As Cardano whales offload 120 mln, why ADA’s downtrend can continue

- Within the final 24 hours, whales offered a major quantity of ADA, forcing a fall.

- Different key technical indicators within the derivatives market influenced a downward pattern as nicely.

Sentiment round Cardano [ADA] has been notably bearish, as traders have been promoting over the previous month. This will proceed, as latest market revelations present that continued promoting efforts have been dominant.

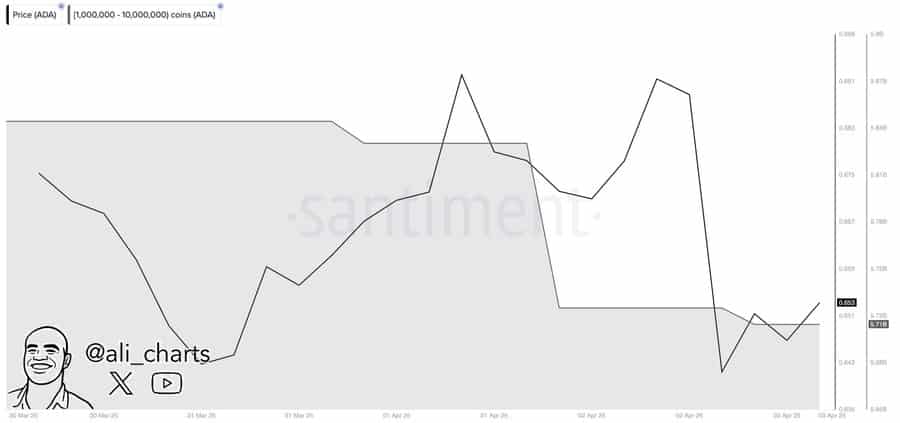

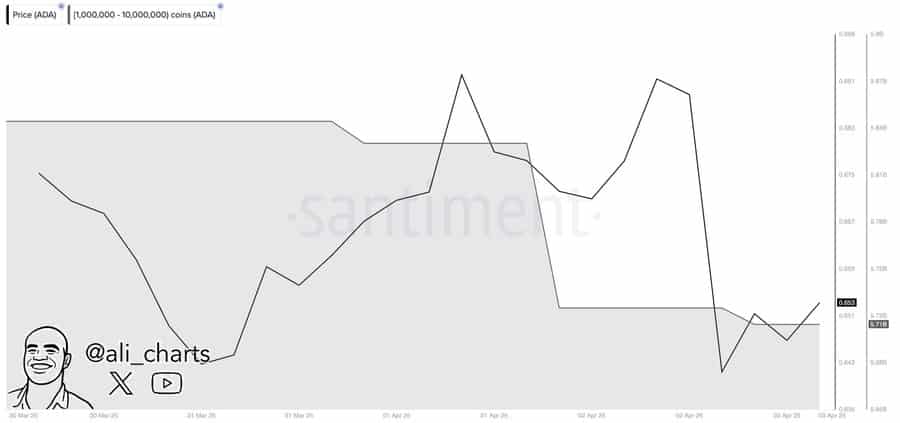

Whales offload main ADA

Whales, who usually management a significant provide of the asset, have continued promoting over the previous 48 hours, bringing complete gross sales to 120 million.

When there’s an enormous sell-off like this out there, it implies a insecurity, and thus, there’s potential for ADA to proceed trending decrease.

Supply: Santiment

Within the derivatives market, the promoting strain appeared extra evident, as Open Curiosity within the Futures and choices market continued to fall.

Press time knowledge confirmed a 1.01% and 0.27% slip to $697.15 million and $374.92k, respectively, prior to now 24 hours.

A drop in Open Curiosity within the derivatives market implies that there was closure of contracts, with a number of elements together with insecurity and lengthy liquidation contributing to the autumn.

Supply: Coinglass

The buying and selling quantity has been largely dominated by sellers, because the long-to-short ratio— that factors to excessive shopping for quantity when above 1 and robust promoting strain when beneath 1—had a press time studying of 0.9767.

With extra sellers than patrons out there, it might affect ADA to proceed dropping, until the metric crosses above 1 once more.

AMBCrypto discovered that DeFi traders are additionally promoting, because the Complete Worth Locked (TVL), used to judge the worth of protocols on the Cardano chain, has plunged notably.

From a excessive of $319.58 million in April, it had declined by $15.54 million to $304.04 million at press time.

Supply: DeFiLlama

If DeFi traders proceed to unlock their ADA deposited throughout these protocols, then the asset will possible proceed to plunge.

Bullish opposition arises

Regardless of the predominant bearish pattern out there, spot market merchants have continued to build up the asset over the previous week.

In line with AMBCrypto’s take a look at Coinglass’ netflow knowledge, merchants saved shopping for and shifting their property into non-public wallets, suggesting indicators of long-term market dedication.

Prior to now week alone, $11.23 million price of ADA has been purchased, following the previous week’s $44.75 million price of ADA purchases.

Supply: Coinglass

Nonetheless, the impact of bullish spot market merchants would have minimal affect until different key market sentiments shift in a bullish route.