Analyzing MOVE crypto’s rally – Will profit-takers fuel a reversal?

- MOVE crypto has gained by greater than 12% in 24 hours after a surge in shopping for stress.

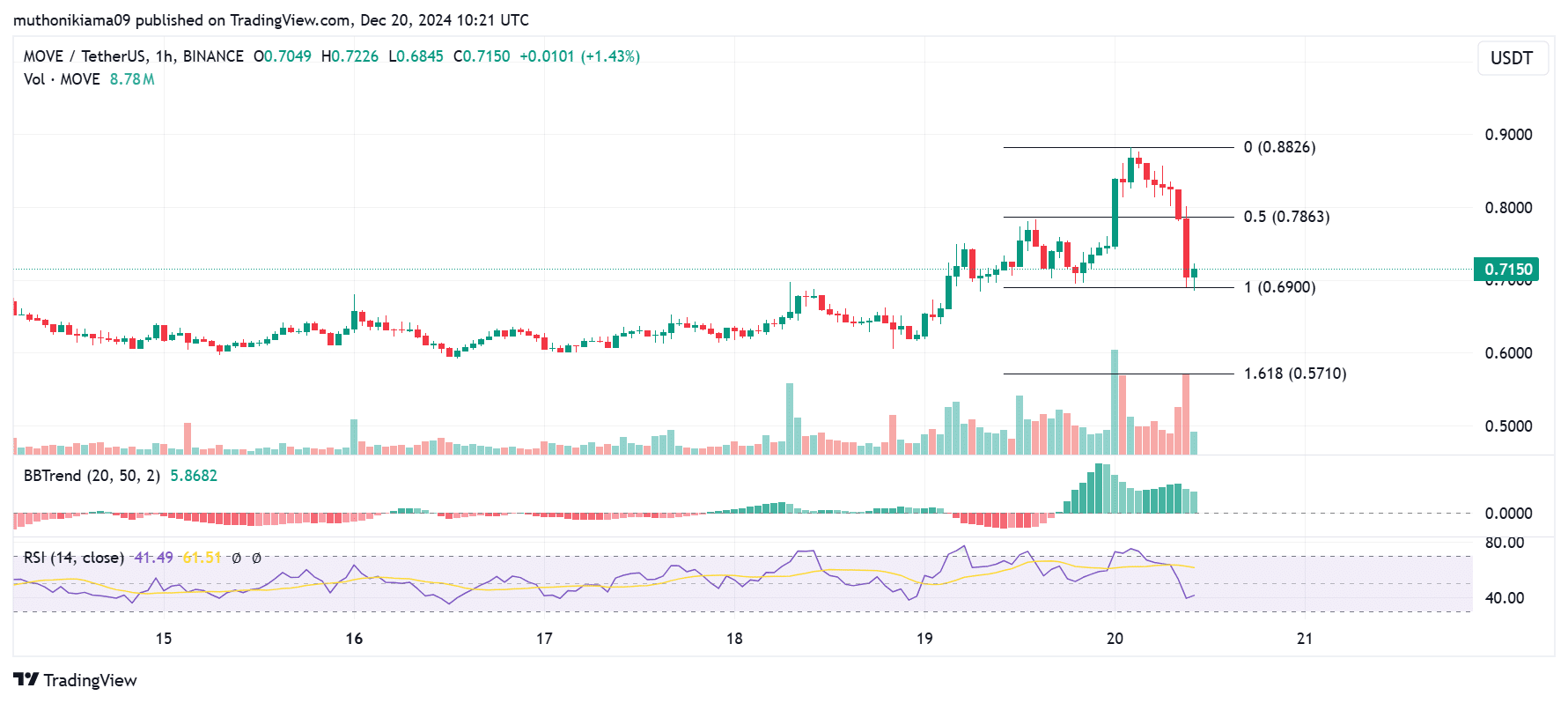

- The dropping RSI on the hourly chart means that merchants who purchased through the rally may be reserving income.

Motion [MOVE] has outperformed the remainder of the broader market after recording an over 12% achieve in 24 hours. At press time, MOVE traded at $0.797 amid a 137% surge in buying and selling volumes per CoinMarketCap.

