Arbitrum DAO Locks $770 Million In ARB Tokens Into Vesting Contract: Implications For ARB

Arbitrum DAO not too long ago took a step towards addressing an impediment. The DAO has dedicated to locking 700 million ARB tokens, valued at an estimated $770 million, right into a vesting contract to foster clear governance and accountability, per a group proposal.

The approval for this dedication got here from an enchancment proposal launched throughout a contentious interval throughout the Arbitrum ecosystem. The specifics of this dedication contain progressively releasing these funds to the Arbitrum Basis over 4 years.

Particulars Of The Vesting Contract

The brand new initiative, aptly termed AIP 1.1, solves latest disagreements regarding Arbitrum’s inner governance. Earlier this 12 months, the mission was embroiled in controversy on account of a proposal for a ‘particular grants’ program.

This controversial program was initially designed to assign greater than 700 million ARB tokens on to the Arbitrum Basis. These funds, representing $1 billion on the time, had been proposed to be directed towards backing tasks using Arbitrum’s superior know-how.

The sheer magnitude of the allocation sparked issues concerning the transparency of a mission whose ethos is grounded in collective decision-making. This resulted in an alternate proposal to redirect the funds from the Basis again to the DAO, which was subsequently rejected.

To fulfill the issues of the group, the proposal AIP-1.1 was launched. This strategic proposal aimed to impose stricter controls on the allocation of the DAO’s treasury. This plan empowers the DAO with the authority to switch the vesting interval, permitting them to elongate, shorten, and even halt the vesting course of solely.

This transfer in the direction of monetary transparency marks a milestone for Arbitrum’s DAO, reinforcing its dedication to its decentralized and democratic ethos. It not solely offers a verify on the arbitrary allocation of funds but in addition ensures that choices align with the pursuits of the Arbitrum group.

Implications for Arbitrum

Securing $770 million in ARB tokens via a vesting contract is a big occasion for Arbitrum’s DAO. By taking this motion, the Arbitrum Basis can set up a constant supply of funding and exhibit to the group at massive their dedication to transparency and accountability.

The measure may additionally influence the market dynamics for the ARB token. With a big quantity of the tokens locked up, the diminished provide may doubtlessly affect its value.

This additional underscores the significance of this step by the Arbitrum DAO, as its ramifications prolong past governance to straight influencing the ecosystem’s dynamics.

Moreover, this improvement throughout the Arbitrum ecosystem signifies the mission’s maturity and dedication to its democratic beliefs. It exemplifies how DAOs can successfully handle vital assets whereas sustaining transparency and accountability, setting a precedent for different related organizations within the crypto ecosystem.

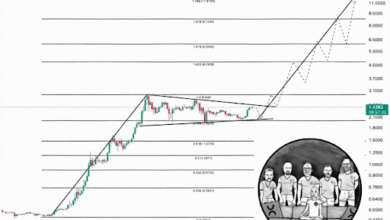

In the meantime, over the previous 24 hours, Arbitrum’s native token ARB has witnessed an upward development of two.3%. This bullish development comes after the asset has seen slight retracement prior to now week, dropping by practically 2%. ARB at present has a market value of $1.12 on the time of writing.

Featured picture from iStock, Chart from TradingView