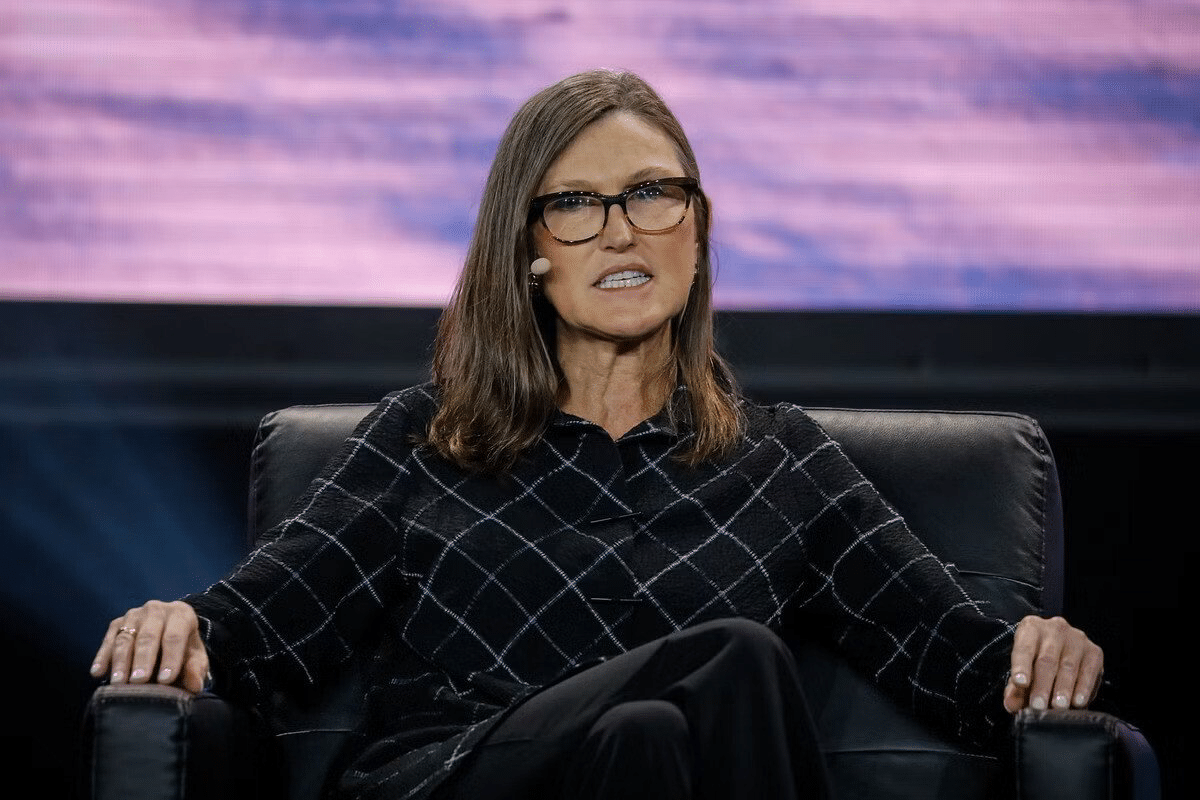

ARK CEO Cathie Wood Calls Bitcoin The “Biggest Of All Crypto Ideas”

Cathie Wooden – CEO of tech-focused funding supervisor ARK Make investments – says her conviction in Bitcoin (BTC) stays unshaken regardless of the asset’s latest “promote the information” market wipeout.

Bitcoin climbed for 4 months in a row after Bitcoin asset supervisor Grayscale bested crypto-skeptical federal regulators in courtroom.

The occasion bolstered market confidence {that a} Bitcoin spot ETF would lastly launch in america throughout the subsequent few months. But after the product lastly hit the market earlier this month, the asset’s bullish momentum rapidly rotated.

“We’re very excited that Bitcoin is now within the ETF wrapper, and subsequently very accessible at very low costs,” mentioned Wooden throughout an interview with CNBC on Wednesday.

CATHIE WOOD: The selloff has not disturbed our perspective in any respect – we predict #Bitcoin is among the most necessary investments of our lifetimes 👀🙌 pic.twitter.com/trObEG0gSe

— (@BitcoinNewsCom) January 24, 2024

Wooden’s funding agency owns certainly one of 9 new Bitcoin ETFs to launch on January 11. After eight days of buying and selling, the fund holds $480 million in property.

The CEO mentioned that Ark anticipated a promote the information occasion after the launch, noting how bankrupt crypto alternate FTX has already bought practically $1 billion value of shares within the Grayscale Bitcoin Belief (GBTC).

“I believe some individuals anticipated [Bitcoin’s price] to carry a little bit greater than it has,” she mentioned. “However this has not disturbed our perspective in any respect.”

Wooden went on to name Bitcoin “some of the necessary investments of our lifetimes,” highlighting its specialty as a worldwide, rules-based financial system. “We expect its the most important of all of the crypto concepts on the market,” she added.

Bitcoin VS Altcoins

Bitcoin’s origins lie in an try by cryptographers to create a fairer type of cash in response to financial institution bailouts in the course of the 2008 monetary disaster. The asset’s wealthiest promotors like BlackRock CEO Larry Fink now characterize it as “digital gold,” with its completely mounted provide of 21 million cash.

Constancy, fund supervisor with a well-liked Bitcoin ETF, printed a report in January 2022 claiming Bitcoin needs to be “thought-about individually from different digital property.” However, each Constancy and BlackRock are presently pining to launch a spot Ethereum ETF, pending regulatory approval.

In the meantime, Franklin Templeton has additionally taken a multi-chain method to crypto. The asset supervisor has donned laser-eyes in its profile image on X, and claimed that it’s persevering with to observe and help networks past Bitcoin, Ethereum, and Solana.