Arbitrum tops liquidity inflows, pegs BSC, Polygon back

- With $78.38 million in seven days, Arbitrum registered the very best liquidity circulation out there.

- Hypothesis round ARB dropped, in addition to the seek for the asset.

Arbitrum [ARB] has emerged as the highest protocol with the very best liquidity within the final seven days. This disclosure was made recognized by Emperor Osmo, a pseudonymous knowledge connoisseur at digital asset knowledge platform Artemis.

Real looking or not, right here’s ARB’s market cap in MATIC’s phrases

Arbitrum items bear fruits

In accordance with Osmo, Arbitrum had a web circulation of $78.38 million throughout the mentioned interval. This was way more than the liquidity the mix of the Binance Sensible Chain, Fantom [FTM], and Polygon [MATIC] zkEVM registered.

Over the previous 7 days, $ARB has emerged because the protocol with the very best liquidity inflows.

Arbitrum surpassed BSC in web deposits by greater than 10x this week.

The STIP impact? pic.twitter.com/TNdNxtPbfc

— Emperor Osmo🧪 (@Flowslikeosmo) October 14, 2023

The hike in liquidity implies that there was plenty of token bridging on the Arbitrum chain. Apparently, this may be linked to the Quick-Time period Incentive Program (STIP) launched by the Ethereum [ETH] L2.

On 14 October, AMBCrypto reported that Arbitrum selected the likes of PancakeSwap [CAKE] and GMX in its first spherical of STIP grants. The initiative meant to extend Arbitrum’s dominance within the L2 terrain appears to be yielding fruits with the liquidity hike.

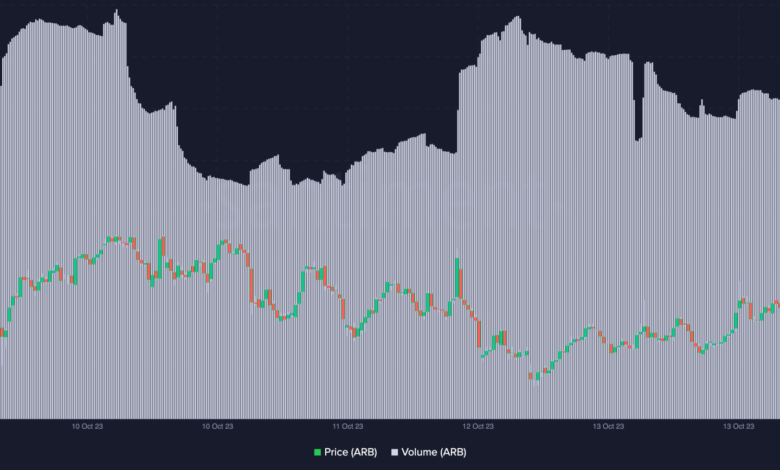

Whereas the rise in liquidity improve shouldn’t be essentially linked to ARB, the volume of the token decreased. In accordance with Santiment, ARB’s quantity within the final seven days was all the way down to 50.17 million.

The lower in quantity implies that there was low exercise by way of to-and-fro ARB between exterior wallets and exchanges. Additionally, the decline signifies an absence of curiosity in both shopping for or promoting.

Supply: Santiment

Fewer eyes on ARB

Though the grants Arbitrum gave out have been some form of good improvement, the affect on the social quantity has been minimal. Primarily based on press time on-chain knowledge, Arbitrum’s social quantity decreased.

Social quantity is outlined because the variety of search phrases associated to an asset. When the metric will increase, it means there are plenty of contributors looking out for happenings inside a challenge. Nevertheless, ARB’s social dominance depicts that of an asset that’s presently being missed.

One other metric that had a similar trend like quantity and social dominance is lively addresses. On the time of writing, the seven-day lively addresses on the Arbitrum community have been all the way down to 41,100.

Supply: Santiment

How a lot are 1,10,100 ARBs value immediately?

Lively Addresses present the variety of distinctive customers concerned in ARB transactions day by day. A rise within the metric implies that interplay with the token is excessive. Conversely, when Lively Addresses lower, it implies that hypothesis round a token is low, and that was the case with ARB.

Because it stands, it’s doubtless that Arbitrum will proceed to excel with elevated liquidity on its community. Nevertheless, its native token shouldn’t be prone to expertise the identical contemplating the press time sentiment out there.