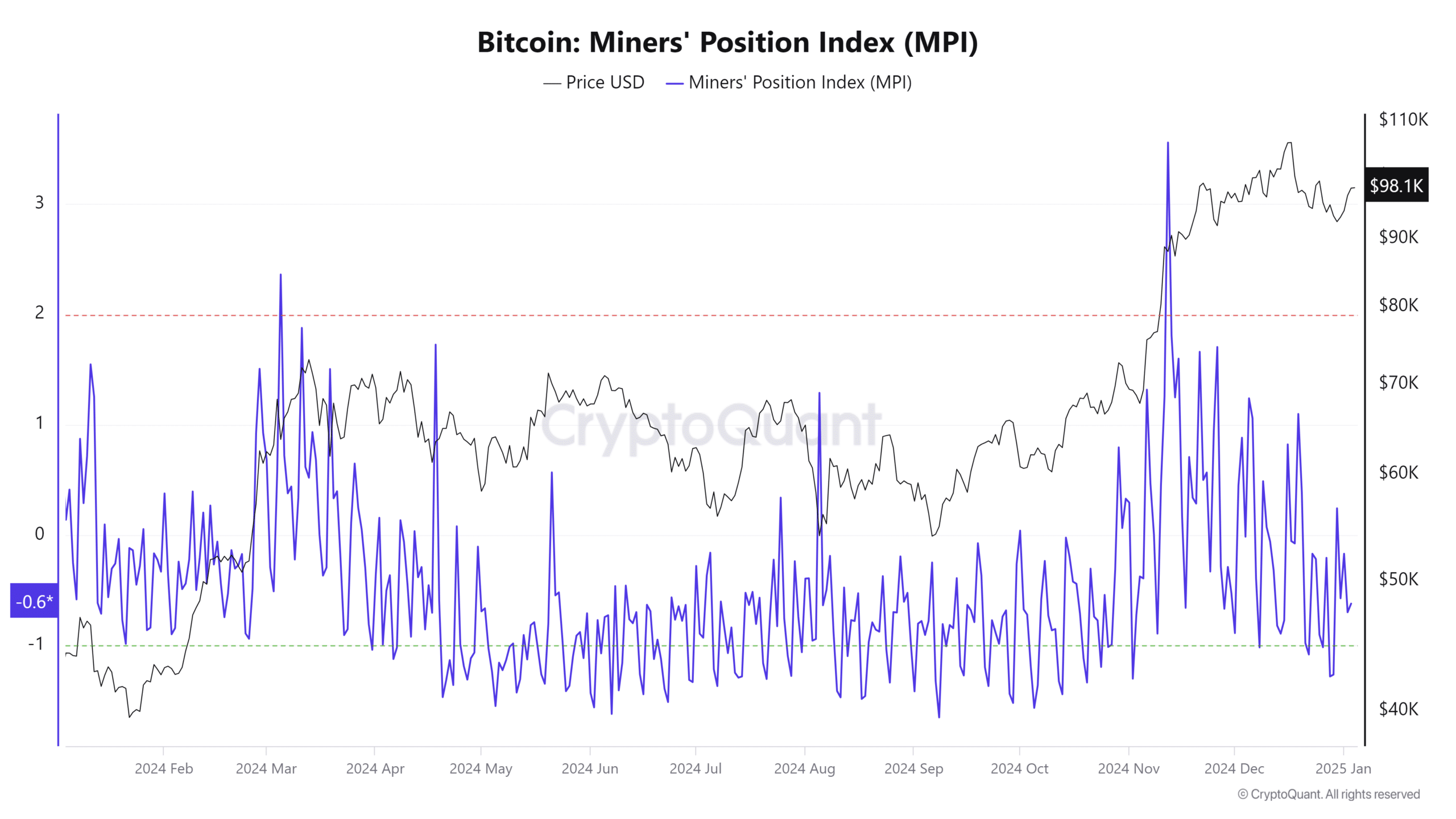

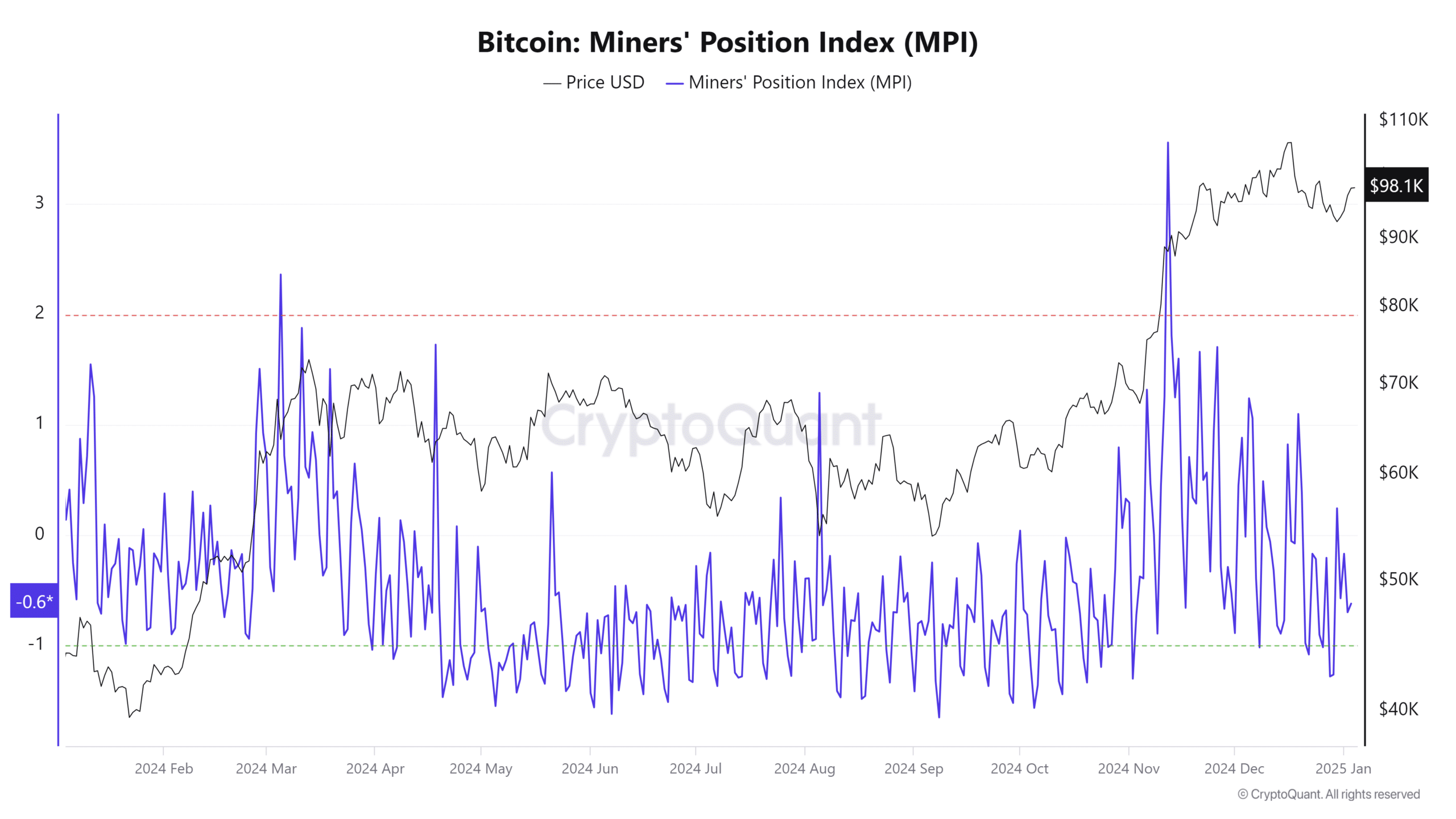

The aforementioned statement appeared to be according to the miner place index (MPI). A excessive MPI signifies that miners are transferring extra BTC, which regularly interprets to extra promote strain.

This indicator’s final peak was on 12 November, only a few weeks earlier than the worth achieved its historic peak.

Supply: CryptoQuant

The MPI peak confirmed robust promote strain from Bitcoin miners. Nonetheless, it has since dipped significantly, and it closed December close to its backside vary – An indication that miner outflows cooled down significantly.

