Arta TechFin And Chainlink Are Exploring Solutions To Tokenize Real Assets Such As Real Estate

Actual asset tokenization is reported to be the following massive frontier for the blockchain trade, and Chainlink continues to broaden world partnerships with a concentrate on actual asset tokenization and cross-chain transactions. On Might 21, the world’s largest blockchain oracle community introduced an expanded partnership with Arta TechFin, a Hong Kong-based asset administration and monetary providers firm, to carry real-world belongings on-chain.

Arta Techfin CEO Eddie LAU stated the partnership goals to handle a market hole for an end-to-end resolution that addresses ache factors from main off-chain creation and secondary buying and selling to enhancing product integrity. Based on Chainlink, world real-world belongings quantity to a whopping $867 trillion. Tokenization will enhance the speed of cash by opening up beforehand illiquid belongings comparable to collectibles and actual property to electronically tradeable markets.

Actual property, particularly, is infamous for its illiquidity and unimaginable complexity of transactions. Assuming there isn’t any money purchaser, a typical U.S. actual property transaction takes 30 to 60 days to shut. After closing, flipping a house or utilizing fairness exposes the proprietor to a fancy and arcane course of that may additionally take months. On the core of the pooling of actual belongings on the chain are Chainlink’s real-time worth feeds and the CCIP interoperability protocol, which permit the oracle community to work together with different blockchains and transfer belongings between chains.

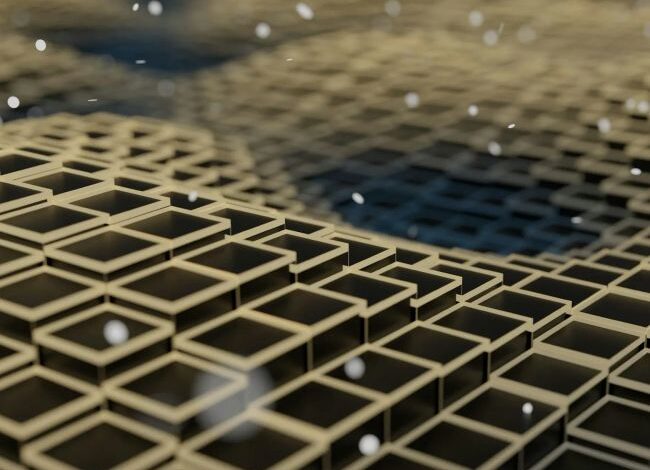

Picture: Chainlink At this time