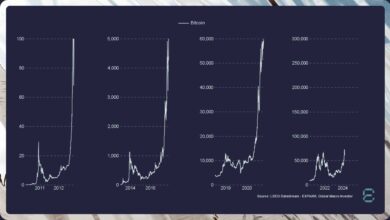

As Bitcoin halving draws closer, how these people are seeking profits

- March has seen a hike in BTC miner-to-exchange exercise.

- Miners are looking for to guide earnings from the coin’s present rally.

Bitcoin [BTC] miner-to-exchange exercise has seen a spike forward of the following halving scheduled for round mid-April, on-chain knowledge revealed.

This pre-programmed occasion cuts the reward for mining a block in half, aiming to manage inflation by limiting new Bitcoin issuance.

In response to knowledge from CryptoQuant, the BTC miner reserve has been slowly declining because the twenty sixth of February. This metric measures the quantity of cash held in affiliated miners’ wallets.

When its worth declines, it means that miners are offloading their cash.

Sitting at 2 million BTC at press time, BTC’s miner reserve has fallen by virtually 2% prior to now two weeks.

Supply: CryptoQuant

In a brand new report, CryptoQuant analyst Joao Wedson famous that March thus far has been marked by,

“A constant circulation of Bitcoin from miners’ wallets to exchanges.”

When there may be an uptick in miner-to-exchange exercise on the Bitcoin community, it means that miners are promoting extra BTC than they’re mining.

Per CryptoQuant’s knowledge, the every day circulation of BTC from miners’ wallets to exchanges has risen by over 1000% within the final seven days.

Wedson additionally attributes this present rise to the upcoming halving occasion.

As a result of anticipated decline in mining rewards, miners on the Bitcoin community are at the moment beneath stress to promote their holdings and understand a revenue earlier than mining prices outpace rewards.

In response to Wedson:

“The logic behind that is easy: with the discount in rewards, the stress to promote and guarantee profitability earlier than mining prices turn into disproportionate to the reward might improve. This preventive motion could be an try to mitigate dangers related to the discount in mining revenues.”

Rally above $70,000 results in…

At press time, BTC was at $68,369. On the eighth of March, it traded briefly above the $70,000 value mark to document a brand new all-time excessive, in accordance with CoinMarketCap’s knowledge.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

With the Futures market recording largely constructive Funding Charges, the value leap above $70,000 resulted in a liquidation of quick positions value $58 million, per Coinglass’ knowledge.

Supply: Coinglass

On the identical day, lengthy liquidations totaled $50 million.