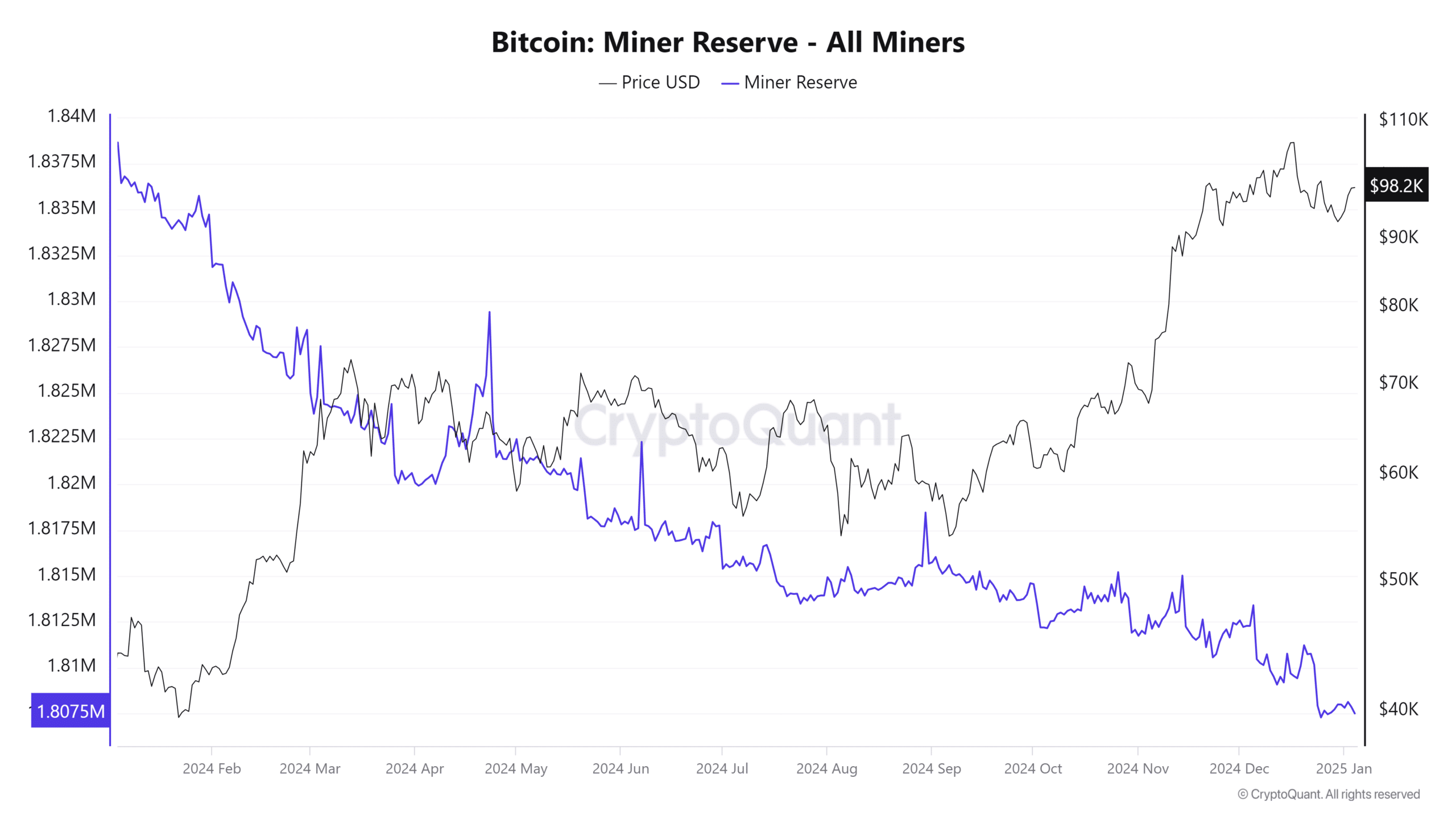

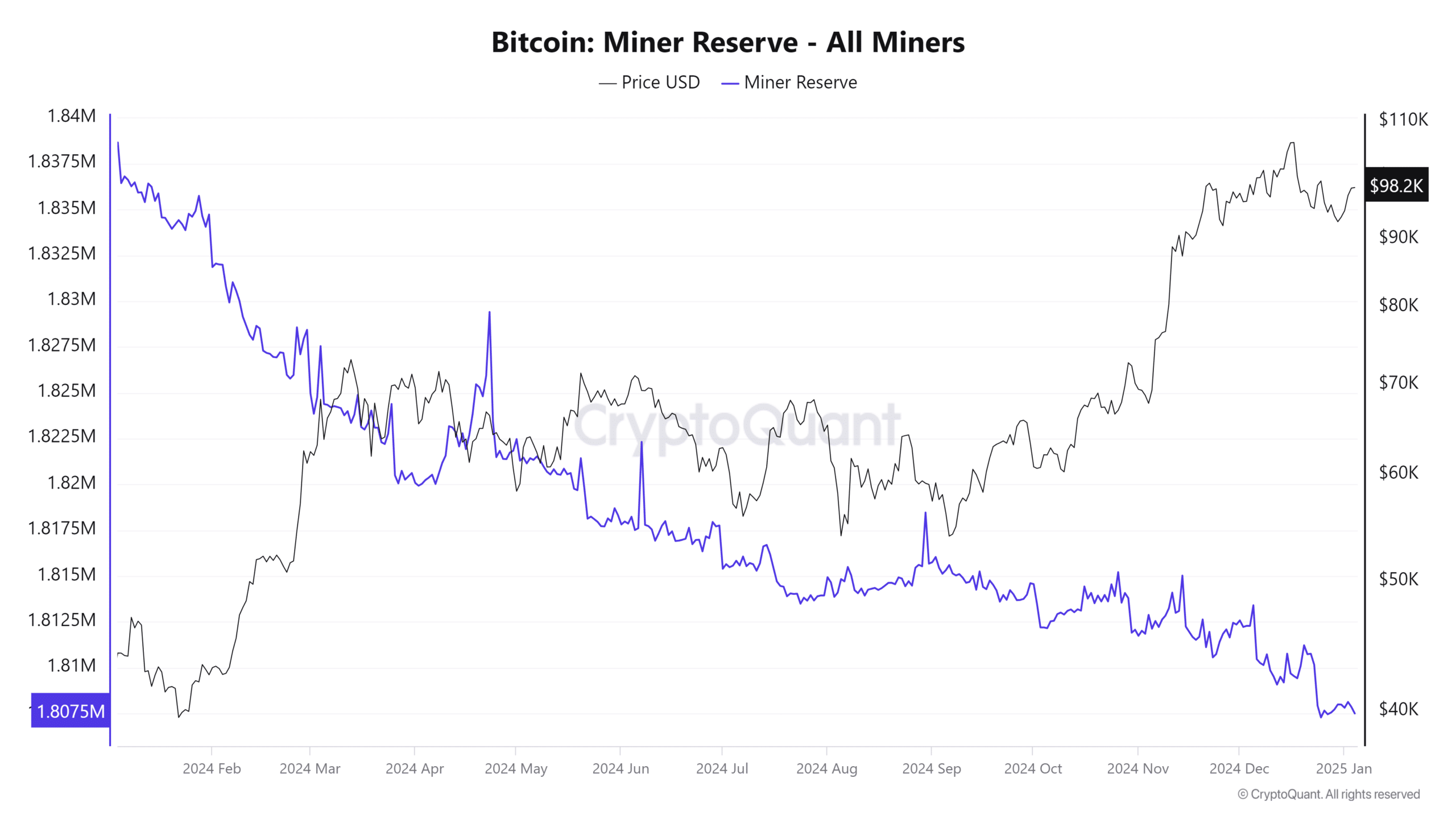

Regardless of this, nonetheless, Bitcoin miner reserves have been declining and hovered near 12-month lows, on the time of statement. For context, there have been barely over 1.838 million in Bitcoin miner reserves in direction of the start of 2024. That determine has since dipped to 1.807 million BTC.

Supply: CryptoQuant

The declining miner reserves confirmed that miners are nonetheless taking some earnings, particularly as the worth soars increased. That is an anticipated consequence since miners nonetheless have to money out a few of their cash to cowl the price of operations.

The MPI confirmed that the speed of promote strain has been declining because the market pulled again. In different phrases, Bitcoin miners could he holding on to a few of their cash in anticipation of upper costs in 2025.

Miner reserve upticks have been happening alongside the best way and the subsequent main uptick may set off one other spike. Right here, it’s value noting that one other key indicator to look out for is institutional demand. ETFs are usually on the forefront of robust demand.

ETF flows have been principally unfavorable within the second half of December and kicked off the primary 2 days of 2025 within the unfavorable. Nonetheless, ETF flows on Friday turned again optimistic with a large $908.1 million acquired. Sustained demand within the coming weeks may probably pave the best way for the worth reclaiming the $100,000 worth stage.