As Bitcoin marches ahead, this cohort springs into action

- Bitcoin broke previous $59K.

- Brief-term merchants had been locking 2% earnings on their gross sales.

Bitcoin [BTC] broke previous $59,000 in the course of the wee hours of the morning, transferring one step nearer to its all-time excessive (ATH).

The bull rally, fueled by sturdy inflows into spot ETFs, spurred a 13% weekly progress within the king coin’s market worth, and greater than 37% over the month, information from CoinMarketCap confirmed.

Bitcoin traders lock in features

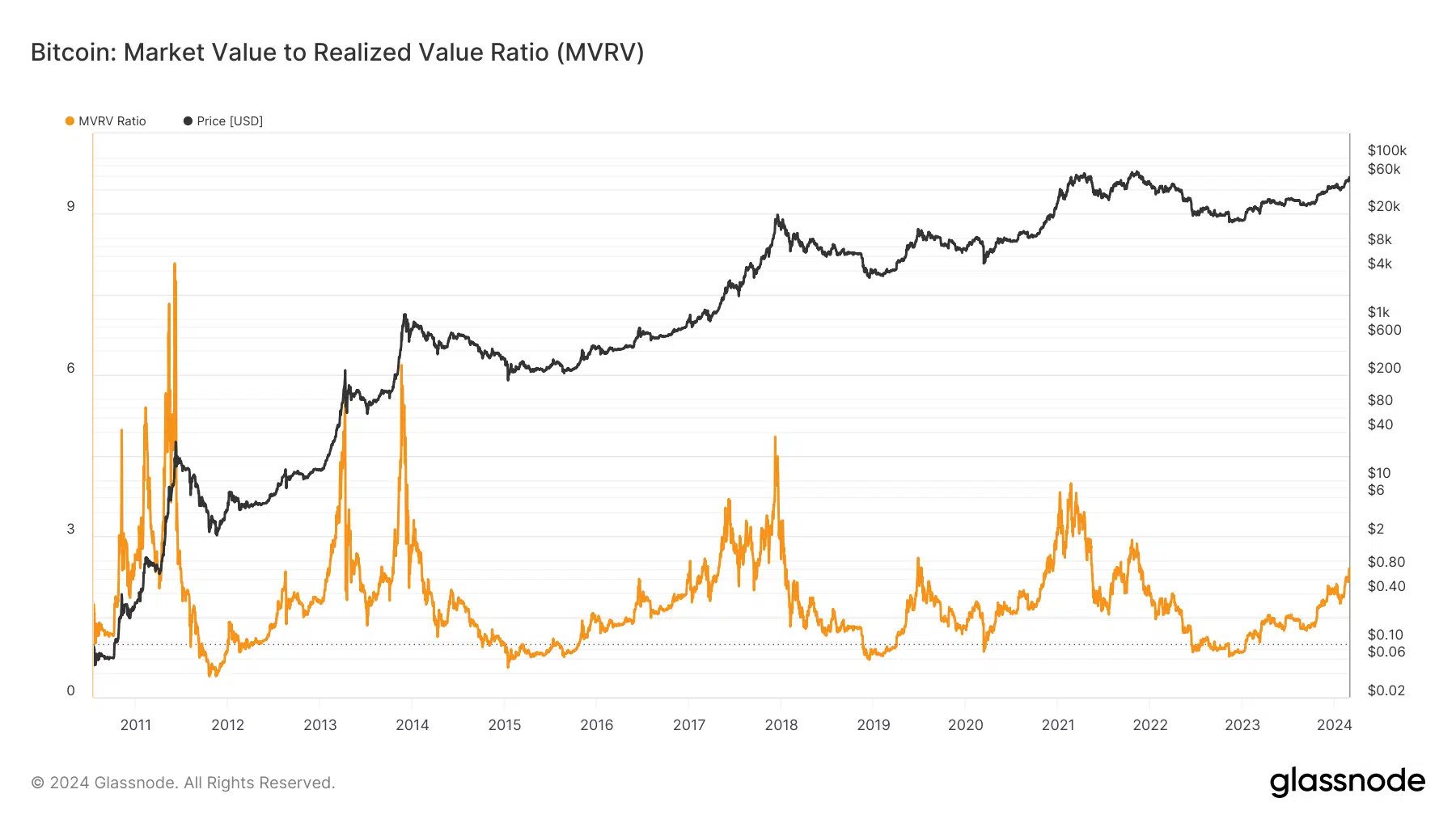

The market growth raised the common profitability of Bitcoin traders to new highs.

In keeping with AMBCrypto’s evaluation of Glassnode’s information, traders had been holding an unrealized revenue of 139% as of this writing.

Whereas this was a measure of earnings that could possibly be locked if individuals offered their cash, the precise earnings realized additionally painted a optimistic image.

Brief-term holders up buying and selling exercise

A latest report by Glassnode confirmed that the market was promoting cash at 13% revenue on common.

Whereas long-term traders who navigated the powerful bear market had been promoting at 2x earnings, short-term merchants had been additionally locking 2% earnings on their gross sales.

