Satoshi-Era Bitcoin Whale Shorted $1.1B Before Tariff News — Insider Tip?

Bitcoin and the final crypto market have witnessed one other important downturn this yr, with costs falling by double digits within the late hours of Friday, October 10. This bearish strain began when rumors of a commerce conflict between the US and China emerged within the early hours of Friday.

The downward strain intensified after US President Donald Trump declared that the US would impose a 100% tariff on Chinese language items. On account of this announcement, over $5.5 billion was liquidated from the crypto market in lower than an hour, with the Bitcoin value briefly falling to as little as $101,500.

Is This BTC Whale Linked To The US Authorities?

In a current publish on X, on-chain analyst Maartunn highlighted a selected Satoshi-era Bitcoin investor who may need anticipated this downturn means earlier than it occurred. A take a look at the dealer’s market strikes means that the big BTC holder virtually at all times is aware of one thing the market doesn’t.

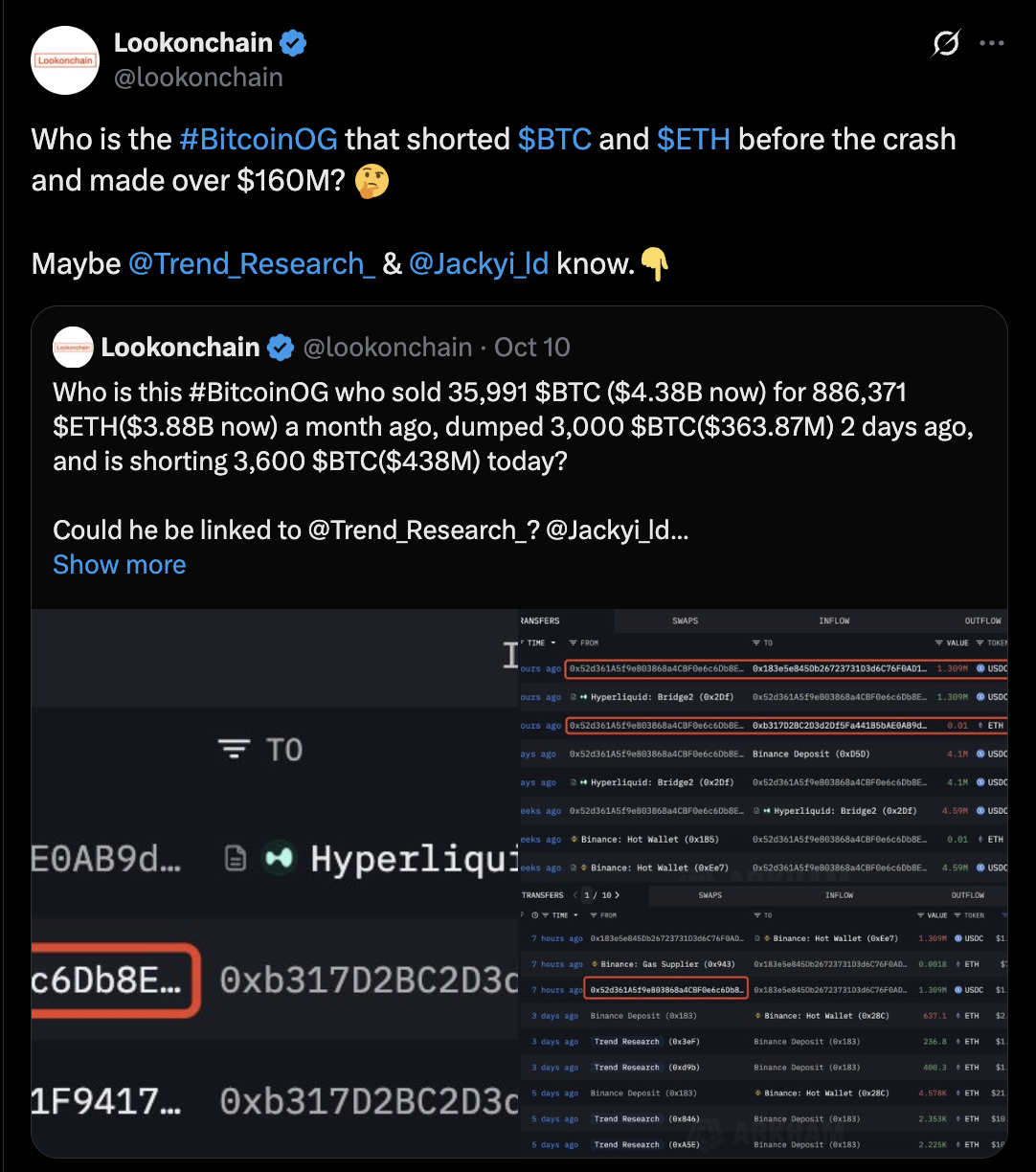

Whereas the worth of Bitcoin steadily dropped in direction of $117,00 throughout the day, blockchain analytics platform Lookonchain revealed that this Bitcoin OG stored piling up their quick positions as much as $1.1 billion. Following the BTC crash under $110,000, this huge investor made a revenue of over $160 million, resulting in speculations about them having insider data.

Maartunn went additional to spotlight the big holder’s actions previously few months. In keeping with the analyst’s publish on the social media platform X, this Bitcoin OG began promoting a part of their 86,000 Satoshi-era BTC stash when costs peaked round August 2025.

Equally, the BTC whale took to shaving off their holdings once more when the Bitcoin value ran as much as new highs in early October. What’s extra attention-grabbing is that the Satoshi-era investor quickly opened leveraged quick positions on each Bitcoin and Ethereum on the Hyperliquid platform.

Maartunn thought that the timing of those trades could be attention-grabbing, particularly as the final crypto market quickly witnessed a downturn because of President Trump’s tariff announcement. The on-chain analyst then concluded that the “Satoshi-era OG have insider ties to the US authorities.”

Bitcoin Worth At A Look

As of this writing, the worth of BTC stands at round $113,250, recovering swiftly from the plunge to round $101,500. Nevertheless, the premier cryptocurrency continues to be down by almost 7% previously 24 hours.