Coinbase and Bybit Grab Market Share After Binance’s Settlement With the US Government: Analytics Firm Kaiko

Authorized troubles confronted by Binance, the most important crypto alternate on the earth, have allowed different exchanges to develop their market share, new information stories.

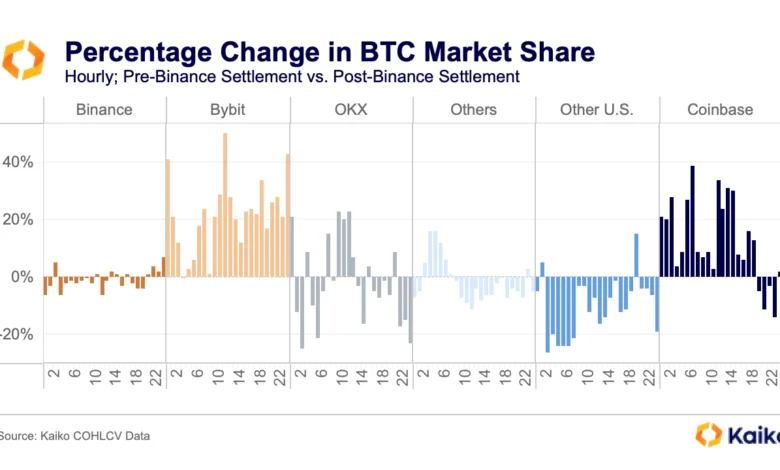

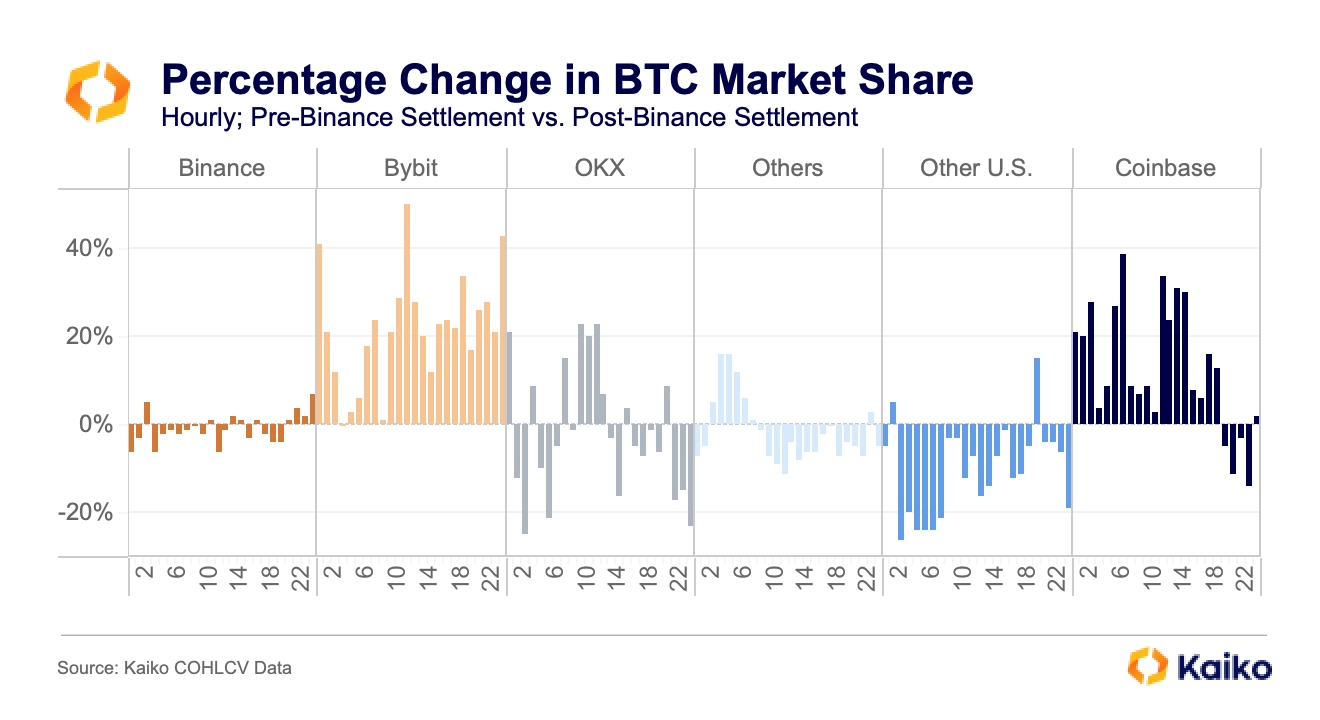

Following Binance’s $4 billion settlement with the US authorities and its former CEO’s admission of violating anti-money laundering (AML) legal guidelines, Coinbase and Bybit have gained floor within the crypto buying and selling business, analytics agency Kaiko reveals.

Kaiko says information of the Binance settlement added “gasoline to the hearth” of Coinbase’s already robust November.

“Coinbase was already within the midst of a robust month when the information broke, and the information seemingly solely added gasoline to the hearth, propelling the inventory to a 75% achieve in a single month. The prevailing narrative is that the bear market is thawing, and Coinbase can be a serious beneficiary of this transformation in situations.”

Kaiko says that Binance has ceded some market share to Coinbase throughout non-US buying and selling hours and to Bybit throughout the board.

Whereas the fees towards Binance have largely been perceived as damaging for the corporate, Kaiko says there’s an argument to be made that Binance has now cleared up any uncertainty directed on the alternate and will permit for clearer skies forward.

“It’s too early to make sweeping predictions, however early tendencies look removed from dire for Binance, whereas additionally promising for Coinbase and Bybit. This competitors developed an attention-grabbing wrinkle this week within the type of an e mail from Coinbase to prospects, which knowledgeable them that Coinbase acquired a subpoena from the CFTC (Commodity Futures Buying and selling Fee) associated to Bybit.

Whereas the most well-liked idea is that Binance will lose share to different exchanges, it’s additionally potential that the compliance monitor and improved AML/KYC (know-your-customer) procedures will improve belief within the alternate, serving to to keep up its share. Whereas it may very well be argued that centralized exchanges are good substitutes, the turbulence of the previous couple of years has proven that there’s some stickiness to liquidity and volumes; folks are inclined to need to maintain utilizing the exchanges that they’re already utilizing.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Generated Picture: Midjourney