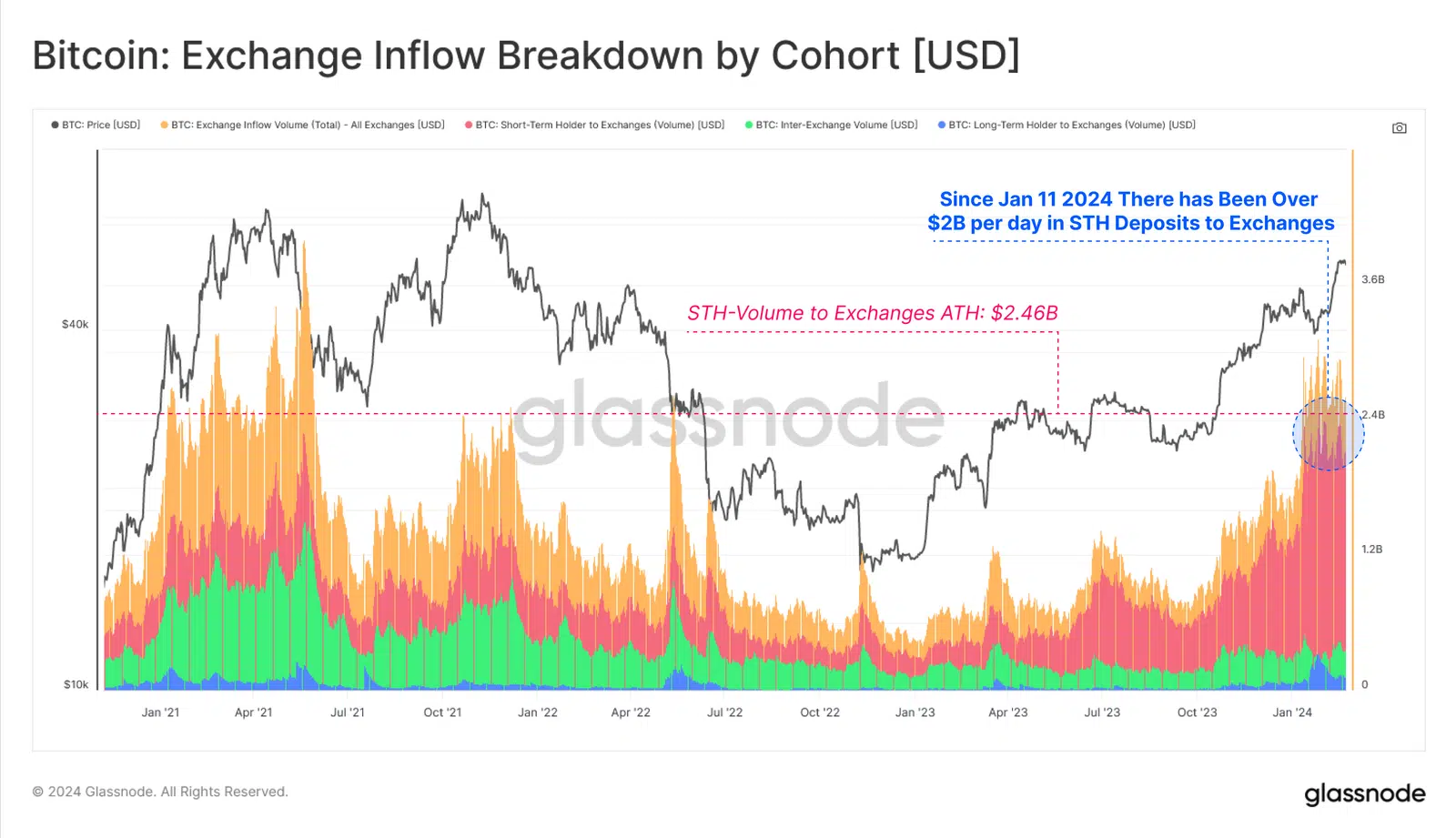

Brief-term holders (STH), additionally known as energetic market merchants, have additionally elevated their alternate interplay previously month.

Knowledge confirmed STH sending $2 billion per day since mid-January to exchanges, within the course of additionally hitting a brand new ATH of $2.46 billion.

The cohort has been transferring greater than 1% of their provide day-after-day since October 2023.

The better participation by the STH cohort implied that danger urge for food for the market was growing.

Diamond palms favor HODLing

Then again, long-term holders (LTH) made far fewer deposits. This was anticipated as these diamond palms had been making an attempt to build up from a fast-dwindling provide.

Regardless of offloading a substantial portion of their holdings within the final month, the LTH cohort nonetheless held three-fourths of Bitcoin’s provide.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

This numerical superiority provides them the ability to dictate how lengthy the bull run would final.

Over time, Bitcoin’s narrative as a retailer of worth has strengthened. With provide/demand economics working to its benefit, it received’t be shocking to see diamond palms holding on to their Bitcoins for eternity.