Are Ethereum and Solana threatening the crypto market’s stability?

- Neighborhood is bearish on Solana and Ethereum, however consultants are nonetheless very bullish on SOL.

- Crypto markets are nonetheless correcting, with most altcoins presently within the pink.

The crypto market remains to be reeling from a powerful case of the corrections, and altcoins are having it worse than all.

At press time, nearly all of the altcoins on the highest 25 are within the pink, having seen a slight lower on each day charts. Is there a bearish storm on the horizon? Or are we nonetheless on for an altseason?

Solana and Ethereum encourage bearish sentiments

Two prime altcoins have stood out among the many crowd, seemingly dancing with the bears. Each cash have dropped from the essential assist ranges of $2,995 and $145.

On the time of writing, Ethereum [ETH] was price $2,968 and Solana [SOL] was at $141.

Information from CoinGecko says that the neighborhood is generally bearish on each tokens proper now.

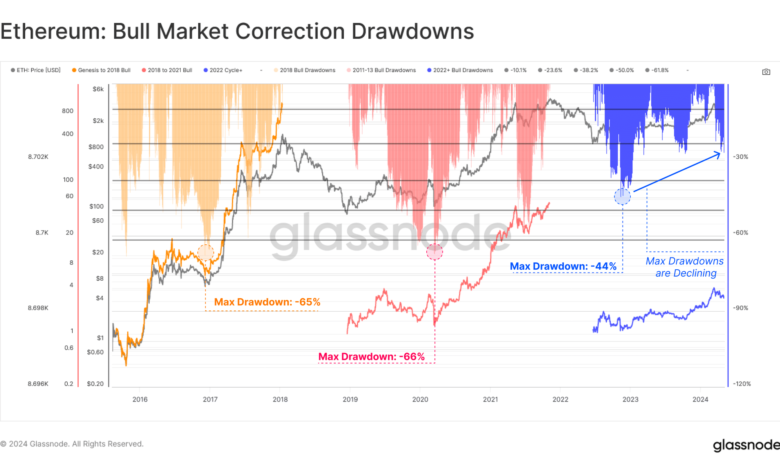

Simply two days in the past, Glassnode shared that Ethereum’s efficiency is far weaker than Bitcoin [BTC], regardless of the other being the case solely a month prior.

It is a stark reversal from its earlier place, the place it had proven dominance over Bitcoin.

Ethereum’s value drop has been large, with its deepest drawdown reaching 44% over the cycle, which is greater than double that of Bitcoin’s 21%.

This highlights Ethereum’s struggles and underperformance relative to Bitcoin.

The Quick-Time period Holder Price Foundation for Ethereum, which generally affords assist, exhibits that present costs are hovering very near the fee foundation of current consumers.

Glassnode warns that this example has created a precarious state of affairs the place any additional market dip might set off a sell-off panic.

Supply: Glassnode

A silver lining

Regardless of the gloomy outlook, not all hope is misplaced. Solana, as an illustration, appears to have weathered what might need been its final main correction for this market cycle.

In keeping with a well-followed crypto analyst often known as Inmortal, the one assist degree Solana wanted to defend is $120.

He’s nonetheless anticipating a rally, along with his projections suggesting a climb to a brand new excessive of $320 a while later this 12 months.

Moreover, there are indicators that Solana may quickly overtake Ethereum when it comes to transaction charges.

Dan Smith, a senior analysis analyst at Blockworks, suggested that Solana might surpass Ethereum in transaction charges and seize maximal extractable worth (MEV) as early as this month.

MEV represents the utmost revenue that may be extracted from blockchain transactions by means of means like arbitrage.

On the seventh of Might, Solana’s complete financial worth was reported at $2.8 million, nearing Ethereum’s $3.1 million. Elite figures like Arthur Hayes are additionally nonetheless extremely bullish on SOL.

Apparently, nonetheless, the neighborhood appears to be extremely bullish on the broader altcoin market, particularly AI tokens like Fetch.ai [FET].

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

Meme cash like Pepe [PEPE] and Bonk [BONK] are nonetheless seeing new holders each single day, suggesting that buyers and merchants are nonetheless very a lot anticipating a bull run for 2024.

So, sure, the bears might need managed to grab management. However it’s more likely to be momentary.