MOVE’s uptrend has seen its market capitalization surge previous $1.79 billion, and the altcoin now ranks because the 61st largest cryptocurrency by this metric.

One of many components that stirred MOVE’s uptrend was a spike in shopping for exercise as short-term merchants sought to ebook income through the rally. Nevertheless, shopping for volumes seem to have subsided on decrease timeframes, which might set off a downtrend if promoting volumes improve.

The Relative Power Index (RSI) had dropped to 41 at press time, and it was near oversold areas. Whereas this might precede a short-term correction to the upside, it might counsel that the merchants who bought through the uptrend are starting to promote.

Supply: Tradingview

The inexperienced Bollinger Band Development indicator additionally exhibits that bulls have the higher hand regardless of the spike in promoting exercise. If patrons reenter the market, it might push the value again to the important thing resistance stage of $0.882.

However, if the bearish tendencies persist and patrons fail to step in, MOVE might drop to an important assist stage on the 1.618 Fibonacci stage ($0.57).

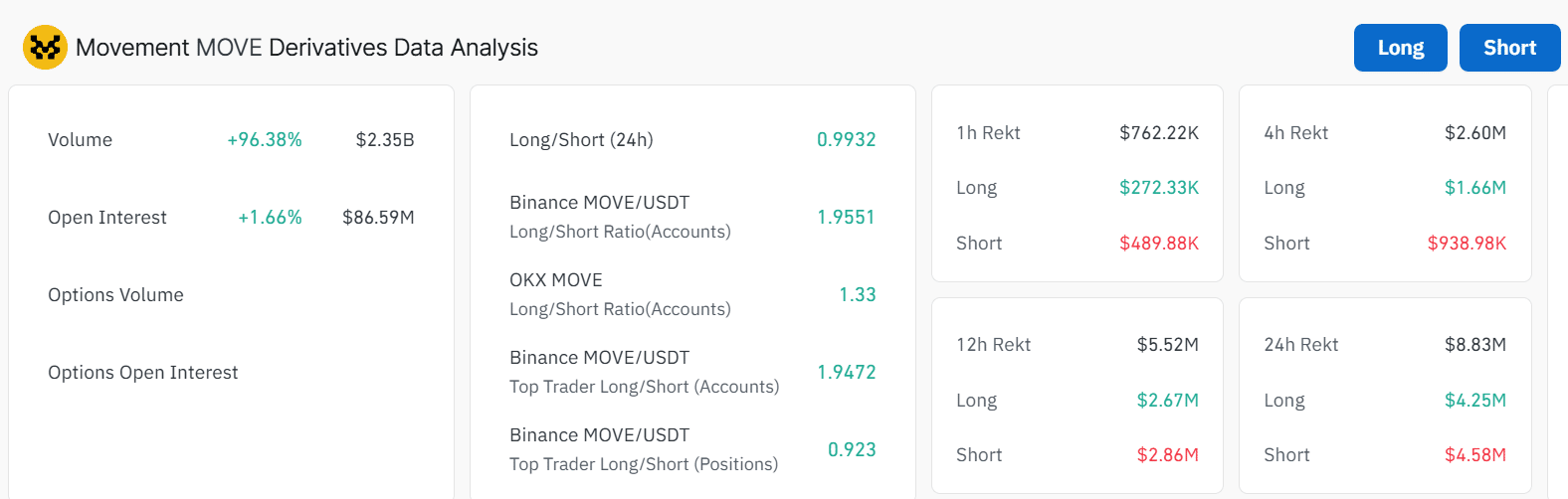

Analyzing derivatives information

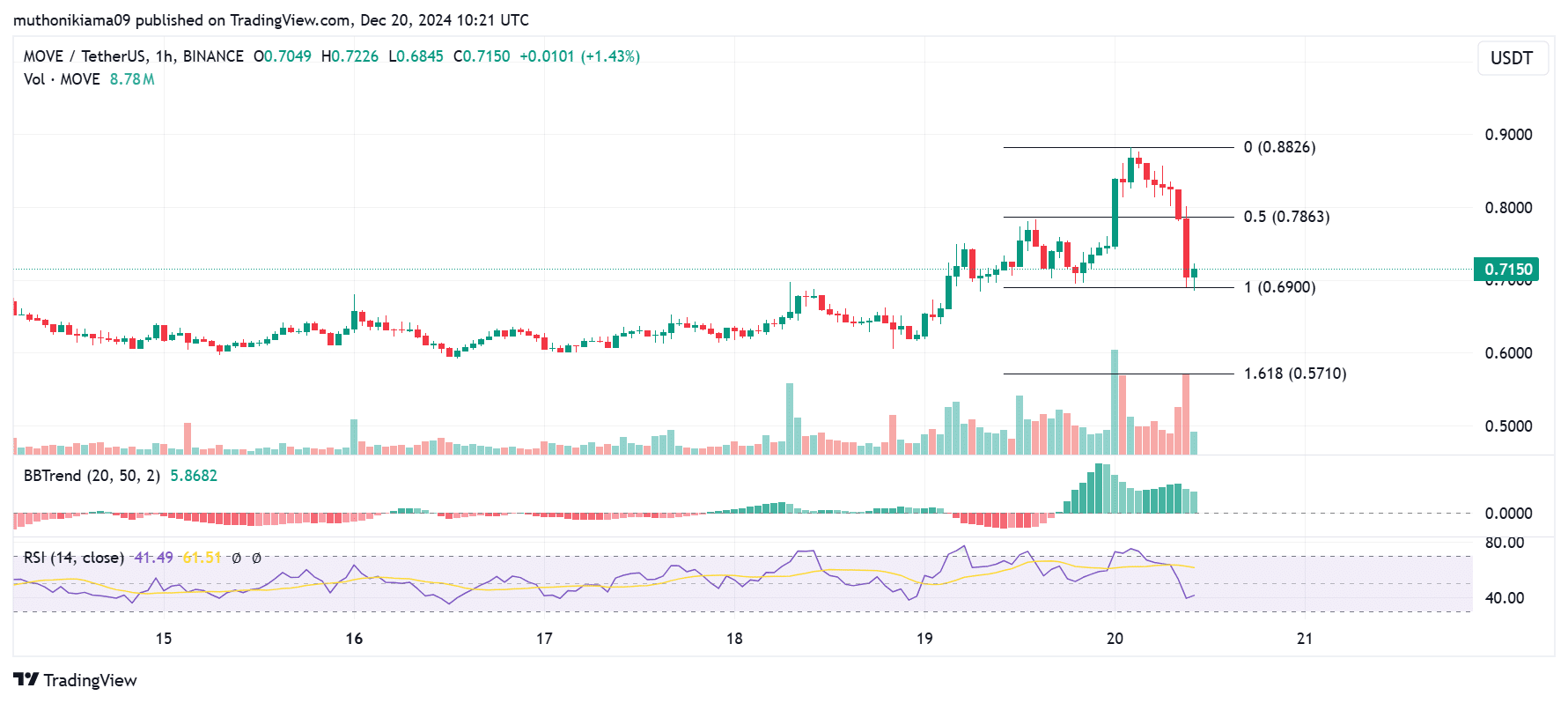

A have a look at derivatives market information for MOVE crypto exhibits a major spike in speculative exercise that might drive volatility.

The token’s open curiosity has elevated to $86 million after a slight 1.6% achieve in 24 hours. On the identical time, volumes throughout the derivatives market have surged by 96% to $2.35 billion.

The unstable value strikes have led to surging liquidations of each lengthy and quick positions, with greater than $8 million being liquidated in 24 hours.

Supply: Coinglass

The lengthy/quick ratio of 0.99 exhibits a impartial market sentiment with quick positions being barely extra. Nevertheless, with this balanced market, there’s a lowered threat of a brief squeeze or an extended squeeze resulting in lowered volatility.

