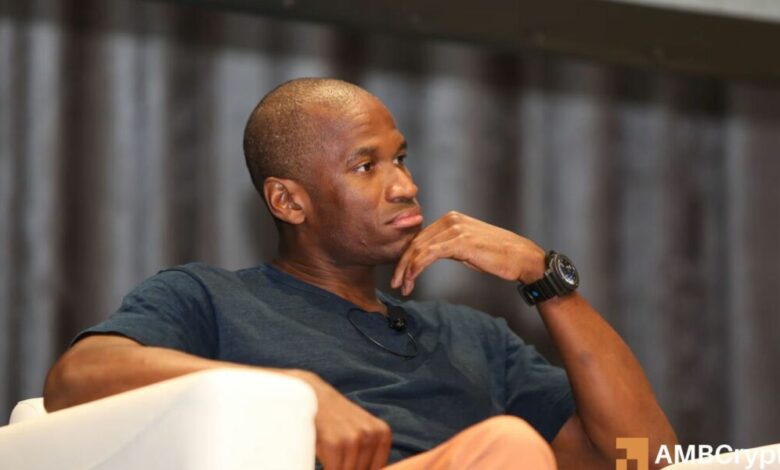

Arthur Hayes’ Bitcoin prediction: ‘Drop to $75K before $250K by end-2025’

- Arthur Hayes projected a 30% BTC correction to $70K-$75K within the close to time period.

- He linked the potential drop to rising U.S. Treasury yields and sticky inflation.

Arthur Hayes, co-founder of the BitMEX change, has cautioned that Bitcoin’s [BTC] value may drop to $70K-$75K within the brief time period earlier than rising to $250K by the top of the yr. A part of his latest blog learn,

“I feel we usually tend to go right down to $70,000 to $75,000 Bitcoin after which rise to $250k by the top of the yr than to proceed girding greater with no materials pullback.”

Hayes linked his near-term ‘30% BTC correction forecast’ to rising 10-year Treasury yields and its seemingly impression on shares and crypto.

Is BTC due for prolonged correction?

For context, a hike in Treasury yield at all times indicators tighter liquidity, making risk-on belongings like shares and crypto much less enticing than bonds. So, a rising yield is a web destructive to the crypto market, particularly BTC.

Hayes added,

“Inflation continues to be elevated and more likely to go greater within the close to future because the world decouples economically. This is the reason I anticipate 10-year yields to rise… Shares will dump.”

Given the shut correlation between U.S. shares and BTC (surged to a latest excessive of 0.70, per Pearson 30-day correlation), such a decline may drag the king coin, too.

Supply: The Block

Hayes famous BTC may drop earlier than U.S. shares in such a near-term liquidity squeeze situation.

“BTC is extraordinarily delicate to international fiat liquidity circumstances; due to this fact, if a fiat liquidity crunch is forthcoming, its value will break down earlier than that of shares and would be the main indicator of monetary stress.”

Nevertheless, the investor highlighted that such misery would power the U.S., China, and Japan to reply by printing cash and QE (quantitative easing). He forecasted a 60% probability of a probable QE pivot in Q1 or Q2.

“A mini monetary disaster within the US would supply the financial mana crypto craves. It could even be politically expedient for Trump.”

Since QE drives U.S. liquidity and risk-on belongings, it may gasoline the BTC rally to a brand new all-time excessive of $250K, per Hayes.

That being stated, BTC’s ‘All the pieces Indicator,’ a collective gauge of miner profitability, cash provide, and community progress, confirmed BTC was halfway within the bull run.

Traditionally, a studying above 80 (crimson zone) marked earlier cycle tops in 2017 and 2021. The present studying was above 50, suggesting room for progress.

Supply: BM Professional