As Ethereum’s market direction remains unclear, what now?

- Ethereum’s Open Curiosity has rallied steadily for the reason that starting of September.

- With costs down 5% this month, spot market merchants stall on accumulation.

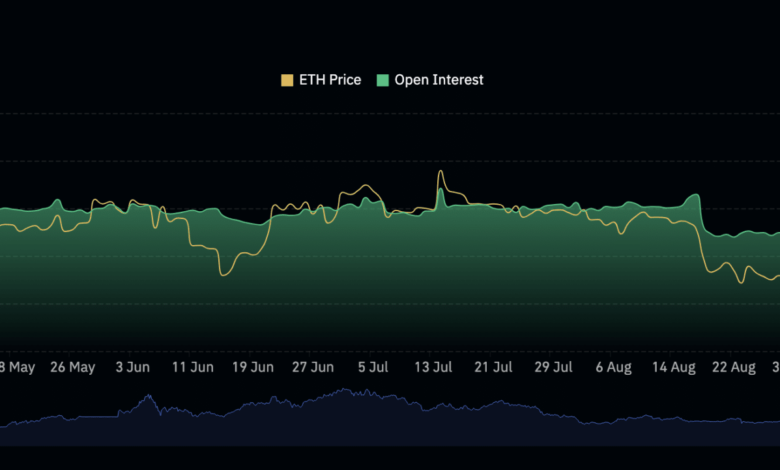

Ethereum [ETH] futures Open Curiosity has risen by 9% for the reason that starting of September regardless of the coin’s slender value actions inside that interval.

Learn Ethereum’s [ETH] Value Prediction 2023-24

In accordance with knowledge from Coinglass, the main altcoin’s Open Curiosity at press time was $5.43 billion.

Supply: Coinglass

Open Curiosity refers back to the complete variety of excellent contracts in a derivatives market. It’s a measure of the general exercise in a market and can be utilized to gauge investor sentiment.

When ETH’s Open Curiosity will increase, it implies that the overall variety of ETH Futures contracts that haven’t been settled has elevated. It’s a bullish sign because it means that extra traders are opening new positions in ETH and that there’s rising demand for the asset.

Nonetheless, the month-long uptick in Open Curiosity has been accompanied by “impartial to detrimental” funding charges, crypto analysis agency Kaiko famous in a latest publish on X (previously Twitter).

#ETH open curiosity has elevated for the reason that begin of September.

Funding charges stay impartial to detrimental, suggesting the market lacks path. pic.twitter.com/EHESMQMncw

— Kaiko (@KaikoData) October 10, 2023

Constructive funding charges point out consumers are paying sellers to maintain their contracts open, which suggests the market is bullish.

Alternatively, detrimental funding charges point out that sellers are paying consumers to maintain their contracts open, which means that the market is bearish.

When an asset sees impartial to detrimental funding charges in its futures market, it means that the market lacks a transparent path or bias. It connotes that there isn’t a powerful bullish or bearish sentiment dominating the market, and merchants stay unclear in regards to the market’s subsequent path.

The downtrend is obvious within the coin’s spot market

At press time, an Ether coin bought for $1,560, in keeping with knowledge from CoinMarketCap. The month to date has been marked by a decline within the ETH’s worth. After its temporary stint above $1700 on 2 October, the alt’s value has since trended downward. Within the final week, ETH’s value dipped by 5%.

The regular decline within the alt’s worth has strengthened the downtrend within the coin’s spot market. As of this writing, ETH’s value noticed on a every day chart traded dangerously near the decrease band of its Bollinger Bands indicator.

When an asset’s value trades this fashion, it means that promoting stress considerably outweighs shopping for momentum.

Though it signaled potential oversold circumstances and an imminent short-term value bounce or retracement, ETH’s key momentum indicators, which have been under their respective impartial traces at press time, didn’t point out the potential of that occuring any time quickly.

How a lot are 1,10,100 ETHs value at this time?

Likewise, the coin’s Aroon Down Line (blue) was pegged at 100% at press time. This indicator is used to determine pattern power and potential pattern reversal factors in a crypto asset’s value motion.

When the Aroon Down line is near 100, it signifies that the downtrend is robust and that the latest low was reached comparatively lately.

Supply: ETH/USDT on TradingView