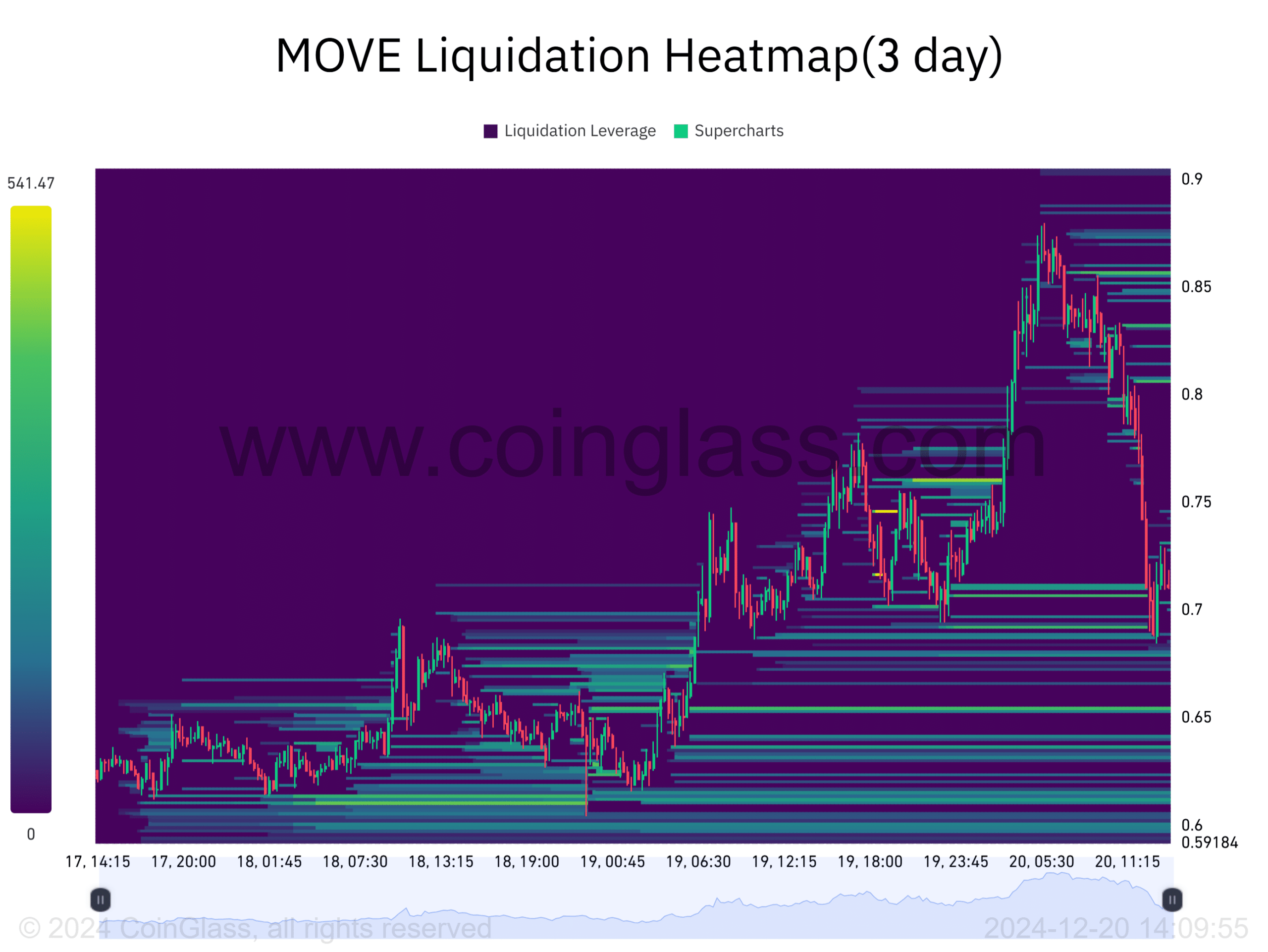

MOVE’s liquidation heatmap exhibits THIS

The liquidation heatmap for MOVE crypto with a 3-day lookback interval exhibits that the uptrend brought on a cascade of quick liquidations. As these positions have been worn out, it accelerated the uptrend as a consequence of compelled shopping for.

Supply: Coinglass

Is your portfolio inexperienced? Test the Motion Revenue Calculator

However, there are liquidation clusters under the value that might push MOVE decrease. The 2 zones that merchants ought to be careful for are $0.65 and $0.67.

If MOVE drops to those ranges, the ensuing closure of lengthy positions might speed up promoting exercise, which can gas the downtrend.