Are BTC miners back on their feet? This data suggests…

- Bitcoin miners present religion in Bitcoin as their BTC holdings begin to develop. Income generated rises, nevertheless, the problem rises alongside.

- Merchants change into optimistic as put to name ratio begins to say no.

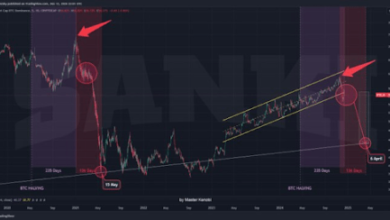

As a result of extraordinarily unstable nature of the value of Bitcoin [BTC], revenues generated by miners have fluctuated massively. Due to this, giant Bitcoin miner outflows occurred within the latter half of 2022. Nevertheless, as Q3 2023 inches close to, miners have began to show optimistic.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

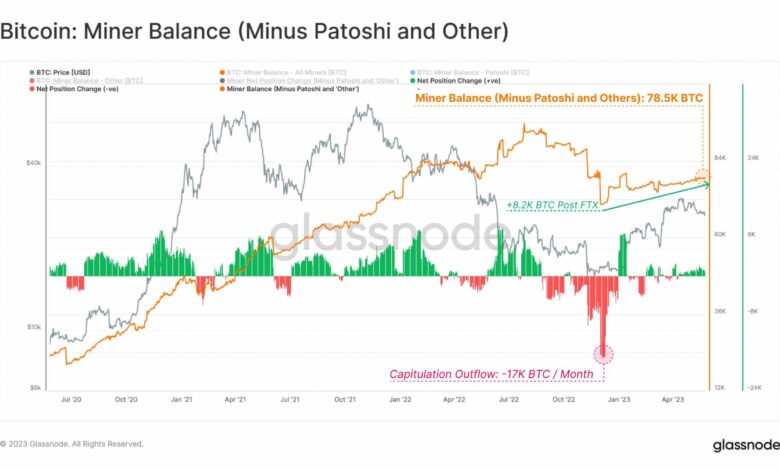

Miner steadiness turns inexperienced

The indication of miners’ confidence in Bitcoin was demonstrated by the growth of their steadiness sheet by way of the acquisition of a further 8.2K BTC. Because of this, their whole holdings have grown to achieve 78.5K BTC in accordance with Glassnode’s information.

The truth that miners have been capable of improve their holdings by buying extra BTC advised continued confidence within the cryptocurrency. This may be seen as a constructive indicator for the broader Bitcoin market, because it signifies ongoing curiosity and assist from miners who play an important position in securing and sustaining the Bitcoin community.

Supply: glassnode

The rising miner income additionally contributed to the positivity showcased by miners. Within the final three months, the each day income generated by miners has grown considerably from $21,370 to $27,253.

Supply; blockchain.com

Throughout the identical interval, there was a big improve in mining problem. When Bitcoin mining problem reaches new highs, it signifies a heightened stage of competitors amongst miners, resulting in elevated computational energy and community safety.

This development additionally highlights the numerous useful resource funding required for mining, doubtlessly impacting block technology charges and the general provide dynamics of the cryptocurrency.

Supply: blockchain.com

Merchants make their predictions

Although the rise in problem could pose challenges sooner or later for miners, their progress additionally largely will depend on Bitcoin’s value. At press time, Bitcoin was buying and selling at $26,463.66 in accordance with CoinMarketCap’s data.

Dealer habits advised that they had been optimistic about BTC’s value and anticipated it to go up additional.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

On the time of writing, there have been 86,000 BTC choices set to run out quickly. These choices have a Put Name Ratio of 0.38, which implies that there are extra bullish (Name) positions than bearish (Put) positions.

The utmost ache level, a value stage the place possibility holders would expertise essentially the most monetary loss, is estimated to be round $27,000. In whole, these choices maintain a notional worth of roughly $2.26 billion.

Supply: The Block